Archives of “January 26, 2019” day

rssLead a Disciplined Life

Paul Tudor Jones on the illusion of information

The Richest Person On Each Continent

With a stock price surge of 13% after Amazon’s most recent quarterly filing, Wall Street analysts were reportedly “shocked” by the company’s rapid growth. The e-commerce juggernaut beat both quarterly revenue and earnings forecasts, and continues to trailblaze with a 34% revenue growth rate.

This boded well for the net worth of Amazon founder Jeff Bezos, which fluctuates wildly based on Amazon stock price movements. In fact, as Visual Capitalist’s Jeff Desjardins notes, the recent jump in price on October 27 helped catapult him past Bill Gates (again) to become the richest person in North America, as well as the entire world.

As of publication time, according to Forbes’ real-time wealth tracker, his wealth stands at $92.6 billion.

NET WORTH LEADERS BY CONTINENT

Today’s graphic comes to us from HowMuch.net and it shows the richest person on each continent.

Courtesy of: Visual Capitalist

Here is the full breakdown:

Net worth figures from HowMuch.net as of November 3, 2017

To be thorough, HowMuch.net also “nominated” a person to represent the continent of Antarctica, even though it has no permanent residents.

Chosen for this title? It’s none other than Arnold W. Donald, the CEO of Carnival, the world’s largest cruise company, which monetizes the icy continent for its Antarctic cruises on a regular basis.

* * *

This graphic has been amended since initial publication. Just yesterday, Mukesh Ambani climbed up the list to become the richest person in Asia, and it now reflects that. Thanks to everyone who pointed this out.

Murphy's Lesser Known Laws.

1. Light travels faster than sound. This is why some people appear bright until you hear them speak.

2. He who laughs last, thinks slowest.

3. Change is inevitable, except from a vending machine.

4. Those who live by the sword, get shot by those who don’t.

5. Nothing is foolproof to a sufficiently talented fool.

6. The 50-50-90 rule: Anytime you have a 50-50 chance of getting something right, there’s a 90% probability you’ll get it wrong.

7. If you lined up all the cars in the world end to end, someone would be stupid enough to try to pass them, five or six at a time, on a hill, in the fog.

8. If the shoe fits, get another one just like it.

9. The things that come to those who wait will be the things left by those who got there first. (more…)

Not A One Way Train

Words of wisdom from Dave Landry’s new book, The Layman’s Guide To Trading Stocks:

Wall Street Myth 1: The market always goes up longer term

It seems to be universally preached that the market “always goes up longer term.” And, all you have to do is buy a diversified mutual fund or index fund and wait. The problem is that markets do not always go up longer term. Well, I suppose it all depends on what you mean by longer term.

Suppose you bought stocks in 1929 at the market peak. Provided you could have held through a 90% loss, it would then have taken you a quarter of a century just to get back to breakeven.

Let’s say you bought stocks in the mid-1960’s. Your return would have been almost zero until the market finally broke out in 1983, which was 17 years later.

When I began this chapter, I was concerned that there might be a “that was then, this is now” mentality. After all, the benchmark S&P 500 wasn’t far below breakeven from the 2000 peak. I thought I was going to have to make a strong case for not buying and holding. Unfortunately for the buy and hold crowd, the market made my case for me. The bear market that began in late 2007 would turn out to be the worst since 1929. By March 2009, the S&P was at 13-year lows. From these lows, the market will have to rally over 200 percent just to get to breakeven.

At more than one cocktail party, I have had people laugh in my face when I tell them that the market can go 25 years or more without going up. This has made for some heated discussions and awkward social situations. I have since learned from Dale Carnegie and my wife Marcy to just nod my head and enjoy my drink. Do not take my word for it, just look at the charts and grab me a Black and Tan while you are at it!

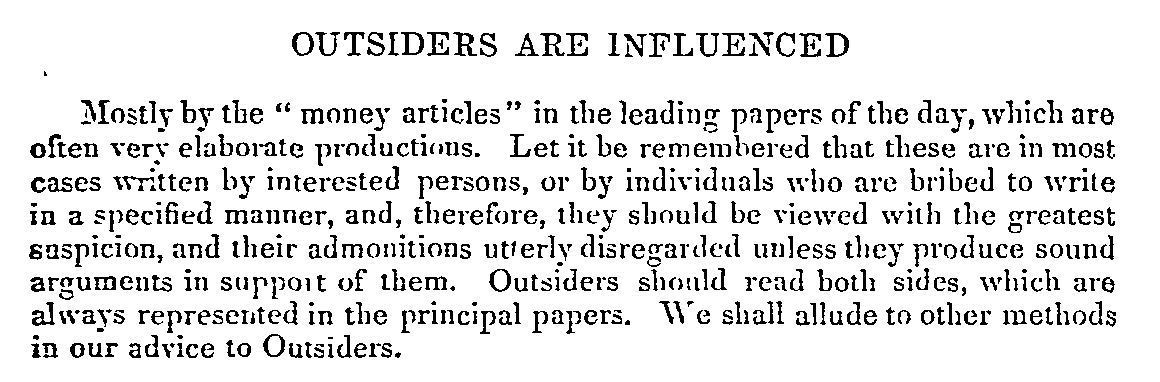

Financial Journalism in 1848 (and not 2015, we hope )

A Professor explained Marketing to MBA students:

Sir John Templeton 16 Rules For Investment Success

Interesting set of rules from legendary investor John Templeton:

1. Invest for maximum total real return

2. Invest — Don’t trade or speculate

3. Remain flexible and open minded about types of investment

4. Buy Low

5. When buying stocks, search for bargains among quality stocks.

6. Buy value, not market trends or the economic outlook

7. Diversify. In stocks and bonds, as in much else, there is safety in numbers

8. Do your homework or hire wise experts to help you

9. Aggressively monitor your investments

10. Don’t Panic

11. Learn from your mistakes

12. Begin with a Prayer

13. Outperforming the market is a difficult task

14. An investor who has all the answers doesn’t even understand all the questions

15. There’s no free lunch

16. Do not be fearful or negative too often

Complete explanation after the jump (more…)

Ferri, The Power of Passive Investing

He cites several studies and some of his own tests that demonstrate the futility of seeking alpha. Among the findings, a single actively managed fund has a 42% chance of beating a comparable index fund over the course of a single year, a success rate that drops to 12% over 25 years. The statistics get much worse as you add more active funds. If you own ten funds, you have a 27% chance of beating an all index fund portfolio over one year and a mere 1% chance over 25 years.

Ferri’s own work analyzed the returns of actively managed funds within a generic asset class over five years. He found that a portfolio of five randomly selected active funds had only a 16% chance of beating an index fund, that only 5% of them won by 0.5% or more, and that 63% of them lost by 0.5% or more. When the portfolio was expanded to ten active funds, the numbers were much worse. Only 8% were winning portfolios, 1% of them won by 0.5% or more, and 70% lost by 0.5% or more. Ferri then massaged his model to see whether the numbers could be significantly improved; they couldn’t. As he summarized the results, “Active fund investors have strong headwinds against them. The probability of selecting a winning fund is low; the average payout for those winning funds does not compensate them enough for the shortfall from being wrong; the addition of several active funds in a portfolio reduces the probability of success; and the longer that portfolio is held, the odds drop even more. That’s a lot of headwind!” (p. 92) (more…)