Archives of “January 2019” month

rssLegendary Trader Ed Seykota's Greatest Quotes- VDO

Self-Factors' of Successful traders

- Self-awareness; – Knowledge of oneself and how one acts and behaves in situations and environments.

- Self-Belief; – Self-Confidence – assuredness in one’s actions, judgments and abilities.

- Self-Trust; -The ability to have faith in oneself under duress and pressure.

- Self-Reliance; – Ability to depend on one’s own capabilities, judgment, and resources , and acceptance that nobody else is responsible for profits and losses.

- Self-discipline; – A structured approach that keeps a person focused and grounded against negative forces and pressures.

- Self-Control; – Is the ability of exert mind muscle and will-power to overcome the negative effects which can so easily distract and distort perceptions and judgments.

- Self-Motivation; – Describes the initiative to undertake risks and activities when the mood and environment have been counterproductive.

- Self-Esteem; – High regard, respect or value for one’s self, but not to the level of being conceited, or having an over-inflated opinion of their worth.

- Self-efficacy; – Belief in one’s own competency and ability.

In summary, successful traders take responsibility for their own actions, but rarely beat themselves up. – If I was to sum it up succinctly, they know themselves, they like themselves, they believe in themselves, and above all – ‘they are comfortable in their own skin’. (more…)

Churchill Quote is Right For Life …Not For Trading !

Standardized Minds

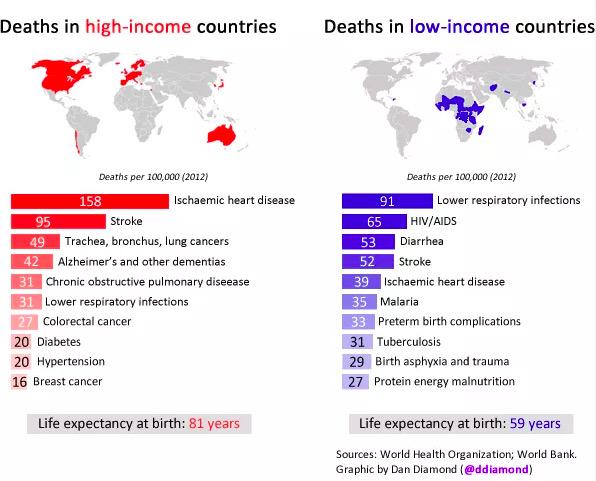

Life Expectancy High Income Countries: 81 Low Income Countries: 59 And here's the divide in causes

Believe or Not :Situation of Indian Economy and Banks

Bend your will to focus on the war

- 1) Allow yourself to enjoy the victories. Traders have a tendency to get very upset about busted trades and in so doing burn memories strongly in their minds. The same traders get little satisfaction from the good trades, thus not burning as strong a memory. If you have done your homework, followed your rules, entered and exited the trade as planned, then give yourself credit and enjoy it. You deserve it.

- 2) Take control of your beliefs. Successful traders are realistic about trading when accepting the fact that trading is a game of probabilities. Successful traders believe in probabilities and in so doing know that with each trade there is a higher probability the trade will work than not. How do they know this? Because they have tested and traded their set up(s) enough times to know that the odds are in their favor. However, the successful traders also know that favorable odds do not guarantee success 100% of the time. Successful traders believe with each trade that the odds are in their favor but they also believe that the trade will not always work. By knowing this successful traders will be able to enter every trade with a clear mind open to the fact that anything can happen NO MATTER WHAT HAPPENED ON THE LAST TRADE! If you believe this then you will never focus on the last trade, only on the present one.

You cannot live in the past so there is no need to trade in it either. Just as every day is a new one so is every trade. Focus on the present battle and in war you will be victorious!!

Think About It

17 One Liners for Traders

Trade the market, not the money

• Always trade value, never trade price

• The answer to the question, “What’s the trend?” is the question, “What’s your timeframe?”

• Never allow a statistically significant unrealized gain to turn into a statistically significant realized loss (ATR)

• Don’t tug at green shoots

• When there’s nothing to do, do nothing

• Stop adjustments can only be used to reduce risk, not increase it.

• There are only two kinds of losses: big losses and small losses, given these choices – always choose small losses.

• Don’t Anticipate, Just Participate

• Buy the strongest, sell the weakest (RSI)

• Sideways markets eventually resolve themselves into trending markets and vice versa

• Stagger entries & exits – Regret Minimization techniques

• Look for low risk, high reward, high probability setups

• Correlations are for defense, not offense

• Drawdowns are for underleveraged trading and research

• Develop systems based on the kinds of “pain” (weaknesses) endured when they aren’t working or you’ll abandon them during drawdowns.

• Be disciplined in risk management & flexible in perceiving market behavior