Archives of “January 2019” month

rss10 Things A Trader Needs to START DOING …To Mint Money

There are many trading principles that are common among successful rich traders. It is important to learn the things that allow them to win so we can follow in their footsteps and make money. There are 10 things that new traders can start doing tomorrow to improve their results immediately. If you have been trading for awhile but have not been profitable these may be things that you need to start doing to stop losing money.

1. Start trading the price action by using charts. The market doesn’t care about your opinions but the chart expresses the collective actions of all market participants. Learn to understand what the chart is saying.

Start to understand that the market determines whether any single trade wins or loses not you and not an imaginary “they”.

2. We can only surf the price waves not control them.

Start to take 100% responsibility for your losses.

3. You enter the trade, you exit the trade, the wins and losses are yours alone. The blame game is a losing game in the markets.

Start to bounce back from losing trades quickly, move on don’t ruminate.

4. If your position size and risk management are correct no one losing trade should emotionally devastate you it should be only one of the next hundred trades with little significance by itself.

Start caring more about what the market is doing and less about what you think it should be doing.

5. ALL that really matters is current price action not your opinion of what might be price action later. (more…)

Chart: The 20-day moving average of the S&P 500 daily trading range

More to our Members /Anirudh Sethi /Baroda/India

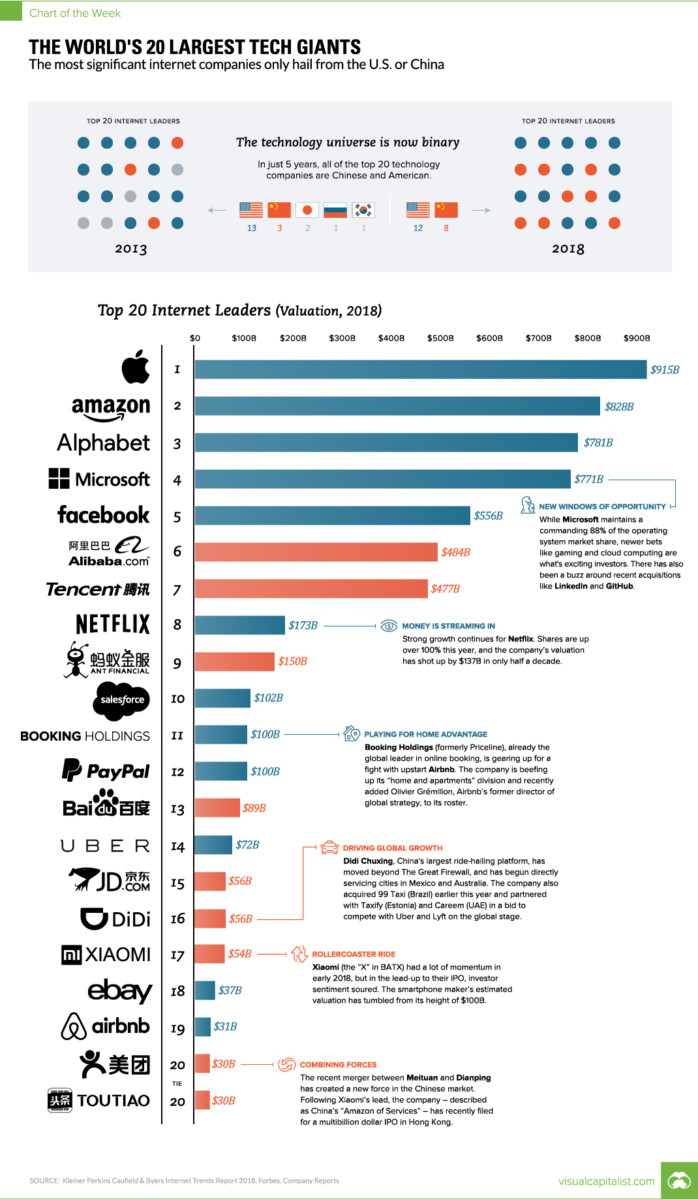

World’s 20 Largest Tech Giants

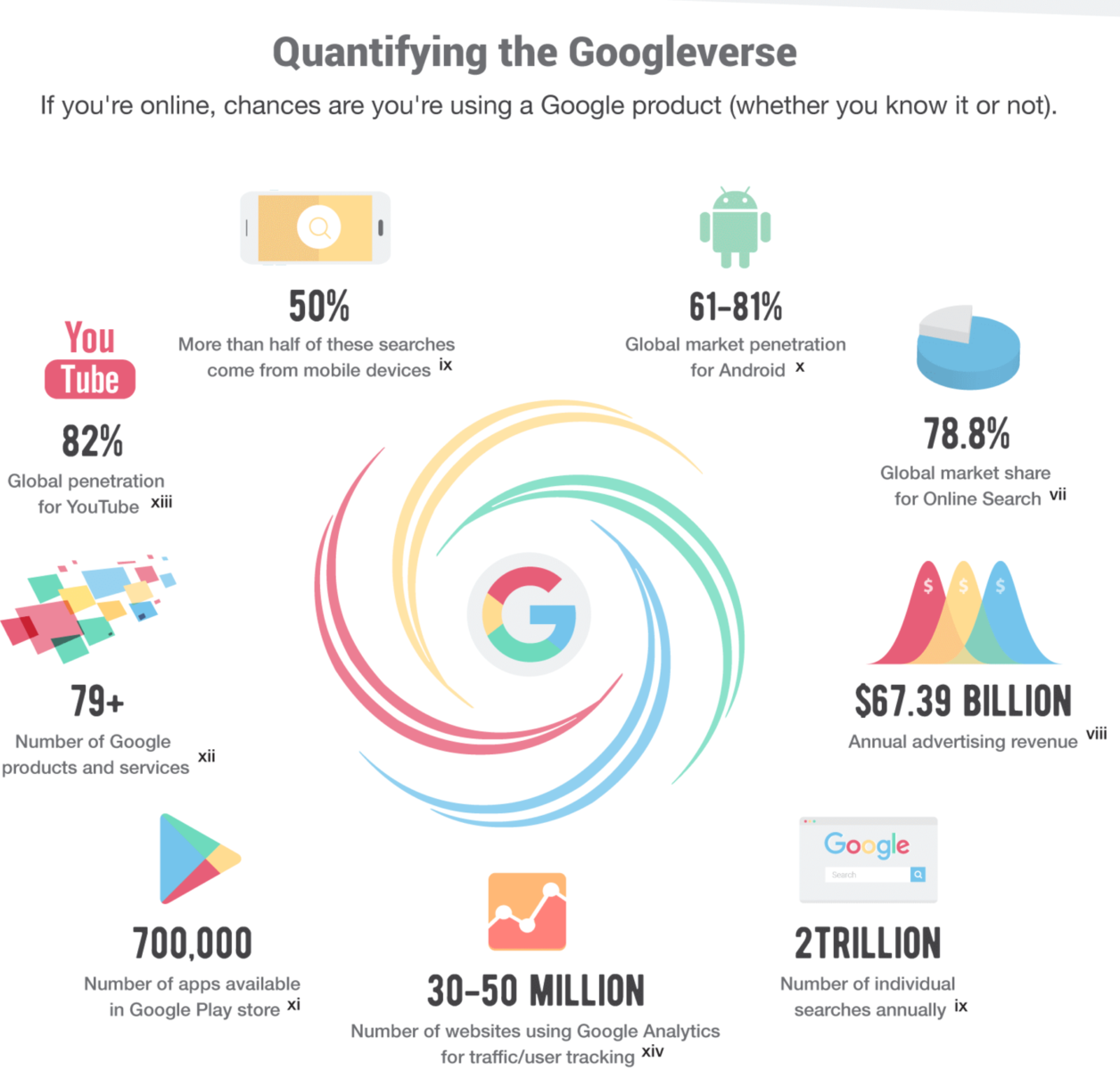

How Google Tracks You

Wolfpack

13 Rules for Making Good Trading Decisions

Never, ever, under any circumstance, should one add to a losing position…not ever!

Averaging down into a losing trade is the only thing that will assuredly take you out of the investment business. This is what took LTCM out. This is what took Barings Brothers out, this is what took Sumitomo Copper out, and this is what takes most losing investors out.

Rule #2

Never, ever, under any circumstance, should one add to a losing position…not ever!

We trust our point is made. If “location, location, location” are the first three rules of investing in real estate, then the first two rules of trading equities, debt, commodities, currencies, and so on are these: never add to a losing position.

Rule #3

Learn to trade like a mercenary guerrilla.

The great Jesse Livermore once said that it is not our duty to trade upon the bullish side, nor the bearish side, but upon the winning side. This is brilliance of the first order. We must indeed learn to fight/invest on the winning side, and we must be willing to change sides immediately when one side has gained the upper hand.

Rule #4

Don’t hold on to losing positions

Capital is in two varieties, mental and real, and of the two, the mental capital is the most important.

Holding on to losing positions costs real capital as one’s account balance is depleted, but it can exhaust one’s mental capital even more seriously as one holds to the losing trade, becoming more and more fearful with each passing minute, day and week, avoiding potentially profitable trades while one nurtures the losing position.

Rule #5

Go where the strength is

The objective of what we are after is not to buy low and to sell high, but to buy high and to sell higher, or to sell short low and to buy lower.

We can never know what price is really “low,” nor what price is really “high.” We can, however, have a modest chance at knowing what the trend is and acting on that trend. We can buy higher and we can sell higher still if the trend is up. Conversely, we can sell short at low prices and we can cover at lower prices if the trend is still down. However, we’ve no idea how high high is, nor how low low is.

Rule #6

Sell markets that show the greatest weakness; buy markets that show the greatest strength.

Metaphorically, when bearish, we need to throw our rocks into the wettest paper sack, for it will break the most readily, while in bull markets, we need to ride the strongest wind, for it shall carry us farther than others. (more…)

10 Rules For Traders

1. Find and trade markets where your edge is the greatest.

1. Find and trade markets where your edge is the greatest.

2. Avoid markets were the probability of rule changes and lack of transparency is present.

3. Think of and imagine market scenarios others fail to.

4. Fundamental macroeconomic forces will ultimately prevail.

5. Trading time frames and profit objectives though must coincide with what the market is giving you at any one time.

6. Quantify risk with a multidimensional perspective, not just by one or two measures such as VAR or a price stop.

7. Learn from history. Jay Gould and his attempts to corner the gold markets in the late 1860’s. The Russian default of 1917 and 1998. The European Rate Mechanism break up. The Tequila crisis of 1994. The Asian financial crisis.

8. Be deadly serious, as Gichin Funakoshi said “You must be deadly serious in training”. If you have a position make it a meaningful size and monitor it carefully. I recall many comments from fellow traders the past few years saying something like “I am long EuroSwiss just to have some on but not really watching it.”

9. Define and use a trading methodology that incorporates a process and framework that works for you. Inclusive in this should be a daily routine that includes diet, exercise, family time, etc.

10. Seek out catalysts for CHANGE in markets. Where are the forces, in a Newtonian like law of motion, building up the greatest to cause a CHANGE and movement in markets?

Who has to work the longest to buy an iPhone?

Disciplined Traders vs. Emotional Traders