Archives of “January 18, 2019” day

rssThis Happening In India -Official Manipulation

Tim Backshall On Europe: "Default Now Or Default Later" As EuroStat Complains That Greece Is Still Withholding Critical Data

There is one major problem with putting houses of card back together – they tend to fall…over and over. And while abundant liquidity in May and June served as an artificial prop to return European core and PIIGS spreads to previous levels merely as mean reversion algos took holds, the second time around won’t be as lucky. CDR’s Tim Backshall was on the Strategy Session today, discussing the key trends in sovereign products over the past few months, noting the declining liquidity in both sovereign cash and derivative exposure (we will refresh on the DTCC sovereign data later after its weekly Tuesday update). Yet the most interesting observation by Backshall is the declining halflife of risk-on episodes, which much like the SNB’s (now declining) interventions, are having less of an impact on the market, as ever worsening fundamentals can only be swept under the carpet for so long before they really start stinking up the place, and indeed, as Tim points out at 5:30 into the interview, even the IMF now realizes that soon the eventual second domino will fall, and it is better the be prepared (via the previously discussed infinitely expanded credit line), than to have to scramble in the last minute as was necessary in May. In other words, the storm clouds are gathering and only fools will invest in risk asset without getting some additional clarity on what is happening in Europe. The bottom line as Backshall asks is: “do they default now or default later.” And that pretty much sums it up. Buy stocks at your own peril.

There is one major problem with putting houses of card back together – they tend to fall…over and over. And while abundant liquidity in May and June served as an artificial prop to return European core and PIIGS spreads to previous levels merely as mean reversion algos took holds, the second time around won’t be as lucky. CDR’s Tim Backshall was on the Strategy Session today, discussing the key trends in sovereign products over the past few months, noting the declining liquidity in both sovereign cash and derivative exposure (we will refresh on the DTCC sovereign data later after its weekly Tuesday update). Yet the most interesting observation by Backshall is the declining halflife of risk-on episodes, which much like the SNB’s (now declining) interventions, are having less of an impact on the market, as ever worsening fundamentals can only be swept under the carpet for so long before they really start stinking up the place, and indeed, as Tim points out at 5:30 into the interview, even the IMF now realizes that soon the eventual second domino will fall, and it is better the be prepared (via the previously discussed infinitely expanded credit line), than to have to scramble in the last minute as was necessary in May. In other words, the storm clouds are gathering and only fools will invest in risk asset without getting some additional clarity on what is happening in Europe. The bottom line as Backshall asks is: “do they default now or default later.” And that pretty much sums it up. Buy stocks at your own peril.

Incidentally all this is happening as we read in an exclusive Bloomberg piece that “four months after the 110 billion- euro ($140 billion) bailout for Greece, the nation still hasn’t disclosed the full details of secret financial transactions it used to conceal debt” and that EuroStat still has not received the required disclosure about just how fake (or real) the Greek debt situation truly is. When one steps back and ponders just how bad (and unknown) the situation in Europe is, and that stocks are unchanged for the year, one must conclude, as Dylan Grice does every week, that the lunatics have truly taken over the asylum.

A lot of Traders make this mistake in the markets

How many trades do you test your strategies with?

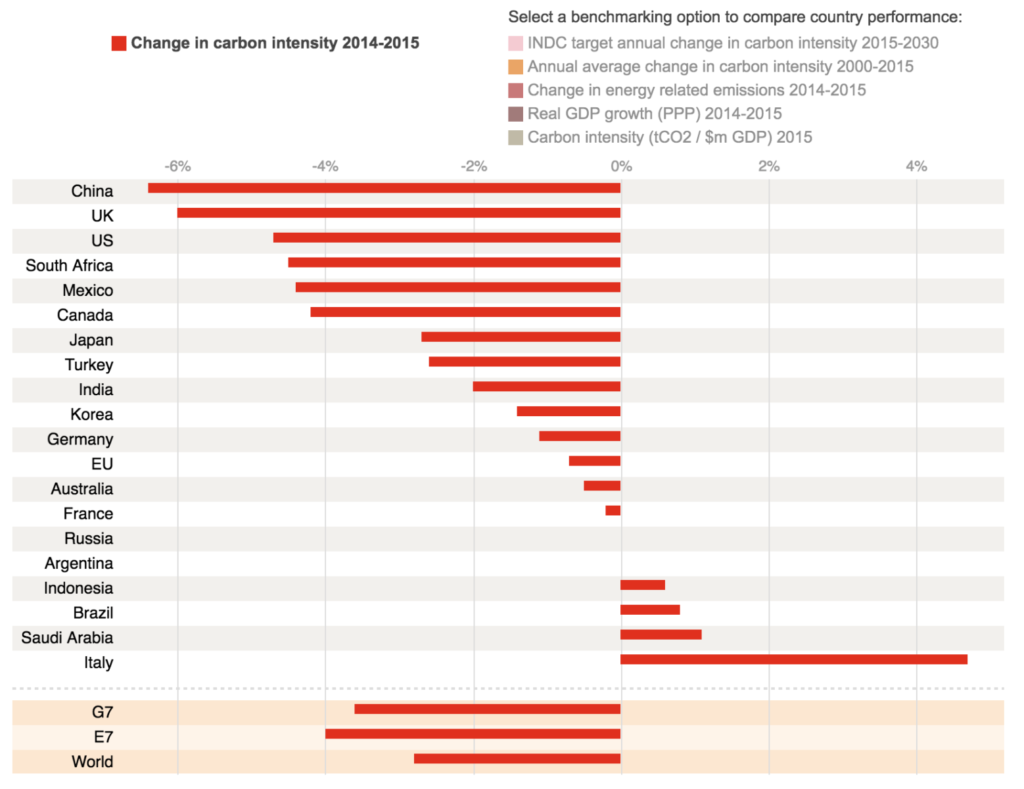

Change in Carbon Intensity 2014-2015

4 Trading Mistakes

Don’t over-leverage yourself or have all of your money tied into one position. Keeping cash on hand is okay as a trader. These days brokers are offering extremely competitive margin requirements for day trading futures, but low margins can be a wolf in sheep’s clothing.

Don’t over-leverage yourself or have all of your money tied into one position. Keeping cash on hand is okay as a trader. These days brokers are offering extremely competitive margin requirements for day trading futures, but low margins can be a wolf in sheep’s clothing..

.

Day Trading Cartoons

30+3 Ways to Stay Creative

Mystery bidder offers $3,456,789 for lunch with Warren Buffett (Rs 22 crore 81 lakh 48 Thousands )

An anonymous bidder has paid $3,456,789 for a lunch date with the investment guru and founder of Berkshire Hathaway, some 47 per cent more than the winner of the charity auction last year.

Mr Buffett will meet the winning bidder and up to seven friends for an intimate meal, in what has become an annual tradition that has netted more than $23m in total for the San Francisco charity, Glide.

Mr Buffett’s late wife Susan used to be a volunteer at Glide, which offers meals, medical testing and other services to homeless and low-income people in the San Francisco’s Tenderloin district. Volunteers and supporters sang and cheered as the five-day auction moved into its final minutes on Friday night, and a late bid swelled the proceeds from $2.8m, where bidding had hovered for most of the day, to a final total that matched the all-time record from 2012. (more…)