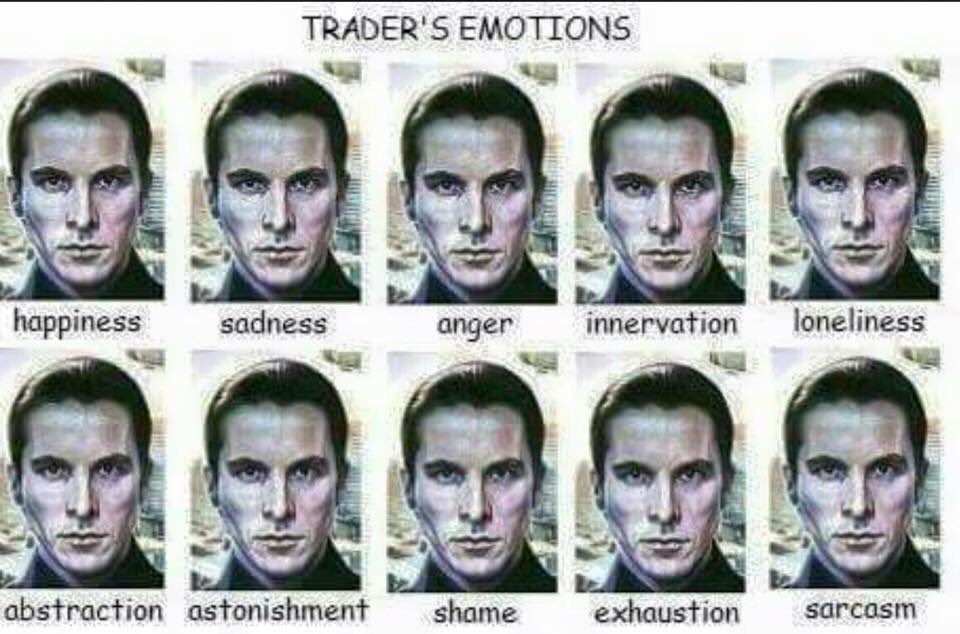

Those who have chosen this very unique career of “trader” face a mountain of challenges each day based on ever-changing market conditions. Added to the market challenges are emotions, which can be 90% of the game. You can have a great method, strategy and be taught by the best, but if fear, apprehension or hesitation come up the trader won’t take the trade…..this is an emotional block. All successful and experienced traders learn quickly to become the masters of their emotions. To accept and manage their weaknesses and leverage their strengths.

Those who have chosen this very unique career of “trader” face a mountain of challenges each day based on ever-changing market conditions. Added to the market challenges are emotions, which can be 90% of the game. You can have a great method, strategy and be taught by the best, but if fear, apprehension or hesitation come up the trader won’t take the trade…..this is an emotional block. All successful and experienced traders learn quickly to become the masters of their emotions. To accept and manage their weaknesses and leverage their strengths.

At first most traders start by researching and determining a method to trade. They do little to emotionally prepare for what’s to come. Yet they quickly find out that their emotions come into play early on, especially if they experience immediate losses. Losing money coupled with one’s own emotional “baggage” can impact the minds thought process and outcome.

My work focuses on the power of the mind and in particular the power of thought. These three problems and solutions do too. Nothing happens without the some form of thought, be it sub-conscience or conscience. After all, isn’t this what we’re left with when sitting in front of our monitors trading? What comes into our minds, as we trade can be avalanches of different thoughts. These thoughts then have the ability to assist us and add to our success or become our worst nightmares resulting in multiple losses.

Traders over time, come to the realization that trading will force them to face ALL their old and current emotional baggage and blocks. And that NOT being able to manage or “dump” the baggage, can hit the bottom line quickly.

When a trader’s plan doesn’t work they tend to blame it on the method, when in reality it usually comes down to an emotion causing them to react inappropriately. We can pick up automatic emotional blocks that prevent us from implementing a method effectively. Many try to get over these emotions on their own, but few master the changes needed.

But lets get specific and to the heart of these three trading problems. The first reason traders lose may seem obvious but in reality it stems from long term social conditioning. It’s their inability to ACCEPT LOSS. Losing generates powerful emotions, such as fear, uncertainty, apprehension, and self-doubt especially with men. And while women today can also be as affected, the data is supported mostly by men as they represent a larger portion of the client base.

Men are socially conditioned to succeed from the time they enter the world. From little boys being read, “The Little Train That Could” to the environments that surround them as they grow up. They are guided to be become achievers. Influenced by family, friends, education, and career environments they are encouraged to seek professions of Doctors, Lawyers, and Bankers. Images and social metaphors reinforce them. Striving to be right, number one, the breadwinner, and the best, always seeking perfectionism. They are socially conditioned to be the family providers. Add to this various cultural pressures and demands and men have a built-in fundamental obligation to succeed. (more…)

![]()

Those who have chosen this very unique career of “trader” face a mountain of challenges each day based on ever-changing market conditions. Added to the market challenges are emotions, which can be 90% of the game. You can have a great method, strategy and be taught by the best, but if fear, apprehension or hesitation come up the trader won’t take the trade…..this is an emotional block. All successful and experienced traders learn quickly to become the masters of their emotions. To accept and manage their weaknesses and leverage their strengths.

Those who have chosen this very unique career of “trader” face a mountain of challenges each day based on ever-changing market conditions. Added to the market challenges are emotions, which can be 90% of the game. You can have a great method, strategy and be taught by the best, but if fear, apprehension or hesitation come up the trader won’t take the trade…..this is an emotional block. All successful and experienced traders learn quickly to become the masters of their emotions. To accept and manage their weaknesses and leverage their strengths.