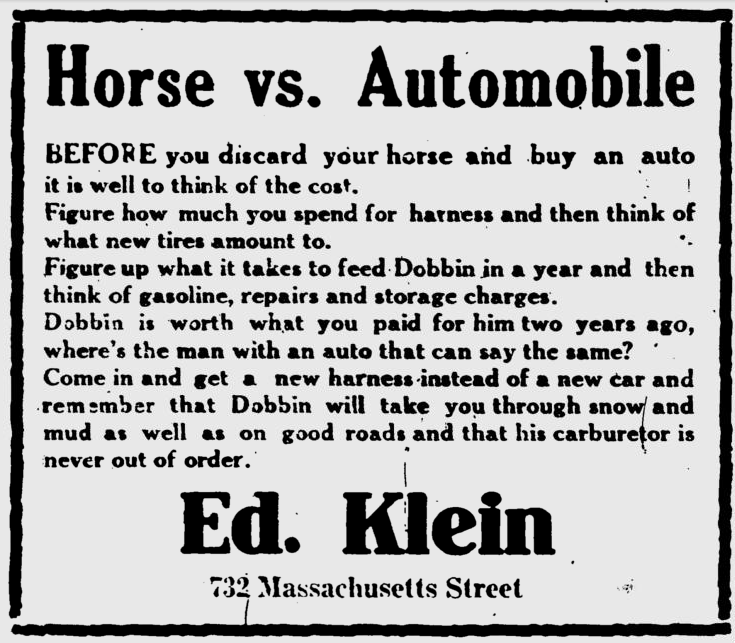

"BEFORE you discard of your horse and buy an auto it is well to think of the cost" (1915)

Good morning. The long-awaited jobs report is out and it came as worse than expected (as Goldman predicted). 263,000 jobs were lost and unemployment rate came in at 9.8%. Futures were trading lower ahead of the report and have stayed that way since.

Other news include the World Bank’s warning of a wobble ahead for the global economy, a strong dollar is very important to Geithner, Bernanke suggests a Board of Regulators, Meredith Whitney says small business credit crunch continues and Comcast & NBC are apparently in deal talksAt 10:AM we have Factory Orders for August and news of the Chicago Olympic Bid will also come out today between 12:30PM to 1:PM EST.

Already this fall I had expected and written to have cautious approach.Now just will watch S&P 500.Below 1031 will take to 1014-1009 level and there after retest of 991 level.

Will update more about DOW ,Nasdaq Compostite and S&P very shortly.

Iam personally Bearish for Stocks/Commodity from last 15 days and will not buy anything.

Technically Yours

Anirudh Sethi

Van K. Tharp mentioned there are 3 biases that will affect one’s trading:

1) Gambler’s fallacy bias

People tend to believe that after a string of losses, a win is going to come next. Take for example that you are playing a game of coin tossing with a capital of $1000. You lost 3 bets in a row on heads and cost you $100 each bet. What will you bet next and how much would you stake?

It is likely you will continue to bet on heads and with a higher stake, say $300. You do not ‘believe’ that it can be tails consistently. People fail to realize coin tossing is random and past results do not affect future outcomes.

Traders must treat each trade independently and not be affected by past results. It is important that your trading system tells you how much to stake your capital which is also known as position sizing, so that the risk-reward ratio will be optimal.

2) Limit profits and enlarge losses bias

People tend to limit their profits and give more room to losses. Nobody likes the feeling of losing. Most investors tend to hold on to losses and hope their investments will turn around soon, and they will be happy if their holdings break even. However, chances are that they will amount to greater losses. On the other hand, if they are winning, most investors tend to take profits early as they fear their profits will be wiped out soon. Thereafter, they regretted that they didn’t hold a little longer (sounds familiar?). (more…)

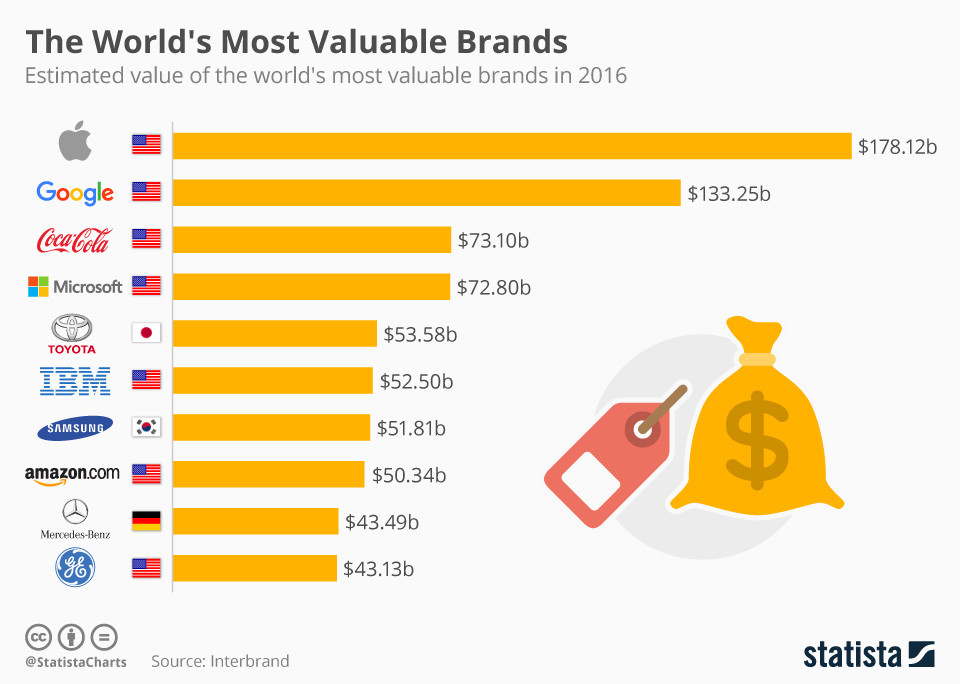

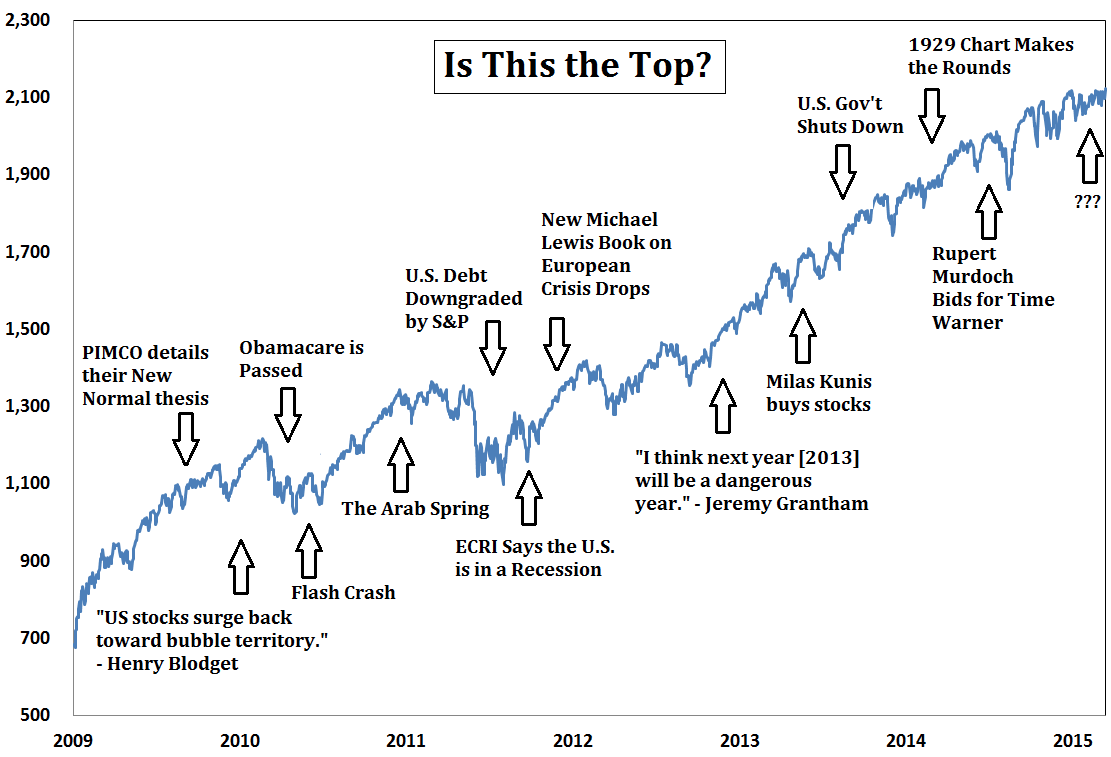

Ben Carlson, who is the Director of Institutional Asset Management in our shop, cranks out some of the most insightful — and mind-blowing — commentary on the internet.

The chart above is a direct indictment of some of the less informed nonsense regularly trotted out during any market debate (go read the entire thing here).

If you are managing a pension fund, endowment, or any other institutional set of assets, and not following A Wealth of Common Sense, you are doing your investors a huge disservice.