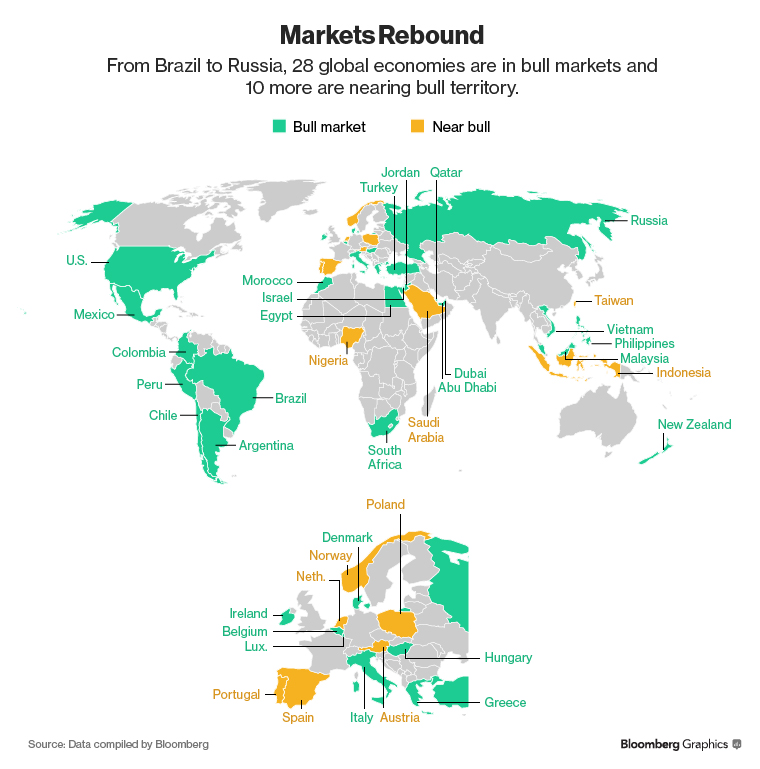

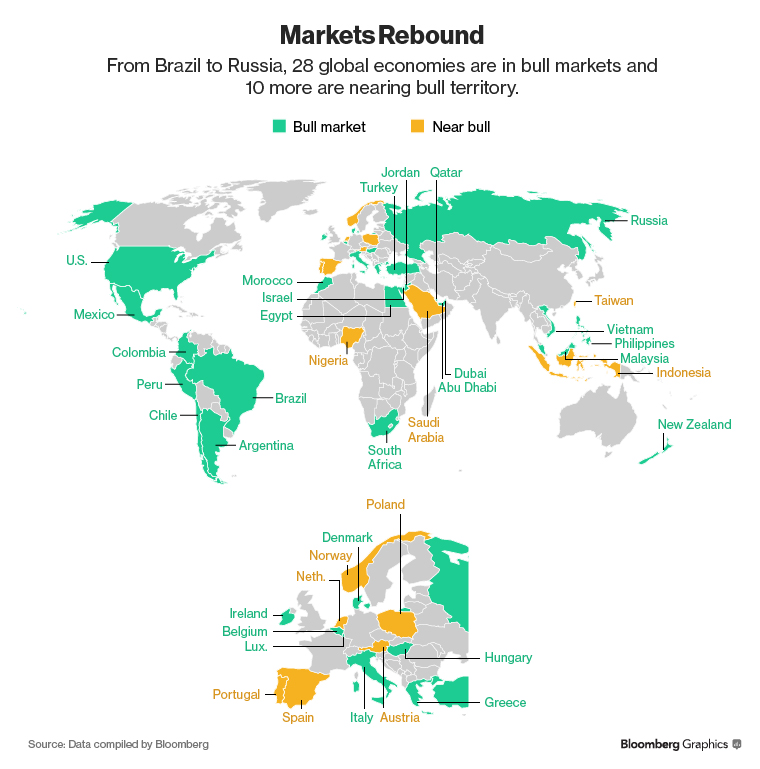

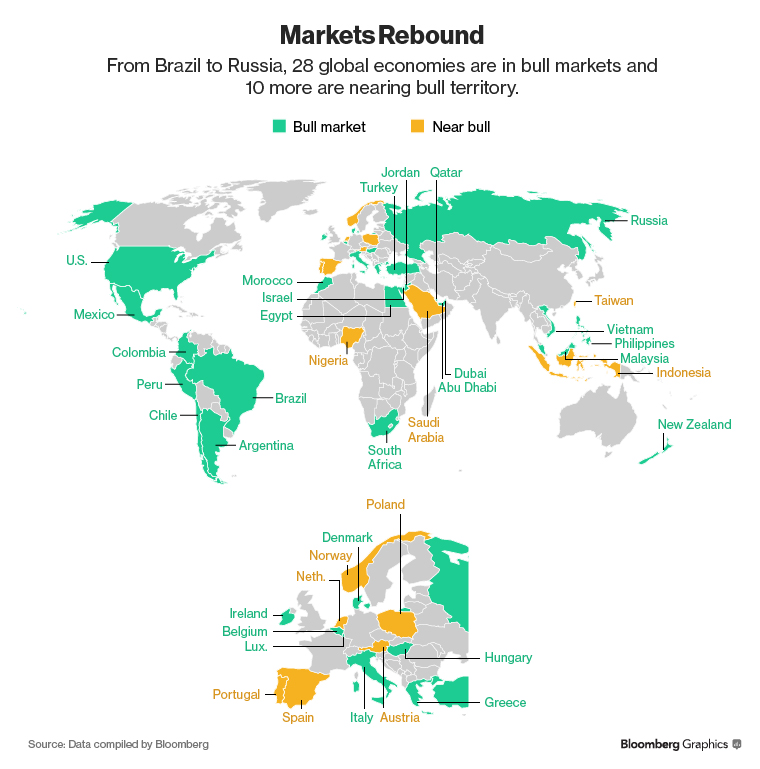

Bull Markets Around the World

Looks like Schwager is putting out a new version of his famous Market Wizards series. Personally I’d like to see a “where are they now” from the past few books. (His other books here.)

Hedge Fund Market Wizards

Table of Contents

Introduction

Part I: Macro Men

Chapter 1 Colm O’Shea: Knowing When It’s Raining

Chapter 2 Ray Dalio: The Man Who Loves Mistakes

Chapter 3 Scott Ramsey: Low-Risk Futures Trader

Chapter 4 Jamie Mai: Seeking Asymmetry

Chapter 5 Jaffray Woodriff: The Third Way

Part II: Multi

Chapter 6 Edward Thorp: The Innovator

Chapter 7 Larry Benedict: Beyond Three Strikes

Chapter 8 Michael Platt: The Art and Science of Risk Control

Part III: Equity

Chapter 9 Steve Clark: Do more of What Works and Less of What Doesn’t

Chapter 10 Martin Taylor: The Tsar Has No Clothes

Chapter 11 Tom Claugus: A Change of Plans

Chapter 12 Joe Vidich: Harvesting Losses

Chapter 13 Kevin Daly: Who Is Warren Buffett?

Chapter 14 Jimmy Balodimas: Stepping in Front of Freight Trains

Chapter 15 Joel Greenblatt: The Magic Formula

Conclusion 40 Market Wizard Lessons

Appendix 1 The Gain to Pain Ratio

Appendix 2 TITLE TK

You are watching a stock that has all the signals you look for in an opportunity. The proper point to enter comes, but you wait. You second guess the opportunity and don’t buy the stock. Or, you bid for the stock at a price that is not likely to get filled if the opportunity does pan out the way you anticipate it will. As a result, you get left behind while the market pushes the stock higher. A short while after the initial entry signal, when the stock has made a decent gain, you decide to finally enter the trade. After all, the market has proven your analysis correct, so you must be smart, and right! Not long after you enter, the stock turns south and you end up with a losing trade. If only you had bought when you first thought about it.

The Solution

This is really just a confidence issue. You are either not confident in your ability to analyze stocks, or you are not confident in the methodology that you are using to pick trades. (more…)

1. High probability setups with short profit targets

1. High probability setups with short profit targets

If you are not winning more than 75% of the time you’ll never make it as a professional trader. Whilst there are other components to success, he does make a very good point. The most common trading strategy employed by successful trader is to identify a high probability set up and couple that with an aggressive profit exit strategy that captures short term gains. For example, you might have a entry criteria that easily captures 15 points on average but you set your profit target at 6 points.

2. Adding to winning positions

Many people think all trades should lead to profit but you’ll find the most successful medium term traders on win 40-55% of the time. The difference between an amateur and a professional, when trading short to medium term trading systems, is their ability to maximum their cash on a trade when it’s winning. The Turtles, under the watchful eye o f Richard Dennis and Bill Eckardt, had a way to add to their huge winners up to 4 times. Very powerful. In order to maximize this strategy you will need to identify your R multiples which will be saved for another article.

3. Mechanical trailing profit stops

Knowing when to take profits can be the most mentally draining part of any trading system. Its not unusual to start trying to let profits run that the markets starts retracing and wiping out all your open profits. The way to overcome this emotional rollercoaster is to build mechanical trailing stops that maximize your profits on winning trades whilst minimizing giving back to much in open profits. (more…)

Featured are an eclectic lot: Jesse Livermore, David Ricardo, George Soros, Michael Steinhardt, Benjamin Graham, Warren Buffett, Anthony Bolton, Neil Woodford, Philip Fisher, T. Rowe Price, Peter Lynch, Nick Train, Georges Doriot, Eugene Kleiner and Tom Perkins, John Templeton, Robert W. Wilson, Edward O. Thorp, John Maynard Keynes, John ‘Jack’ Bogle, and Paul Samuelson.

For those who like to keep score, Partridge rates these investors on four metrics: “their overall performance, their longevity, their influence on other investors and investing in general, and how easy it is for ordinary investors to emulate them.” For each metric an investor could earn between one and five stars. Leading the pack, with 18 points each, are Bogle and Graham. The runners-up, with 17 points each, are Fisher and Buffett.

Partridge’s takeaways from the investing careers of these men are: (1) the market can be beaten, (2) there are many roads to investment success, (3) be flexible …, (4) … but not too flexible, (5) successful investing requires an edge, (6) when you do have an edge, bet big, (7) have an exit strategy, (8) ordinary investors have some advantages, (9) big isn’t always beautiful, and (10) it’s good to have some distance from the crowd.

Over the last weekend I finished reading Popes and Bankers: A Cultural History of Credit and Debt, from Aristotle to AIG by Jack Cashill and enjoyed it a great deal. It’s not a perfect book, but it has a lot going for it: the amount of information contained in it is simply amazing for a relatively thin, easy-to-read paperback and it is written from an ethical perspective that I believe most members of this list will find agreeable. I certainly could disagree with very little of the moral and ethical commentary contained therein.

The book is really a collection of loosely tied essays and historical notes on the origins and use of credit and money. Surprisingly, more than anything is is also a kind of a history of Jewish people in Europe and, to a lesser degree, in the US. It is also a cautionary tale about “prodigals” turning on the “usurers” through history demonstrating that little is new under the sun in the financial area other than the technical innovations. The specific distinct areas of the book are too numerous to mention, but even after having a lifelong interest in the origins of money and credit I learned a great deal about the contributions of the Greeks and Romans, the Medicis, Luther and Calvin, as well as Marx and Aristotle and the almost endless parade of German and American Jews. For those who have read more than one description of the various early European manias and the creation of the Fed, those in the book can be safely skipped, but it was worth it for me to pick up some details I wasn’t aware of before.

On the negative side, while interesting there were too many citations from Michael Lewis with respect to the modern American portion of the material. These made for a somewhat amateurish quality of those chapters, and of course reminded me of our host’s lack of respect for the man. Overall though it was a very satisfying book so I highly recommend it.

What we perceive is not just a function of what is out there, but also the lenses that we wear. Many of our cognitive lenses are so much a part of our thinking that we forget they are there. We assume that what we’re perceiving is what objectively exists…but that’s not always the case.

Some of the most powerful lenses are the metaphors that we use in describing markets. Consider the following:

* A trader views the market as an enemy to be conquered;

* A trader approaches the market as a puzzle to be solved;

* A trader sees the market as a paradise of potential riches;

* A trader regards the market as a mistress to be wooed;

* A trader views the market as a dangerous minefield;

* A trader looks at the market as a video game.

How do these metaphors affect our trading? Our emotional responses to trading? How would being aware of our metaphors–and shifting them–change how we trade and how we experience our trading?