11.U Watch Blue Channels-Whole Day

Archives of “January 18, 2019” day

rssThought For A Day

Don't let media define the way you see thing

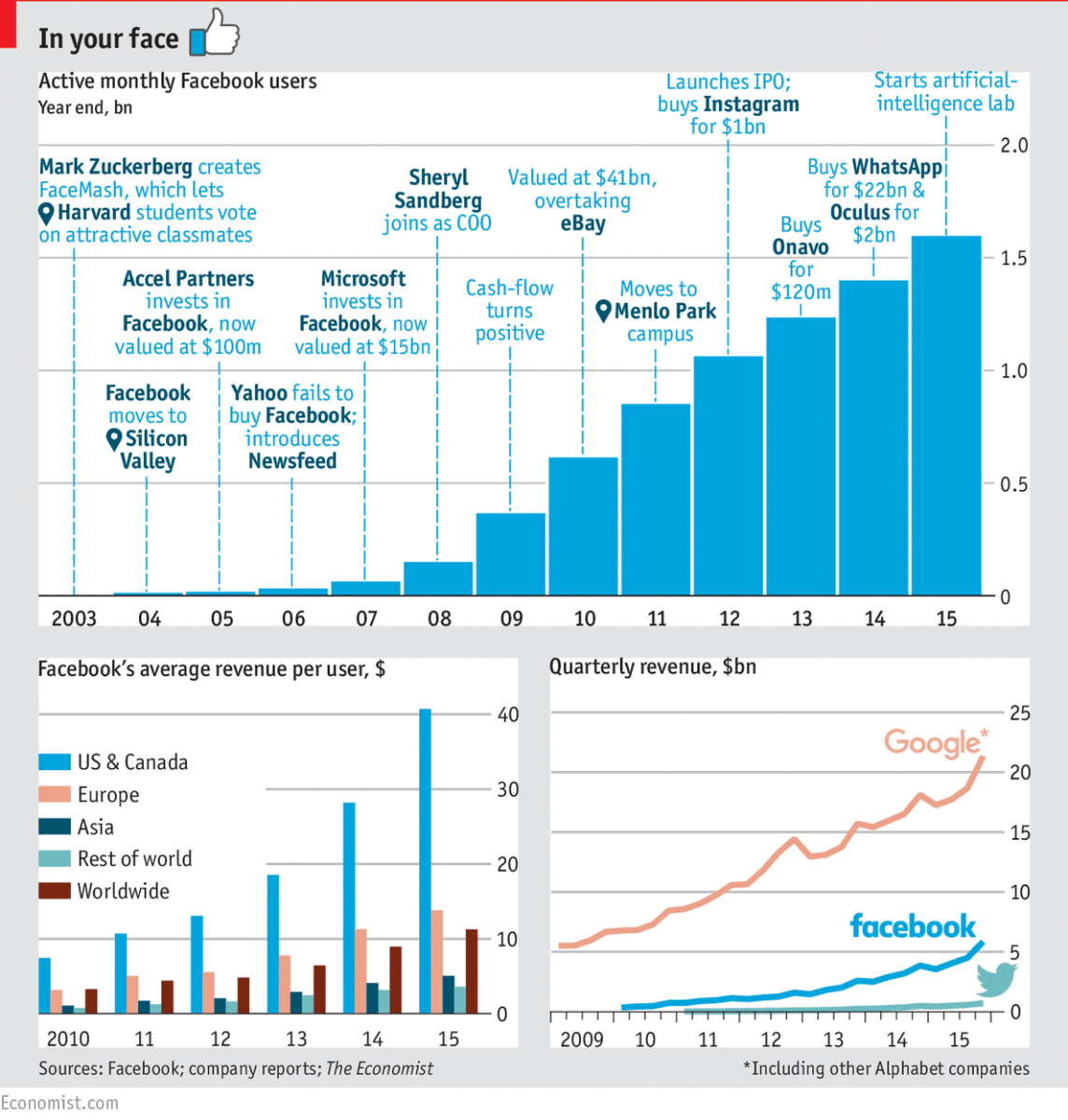

Facebook, the world’s most addictive drug

Traders be like

Thomas Edison and his electric car in 1910 — 1,000 mile endurance run

Mindset of a winner -5 Quotes

– A losing trader can do little to transform himself into a winning trader. A losing trader is not going to want to transform himself. That’s the kind of thing winning traders do.

– The winning traders have usually been winning at whatever field they are in for years.

-It is a happy circumstance that when nature gives us true burning desires, she also gives us the means to satisfy them. Those who want to win and lack skill can get someone with skill to help them.

– The “doing” part of trading is simple. You just pick up the phone and place orders. The “being” part is a bit more subtle. It’s like being an athlete. It’s commitment arid mission. To the committed, a world of support appears. All manner of unforeseen assistance materializes to support and propel the committed to meet grand destiny.

– In your recipe for success, don’t forget commitment – and a deep belief in the inevitability of your success.

Can the Saudis destroy the NYMEX?

Read more here:

Read more here:

For Saudi Arabia, it is a philosophical issue that the black gold pouring out of its deserts should be treated as a tangible, physical commodity – not the paper plaything of traders on Wall Street hedging against the weak dollar. This thinking is at the heart of the Middle Eastern country’s decision last week to abandon its long alliance with West Texas Intermediate crude – the famous oil used by most global producers to price their exports to the US.

It is both a technical issue and a symbolic shift that strikes a blow to the domin-ance of the New York Mercan-tile Exchange, the world’s biggest centre of oil trading where the most popular products relate to WTI crude. (more…)

Discipline

Learning to accept losses as part of the game and cutting them short is the single most important step towards becoming consistently profitable. It sounds simple, but in reality is extremely difficult for everybody. Why? Because we’ve been taught that giving up is for losers and we should fight till last breath. I certainly agree that you should not give up quickly, but only if you can influence the end result. Let me be clear, the stock doesn’t know that you own it and it doesn’t care that you cannot afford to lose the money. The market will strip your last cloth if you don’t know how to manage risk. You have to understand and accept your power. You cannot move the market. You cannot tell him where to go and how fast. This is why so many people, who are successful as entrepreneurs and engineers, have troubles breaking even in the capital markets. It takes a special kind of person. Someone, who can forget his ego and concentrate on what actually works. Very few people are able to reach that level and to distinguish their trading life from their personal life.

Learning to accept losses as part of the game and cutting them short is the single most important step towards becoming consistently profitable. It sounds simple, but in reality is extremely difficult for everybody. Why? Because we’ve been taught that giving up is for losers and we should fight till last breath. I certainly agree that you should not give up quickly, but only if you can influence the end result. Let me be clear, the stock doesn’t know that you own it and it doesn’t care that you cannot afford to lose the money. The market will strip your last cloth if you don’t know how to manage risk. You have to understand and accept your power. You cannot move the market. You cannot tell him where to go and how fast. This is why so many people, who are successful as entrepreneurs and engineers, have troubles breaking even in the capital markets. It takes a special kind of person. Someone, who can forget his ego and concentrate on what actually works. Very few people are able to reach that level and to distinguish their trading life from their personal life.

Trading or investing is a skill that can be learned. There are two ways to learn a new skill in general. Through the school of hard knocks and through the mentorship of others that have the gift of teaching. To become a successful trader, you need to somehow implement both approaches. Nothing can replace personal experience. You can hire the best mentors in the world to teach you and purchase the most expensive equipment and trading software, but this is not going to help you to build a new skill. Skill building is subdued to eternal physical laws. There are a hundred billion neurons in your brain. For every skill that you possess (speaking a language or driving a car), there is a certain combination of connections between some of your neurons. To build a new skill, you need to build a new net of connections. This is why every beginning is hard, this is why big changes do not happen overnight. You have to establish new connections, which takes hard work via repetition and visualization. (more…)

Super Hero :Raghuram Rajan…..(Why Politicians ,Corporate Houses ,Financial Terrorists …Think This way ? )