Don’t miss to Read …..

1. Failing to follow your own rules. Here we go again with the rules! Always rules! The reason we have rules is because the market has none of its own. Rules keep us focused and keep our emotions in check. Thomsett describes the market as a “dangerous place” that is “full of temptations, promises of easy money, and artificial excitement.” Sounds like the perfect place to have a set of rules!

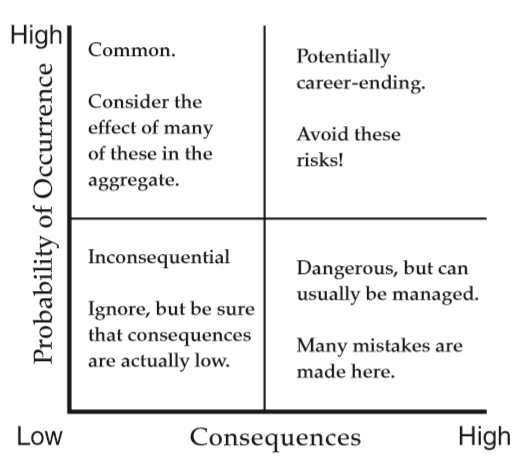

2. Forgetting your risk tolerance limits. Risk tolerance refers to the amount of risk we can afford to take and are willing to take. As traders, we should expose themselves only to the amount of money we can afford to lose. What does that mean? For me, it means if losing X amount of money in a trade can affect how I eat this week then I am overexposed. It is the same with buying a house or a car: will these payments negatively affect my basic lifestyle? If the answer is yes then it may be best to suspend the pleasure of something new.

3. Trying to make up for past losses with aggressive market decisions. If we have a string of losers or one big loser then we can be tempted to make up the loss by doubling up or going all in on a “sure thing”, exposing ourselves to much greater losses. Keep in mind that in the market anything can happen, including losing all your money! Losses are best made up not with home runs and grand slams but with singles, doubles, and an occasional triple.

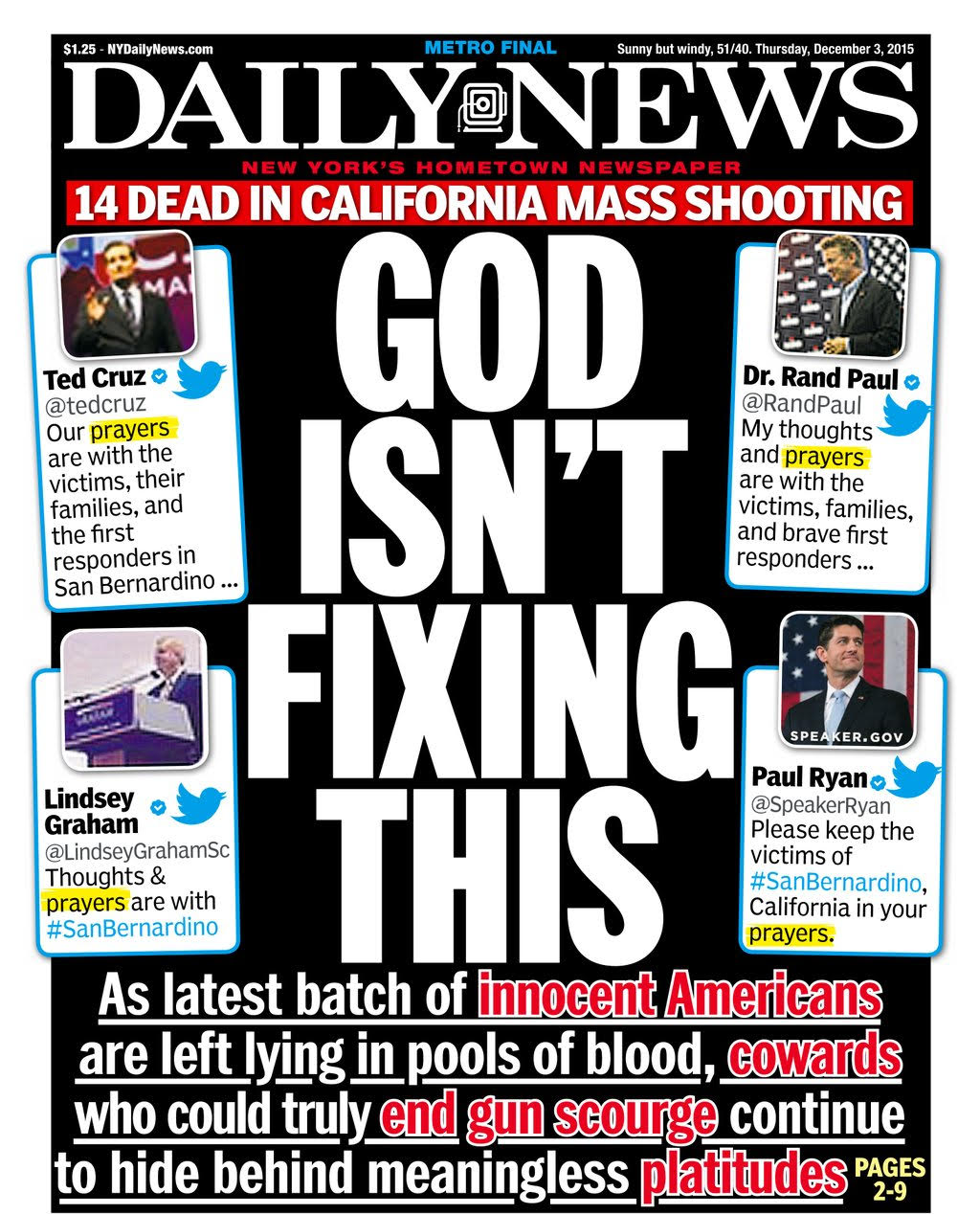

4. Investing on the basis of rumor or questionable advise. Chat rooms, mail solicitations, or pop-up ads that promise sure and fast profits are for fools and are not going to make anyone rich. “Making smart investment decisions invariably requires that you perform your own research, apply your own standards based on clearly identified risk standards, and do your homework directly.”

5. Trusting the wrong people with your money. “As a group, analysts’ advice has led to net losses for their clients.” Bottom line here is “anyone buying stocks and trading options should be making their own decisions and not relying on expensive advice.”

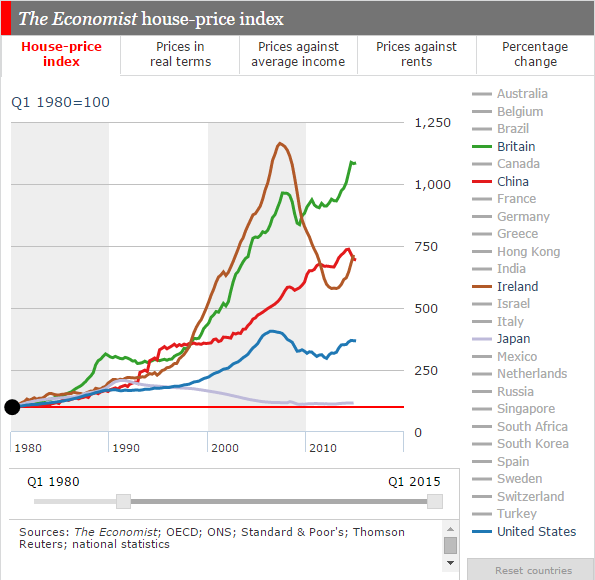

6. Adopting beliefs that simply are not true about the markets. “The market thrives on beliefs that, although strongly held, are simply not true.” When we believe that the market is there to make us rich if only we can find the secret to do so then we harbor false beliefs. When we believe that the market will always come back to make us whole, then we are working under the assumption of a faulty belief system. When we believe that the market makes the same logical sense as the world we are used to living and working in, then our beliefs are in direct opposition to the markets. The list can go on and on. Keep in mind here that the market is specifically designed to take advantage of human nature and those who trade by their emotions… human nature and emotions based on assumptions.

7. Becoming inflexible even when conditions have changed. We may have a great trading strategy that works in a trending market but when the market turns volatile our strategy can lose money. The same goes with a strategy that works best in a volatile market but not in a trending one. It is the ole’ square peg in a round hole experiment. It just won’t fit so we should not waste our energy trying to make it work. Know your strategy and know your market and you will know when to get in and when to stay out.

8. Taking profits at the wrong time. When the market starts working in our favor we tend to be very quick in taking profits but when not very slow in removing losses. On the one hand, we are afraid the market will take what little profit we have if we do not exit immediately with at least a small profit; on the other hand, we feel the market owes us something when it goes against us, therefore we hold on until it comes back. As hard as it may be the only way we can ever make money in the stock market is to let the winners run. Think about it this way: reverse what has become common practice so that the winners are allowed to do what the losers have been allowed to do and let the losers get knocked out quickly just like our winners have been. See if this makes a difference in the bottom line.

9. Selling low and buying high. “A worthwhile piece of market wisdom states that bulls and bears are often overruled by pigs and chickens.” In other words, we will never get anywhere in our trading is we are ruled by fear (at the bottom) and greed (at the top). Selling low and buying high is where the emotions step back in and where the market takes advantage of our human nature. Unfortunately, retail investors get the short end of the stick here as they are the last to get in (at the top) and the first to get out (at the bottom).

10. Following the trend instead of thinking independently. “Crowd mentality is most likely to be wrong. Crowds don’t think. They react.” This takes us all the way back to rule number one: have rules. One of the rules should be to follow our own thinking and not that of the crowd. By the time the crowd jumps on board, the move is usually over anyway! Hence, reaction instead of action.

Some really good lessons here as an old adage continues the provide the best lesson of all: learn from your mistakes!

There has been a lot of talk on the psychology of trading and getting rid of fear etc. I think that one way to help is to understand the performance parameters of your trading system and this means extensive backtesting and changing the way you think when entering a trade.

There has been a lot of talk on the psychology of trading and getting rid of fear etc. I think that one way to help is to understand the performance parameters of your trading system and this means extensive backtesting and changing the way you think when entering a trade.

About a month or so ago, I finally got around to reading Marty Schwartz’s classic,

About a month or so ago, I finally got around to reading Marty Schwartz’s classic,