Take what the market gives u. However, always keep in mind that if life gives u lemons, monopolize the lemon market!

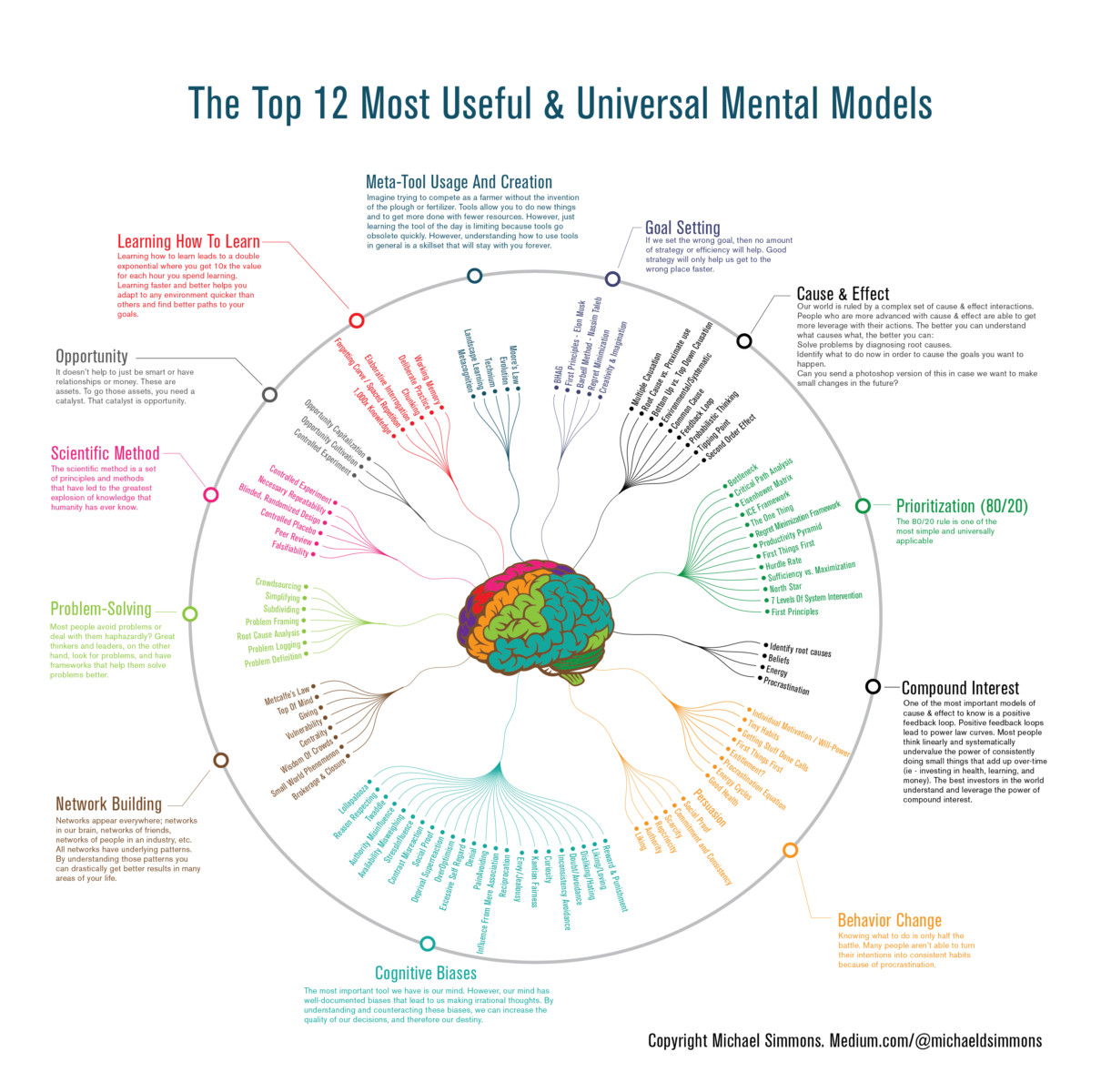

How much time do you spend each week practicing trading-specific skills, obtaining feedback about your performance, and consciously working on improving your performance?

Do your trading results reveal a positively sloped learning curve? What specific skills have you learned–and do you employ–over the past year that have made you a better trader?

Trading Is Complicated

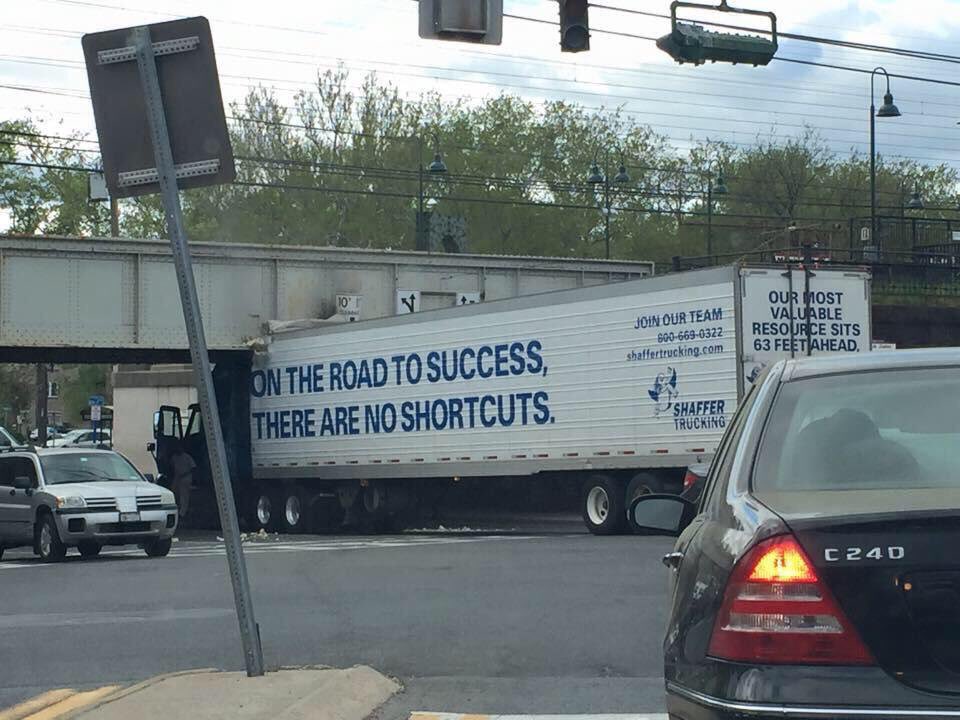

Trading Is ComplicatedTrading is simple. You are complicated.

No, you don’t.

No, you don’t.

No, they won’t.

Another mistake many investors make is that they allow themselves to be influenced by what other people think. I made this mistake myself when I was still learning how to trade. I became friends with a broker and opened an account with him. We played this game called “bust the other guy’s chops when his stock is down.” When I had a losing stock position, 1 was embarrassed to call him to sell the stock because I knew he would he would ride me about it. If a stock I bought was down 5 or 10 percent, and I thought I should get out of it, I found myself hoping it would recover so 1 wouldn’t have to call him to sell it while it was down. Before I knew it, the stock would be down 15 or 20 percent, and the more it fell, the harder it became for me to call. Eventually, I learned that you have to ignore what anybody else thinks.Many people approach investing too casually. They treat investing as a hobby instead of like a business; hobbies cost money. They also don’t take the time to do a post-trade analysis on their trades, eliminating the best teacher: their results. Most people prefer to forget about their failures instead of learning from them, which is a big mistake.

Another mistake many investors make is that they allow themselves to be influenced by what other people think. I made this mistake myself when I was still learning how to trade. I became friends with a broker and opened an account with him. We played this game called “bust the other guy’s chops when his stock is down.” When I had a losing stock position, 1 was embarrassed to call him to sell the stock because I knew he would he would ride me about it. If a stock I bought was down 5 or 10 percent, and I thought I should get out of it, I found myself hoping it would recover so 1 wouldn’t have to call him to sell it while it was down. Before I knew it, the stock would be down 15 or 20 percent, and the more it fell, the harder it became for me to call. Eventually, I learned that you have to ignore what anybody else thinks.Many people approach investing too casually. They treat investing as a hobby instead of like a business; hobbies cost money. They also don’t take the time to do a post-trade analysis on their trades, eliminating the best teacher: their results. Most people prefer to forget about their failures instead of learning from them, which is a big mistake.

They let their egos get in the way. An investor may put in hours of careful research building a case for a company. He scours the company’s financial reports, checks Value Line, and may even try the company’s products. Then, soon after he buys the stock, his proud pick takes a price dive. He can’t believe it! He makes excuses for the stock’s decline. He calls his broker and searches the Internet, looking for any favorable opinions to justify his position. Meanwhile, he ignores the only opinion that counts: the verdict of the market. The stock keeps sliding, and his loss keeps mounting. Finally, he throws in the towel and feels completely demoralized – all because he didn’t want to admit he had made a mistake in timing.

(Time spent watching tv, in all forms, not just Blue Channels is not good for you. The same is true with most social media where everyone is an expert and only makes winning trades. If you want to watch something – watch the charts and focus primarily on what you see not what you think or expect to see. Above all else, you must realize that what others think is good entertainment and a distraction for you but not much else.)