The yogis say our true nature is joy. When we’re laughing and truly having fun, perhaps that’s when we’re most being ourselves – and not the product of something else.

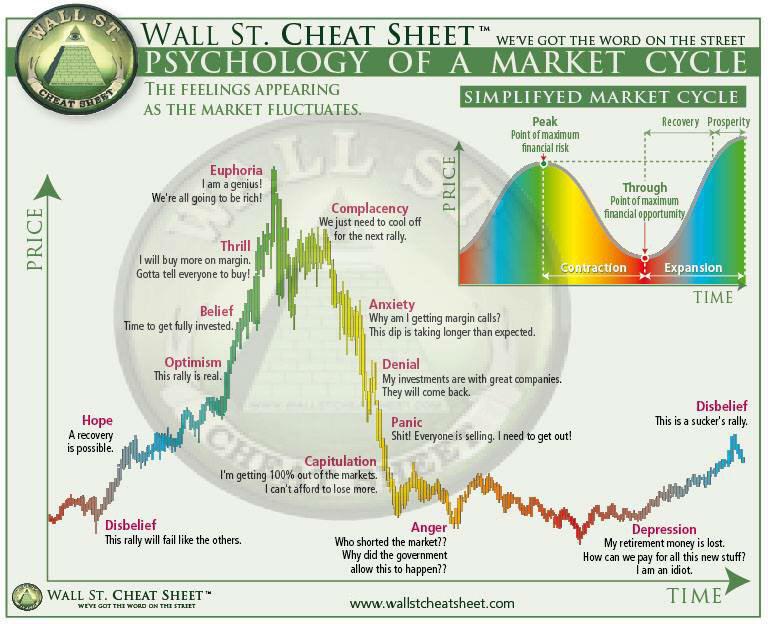

It is easy to be jocular and personable when things are going well, but you get to see who you really are when things are going badly. The energy required to maintain interpersonal facade is redirected toward survival. The market is a very good mirror. And a very bad one.

–

Who you really are is very much like a stock in Portfolio Theory. The good side is the rate of return, but most compare that with the additional information of the standard deviation of the returns.

Similarly a person should be measured along the same lines. The person who is happy go lucky most of the time but occasionally has bouts of violent anger is not as desirable a friend as one who is relatively constant but with lesser high points.

Each person responds differently to stimulus. And as with stocks it is the bad side that is most important. Someone who is in a funk for a long time has the risk of getting clinically depressed, with physiological damage to the synapses.

I always liked the saying that “not all great companies are great stocks”. Forgot who coined that one–maybe from the Livermore books that I have read. Meaning that the stock of the good company may not act or behave well for speculation. In general, it is interesting how stocks are given human qualities by specs.

Trust your gut If something looks like crap and smells like crap, then chances are, it is crap. Listen more to your gut to tell you when to cut a loss and move on.

Trust your gut If something looks like crap and smells like crap, then chances are, it is crap. Listen more to your gut to tell you when to cut a loss and move on.