I figured it out right away!

I figured it out right away!

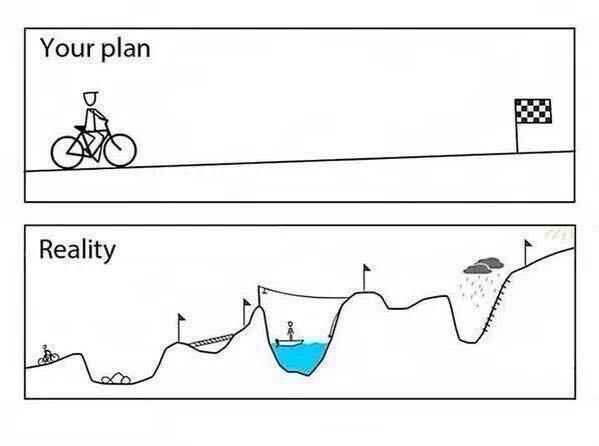

1. Have a Plan: If you are going to actively trade, you must have a comprehensive plan. All too many investors I deal with have no strategy at all — its strictly seat of the pants reaction to each and every market twitch. The old cliche “If you fail to plan, than you plan to fail” is absolutely true.

I suggest that traders write up a business plan for their strategy, as if they were asking Venture Capitalists for money for a start up; In fact, you are asking an investor for capital — just because that investor is someone you know a long time (you) doesn’t mean you should skip the planning stages.

2. Expect to be Wrong: Accept this fact: You will be wrong, and often. The plea for help is at least a tacit recognition that you are doing something wrong — and that means you are a giant leap ahead of many failing traders.

Egotists who refuse to recognize the simple truism of being wrong often give up unacceptable amounts of capital. It is only stubborn pride — and lack of risk management — that keeps people in stocks down 50% or more.

Even the best stock pickers in the world are wrong about half the time.

Michael Jordan has the best quote on the subject: “I’ve missed more than 9,000 shots in my career. I’ve lost almost 300 games. Twenty-six times, I’ve been trusted to take the game winning shot and missed. I’ve failed over and over and over again in my life. And that is why I succeed.”

Mike is the greatest player of all times not merely because of his superb physical skills: He understands the nature of failure — and its importance — and places it within a larger framework of the game

3. Predetermine Stops Before Opening Any Position: Once you have come to understand that you will be frequently wrong, it becomes much easier to use stops and sell targets.

I suggest signing a “prenuptial agreement” with every stock you participate in: When it hits a predetermined point, regardless of methodology — below support or a moving average or a specific percentage amount or the monthly low or whatever your stop loss method is — that’s it, you’re out, end of story. No hopin’ or wishin’ or prayin’ or . . . (Apologies to Dusty Springfield)

The prenup means you are making the exit decision before you are in a trade, and when you are neutral and objective. (more…)

Dear Readers, Today morning I wrote 5077 as Peak NF possibility for the day. It went upto 5072 only. Sensing its failure here, my Message to all Subscribers: Now, at 5065…. Short NF with a Risk of Rs.13. Below 5055 it will tumble upto 5004. Within minutes NF tumbled to 5006. Instant gain of 59

Dear Readers, Today morning I wrote 5077 as Peak NF possibility for the day. It went upto 5072 only. Sensing its failure here, my Message to all Subscribers: Now, at 5065…. Short NF with a Risk of Rs.13. Below 5055 it will tumble upto 5004. Within minutes NF tumbled to 5006. Instant gain of 59

In the same message: Now at 1075, Sell RIL with a stop of 1086-1092. Reliance just in Minutes slid from 1077 to 1056, nearest to its day’s low 1053

At opening bell :Catch Bharti above 289.50 for supergains tgt 297 ,303.50 (It kissed 302)

The point tobe noted here is: Shorting at the peaks. Its possible only when I am committed in my market analysis work at the bottom of my heart. My Levels mentioned in the web-site are the same but my MESSAGES at the right time will trigger action to subscribers for grand gains, unhesitant to Short too which is a rarity.

Just Follow Levels, Make your Vallets Deep, Deeper, Deepest

Join us live during trading hrs and get Intraday live calls of Nifty Future/Stocks.

The mechanics of trend following:

The mechanics of trend following:

– know what to trade

– know when to enter the trade

– know what to do once in the trade

– know when to exit the trade

Spending: If you buy things you don’t need, you’ll soon sell things you need.

Savings: Don’t save what is left after spending; spend what is left after saving.

Hard work: All hard work brings profit; but mere talk leads only to poverty.

Laziness: A sleeping lobster is carried away by the water current.

Earnings: Never depend on a single source of income.

Borrowings: The borrower becomes the lender’s slave.

Accounting: It’s no use carrying an umbrella, if your shoes are leaking.

Auditing: Beware of little expenses; a small leak can sink a large ship.

Risk-taking: Never test the depth of the river with both feet.

Investment: Don’t put all your eggs in one basket.

The following is a clip from Michael Covel’s new documentary, Broke: The New American Dream. The amount of wisdom compressed into a 1 minute and 16 second clip is amazing:

Discipline is the key factor towards the success of trading/investing. Lack of discipline will result a bigger loses when you hesitate in cutting lost or when you enter a trade too early. Discipline no doubt is the bigger key deciding factor in any kind of field.

You need passion to drive you towards the success that you are hunger. You need the passion to do the boring job yet very rewardable at the end of the trading journey.

Tough time come you need to press it on. Never say quit attitude!!! Most of the Good Trader or Investor will experience a major downfall before they succeed in this business. If they did not fight back again then they will never succeed. Once again tell yourself press it on till you succeed.

Many people including me lack the virtue of patience. Trading and investing require plenty of patience as most of the time we are waiting at the sideline and let the newbies to kill each other. Once the market decide to go in the trend then we as a professional trader and investor will act upon it very fast. Being Patience alone will save you plenty and tons of money.

The more sweat you put in the greater reward you will get. Then again if you are doing the wrong thing every time again and again, this mostly likely tell you that your system of trading is not working and thus you need to change. There are a big different between hardworking and just stubbornly sticking to the failed plan. If the system of yours is CLearly not working after you put in months of efforts then you should just change your strategy.

Last but not least you need to strongly believe that you will be able to take money out of the market consistently. Believe that your Tested system will be able to last as long as the market condition do not change much.