Naked Truth :Political Reporting in India

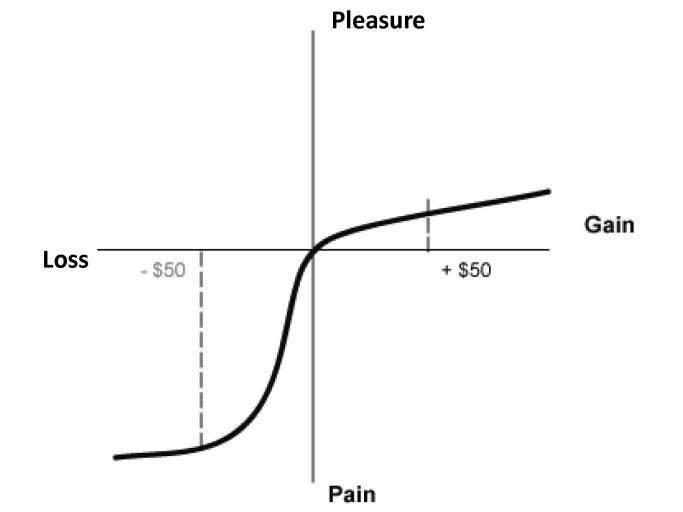

1 Greed, the urge to make as much money as possible, and fear that he will lose it all.

2 Low confidence in himself or his strategy, which makes him enter or exit trades at the wrong time. Low self esteem is also a problem; lots of people are natural victims and believe that they will probably fail, and of course this is what they do.

3 Middle class guilt that makes the trader believe that he should not make super profits because it is morally wrong.

4 Overconfidence. Feeling that after so many winning trades he is invincible.

5 Disbelief. He believes that high rewards cannot possibly be true, and “If trading is that easy, then everyone would be doing it.” He then looks for complicated strategies in the belief that it cannot be easy.

6 Paranoia, believing that the market is conspiring against him.

7 Reward for effort, where he feels that people should be rewarded fairly for the effort that they put in. FX trading does not operate with these rules and that is confusing. The reward can be disproportionately high or can result in punishing losses, and is not dependent on just the work put in.

8 Insecurity, resulting in changing a strategy that is actually winning. All strategies must be tested and then consistently applied in order to engender confidence.

9 The urge to trade simply because he is a trader. This impatience results in entering trades when no real opportunity exists.

10 Low expectation; people with a low expectation of life tend to be less successful. Even though they may be highly intelligent, they aim for less and settle for less. (more…)

You want to be trading opportunity, not your mood of the moment. – Brett Steenbarger

Is it time to be aggressive?

Are you sleeping today thinking how much money you’ll make tomorrow? Are you counting your profits before you’ve even sold it? Are you imagining tomorrow’s going to be another strongly trending up day? Believe me… you are not alone. Upward strong momentum following upside strong surprises releases euphoria in every person. In fact, it is these types of strong markets that fuels even stronger performances in the weeks ahead. Or is it?

So before we rely solely on our human instincts to be greedy and hold all our positions, the first thing we should do is to analyze the charts with a keener eye on volumes other than prices and perhaps check up on what our history teachers have to say. Take away all our biases, and hopefully be mentally flexible to adopt with the perception of the markets, employ sound management practices while profiting with the trend.

Basically, you and I are both thinking the same thing. We both have the same dilemma:

1.) We both don’t want to lose our hefty short term gains.

2.) We both don’t want to sell too early either (i.e. we want to maximize our gains even further).