Thought For A Day

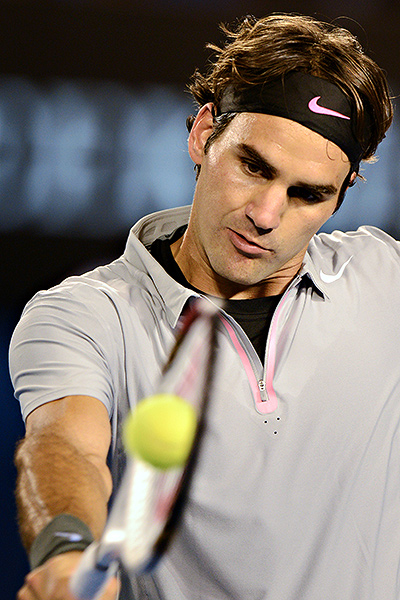

Always something to learn when Federer is clearly beaten which can be applied to markets, especially in a market like today:

1. He was out of position, or better put, poorly positioned for all of the match.

2. Up early in the opening of the match, he failed to hold and close his early lead when he had clear opportunities.

3. He made errors in pivot points early in the second and third sets – giving away every chance to get back into the match.

4. He was a consummate professional in defeat in the post match – the opponent was better, played better, and deserved to win.

The pundits will like to call this another sign of his decline, etc. I’m not so sure. Particular in that his inability to hoist another championship trophy is now nearly fully priced in.

Day after day, week after week, mornings and evenings: if you’re trading well, it’s easy to burn out. If you’re going to leave everything you’ve got on the field by the end of the game, you’re going to need to renew that energy. Just as important as the quality of your market time is the quality of your time away from markets. That includes quality time with loved ones, quality time in physical activity, and quality time immersed in meaningful personal pursuits. Quality time is time spent that gives you energy, that inspires you, that fills you with joy, a sense of meaning, energy, and love. Without positive emotional experience energizing us, our focus is diminished. That takes a toll on our pattern recognition and makes it easier for biases and impulses to color our decision making. It’s not enough to relax after a market day; we need to refresh and renew.

Whether in business or in trading, great outcomes come from great processes. The sad truth is that the majority of traders don’t succeed because they don’t do the things needed to earn success. You can have a relaxed, balanced lifestyle or you can challenge yourself, change yourself, and pursue a performance path. The greats don’t push themselves to succeed; they are pulled by goals larger than themselves.

Video Segments:

0:00 Introduction

4:25 Early Life

8:04 MIT

10:35 Road trip to South America

12:18 Berkley

13:18 First investments

18:20 Urge to do something different/ First business

20:26 Back to academia

26:09 Opposing the war/ Getting fired

30:45 Stony Brook University

36:26 Managing money

39:39 Becoming a trader

45:53 Renaissance technologies/ What makes it successful

49:40 Simons foundation

54:04 Mathematics as a refuge

55:40 Retirement

57:19 Guiding principles

1:00:45 Start of Q&A

1:01:12 When not to do something?

1:02:20 Thoughts on hedge fund industry today?

1:04:31 Why do you focus on collaborative goals?

1:06:30 How did your parents help foster your mathematical knowledge?

1:07:15 When you look back, would you change anything?

1:08:14 Do you think you should share your knowledge?

1:09:52 Thoughts on mathematics education?

1:17:55 Bourbaki movement?

“It has been an old and sound principle that those who cannot afford to take risks should be content with a relatively low return on their invested funds. From this there has developed the general notion that the rate of return which the investor should aim for is more or less proportionate to the degree of risk he is ready to run. Our view is different. The rate of return sought should be dependent, rather, on the amount of intelligent effort the investor is willing and able to bear on his task.”

—-Benjamin Graham, The Intelligent Investor (New York: HarperBusiness, 2003), p. 88.

Can you relate this to your trading?