Archives of “January 2019” month

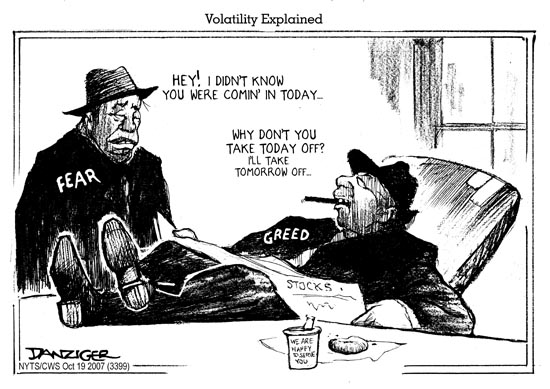

rssVolatility Explained : This Image Says Everything

10 Rules for Life -Must Read ,Must Follow

1) In life, do good and do well. Real success comes from pursuing your talents and enriching the world with their expression.

2) They lead best who follow their calling. Those who follow a genuine calling set an inspiring example with their actions.

3) Not all who rave are divinely inspired. Passion without wisdom is mere noise.

4) True love never dies; it has to be killed. Love is making another’s happiness your own.

5) Be your ideals; in some measure you’re already who you want to become. Conscious living is striving to be who you are when you are at your best.

6) You can’t save damsels who love their distress. Saving people (and organizations) that aren’t ready for change is one of life’s more frustrating experiences–for all involved.

7) To make dreams come true, you first have to wake up. Dreams and visions mean little if you’re not out of your bed and working toward them.

8) Everything in life is use it or lose it. What didn’t you do today? This week? This month? Those are the things you’re losing.

9) You are what you eat–and you are always eating life experience. Life is a mirror; we internalize the things we do and the people we know. Choose your diet wisely.

10) When you are open to opportunity, opportunity opens to you. When you put yourself out there with everything you’ve got, great things can happen.

A chart pattern is a reflection of all buyers & sellers behaviors

Things only Gundlach can say

Catch a couple of good waves

3 Trading Lessons

1. If you are playing “for real”, only play the game you can win.

2. If you are playing “for real”, only play against people that you are confident you can beat.

3. If you are playing “for real”, make sure you are at your peak potential to do. Do nothing to impair your physical and cognitive abilities.

6 Universal principles of successful traders

1). Preparation

Author Brent Penfold is in the minority believing risk management is the #1 priority in trading. Brent believes that once you get your trading system and position size in place you must use the amount you will risk on each trade to determine your risk of ruin. The book shows exactly how to figure this out using Excel. His point is that if your risk of ruin is not zero then you will eventually blow out your account. Risking 1% to 2% of your capital in any one trade usually gives you a zero percent risk of ruin but it also depends on your systems win/loss ratio. But the point is to test any system with 30 trades first then determine your risk of ruin.

2). Enlightenment

Your most important goal is to lower your risk ruin to zero. In trading, the trader with the best ability to cut losses short wins. Simple trading strategies work the best based on traditional support and resistance while trading with the trend on either retracements of break outs. The 10% of winners in the market win by treading where others fear, buying on break outs when they first occur and going short when a new low is made, or buying into the abyss when a security finds support or resistance and reverses at the end of a monster trend.

3). Developing a trading style (more…)

Hendry takes a big bet on China crash

Hugh Hendry, the voluble hedge fund manager well known for his bearish but highly successful calls on the global economy over the past two years, has taken a big position that is designed to profit from a crash in China.

Hugh Hendry, the voluble hedge fund manager well known for his bearish but highly successful calls on the global economy over the past two years, has taken a big position that is designed to profit from a crash in China.

Mr Hendry’s London-based Eclectica Asset Management has constructed a “short credit” portfolio that stands to make gains of 250 per cent for his flagship fund in the event of a slump in China’s growth.

Eclectica is also poised to launch a standalone fund to benefit from the strategy next month, the Financial Times has learned.

The new fund will stand to deliver even larger gains than those for the main fund if successful.

“The investment team and I have carefully constructed a short credit portfolio made up of over 20 single-name industrial, cyclical businesses that have the dubious distinction of suffering from gigantic financial leverage and Asian/commodity overdependence,” Mr Hendry wrote to investors in his monthly letter this week. (more…)

I love this one