What Jesse Livermore said to Richard Wyckoff

Courage…

“The credit belongs to the man who is actually in the arena, who strives valiantly; who knows the great enthusiasms, the great devotions, and spends himself in a worthy cause; who at best, knows the triumph of high achievement; and who, at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who know neither victory nor defeat.”

Theodore Roosevelt

Persistence…

“Nothing in the world can take the place of persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent.”

Calvin Coolidge

The above quotes strike me as being appropriate for all of us engaged in the endless quest of trading profits. I make it a point to review these statements on a regular basis as I am well aware of the fact that I am only as good or bad as my last trade.

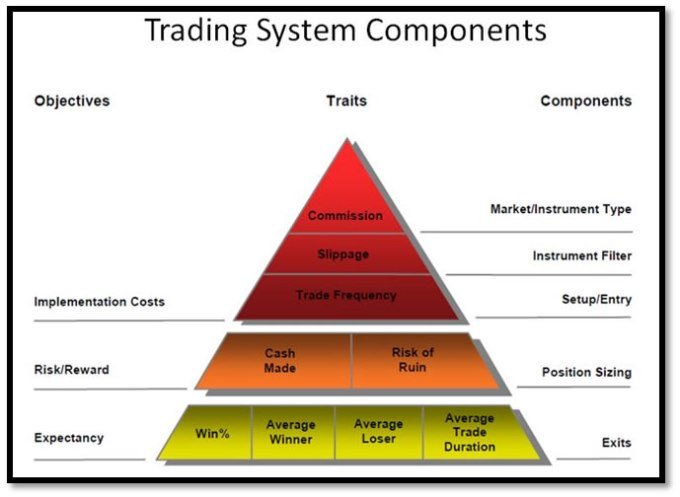

I accept the fact that I will never have it “made” as a trader. Each and every day is a new trading situation and I must be prepared with my trading plan. I must PLAN MY TRADE AND TRADE MY PLAN.

Aswath Damodaran writes:

If one extreme of the numbers/narrative spectrum is inhabited by those who are slaves to the numbers, at the other extreme are those who not only don’t trust numbers but don’t use them. Instead, they rely entirely on narrative to justify investments and valuations. Their motivations for doing so are simple.

1. Story telling is a powerful attention getter/keeper: Research in both psychology and business point to an undeniable fact. Human beings respond better to stories than to abstractions or numbers, and remember them for longer. After all, the Harvard Business School has taken story telling almost to an art form with its cases, tightly wound narratives that are supposed to convey larger lessons.

2. Unrestrained creativity: “Creative” people through the ages have always fought back against any restraints on their creativity, especially those imposed by those that they view as less imaginative than they are.

3. The Creative Superiority Complex: Just as numbers people intimidate with mounds of numbers, good narrators can browbeat “bean counters” with superior story telling, especially if they can back their stories up with personal experience.

Don’t trade off storytelling. Just don’t do it.

Now this is vital to trading success. Imagine a person trying to become a pro athlete, but he or she sleeps in every day, eats excessively, stays up late and parties every night. Is this person going to become an elite athlete or not? The answer is no, and the reason why has everything to do with the amount of discipline. Discipline, in my mind, is like homework, only it’s homework that pays off in dollars in the trading industry. Here are a few rules that I use when it comes to discipline in my life as a trader: