Avoid -TV + Politics + Cricket + Movies + Many More things ….Till u ACHIEVE Something in Life ……………

Avoid -TV + Politics + Cricket + Movies + Many More things ….Till u ACHIEVE Something in Life ……………

Trade in Private

Trade in Private

Never under any circumstances reveal your trading positions to anyone. Your mind must be in complete harmony with your trading positions. When you reveal your positions to someone, they will immediately start to question the trade and start to erode your confidence and concentration in the trade. You will then be a less effective trader and

eventually lose.

Profit Ratio

You should set your profit ratio at 3 times your risk factor. Go back on the previous charts of the market you are trading and determine how much the market has risen or fallen and then set the loss ratio based on that.

Some might not see the benefit to videos like this when it comes to winning in the markets, but if you pause to ponder for just a few minutes the purpose is very clear:

Generally, I can’t see more than a year ahead because things change so rapidly it’s very difficult to have a 5-to 10-year view. I have a rolling one-year view of the world and I impose discipline on myself by

Generally, I can’t see more than a year ahead because things change so rapidly it’s very difficult to have a 5-to 10-year view. I have a rolling one-year view of the world and I impose discipline on myself by

keeping a trading diary. Every morning, I go through the same process: If I have any positions on, I ask why do I have the positions? What has changed?

I wish I could say I follow my own rules 100%. It seems one is constantly relearning the same trading lessons. The market is always there to keep you in check and is a totally objective judge of your

performance. The P/L at the end of the day is yours with no one else to blame.

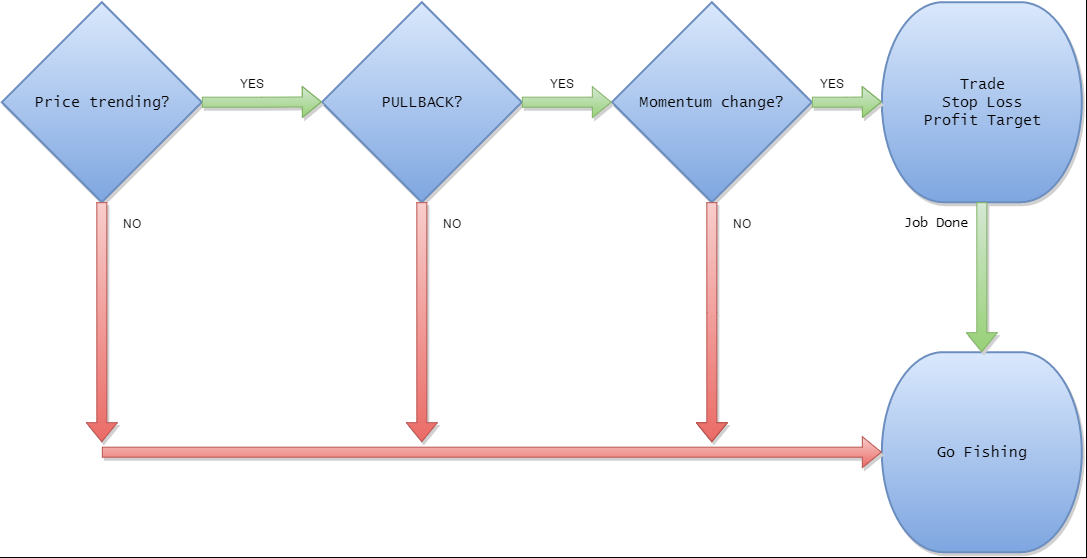

One of the most difficult things about trading is not to trade. That’s probably one of the most common mistakes that people starting out in this business make. Overtrading is as bad as running a losing positions for too long.

James P. Owen, a 40 year veteran on Wall Street, has written a interesting book entitled Cowboy Ethics: What Wall Street Can Learn From the Code of the West. In it he lists the 10 codes of the working cowboy, explaining how each code can be a source of inspiration for all those involved in Wall Street, from traders to institutions. Along with the message are beautiful photographs throughout by David Stoecklein. You could actually classify this as a trader’s coffee table book. Here are the codes:

James P. Owen, a 40 year veteran on Wall Street, has written a interesting book entitled Cowboy Ethics: What Wall Street Can Learn From the Code of the West. In it he lists the 10 codes of the working cowboy, explaining how each code can be a source of inspiration for all those involved in Wall Street, from traders to institutions. Along with the message are beautiful photographs throughout by David Stoecklein. You could actually classify this as a trader’s coffee table book. Here are the codes:

1. Live Each Day With Courage. Real courage is being scared to death and saddling up anyway, setting aside the fear of the unknown knowing there is work to be done.

2. Take Pride in Your Work. Cowboying doesn’t build character, it reveals it. Stock trading brings out what is already there: pride in the preparation.

3. Always Finish What You Start. When you’re riding through hell…keep riding. Good stock traders, like cowboys, never quit in the face of uncertainty.

4. Do What Has to be Done. The true test of a man’s honor was how much he would risk to keep it intact. Stock trading is about taking responsibility for decisions and results, just like the cowboys.

5. Be Tough, But Fair. The Golden Rule was nothing less than a key to survival. Cowboys always treated others with respect, especially those who differed. Should we not do the same, whether bull or bear?

6. When You Make a Promise Keep It. A man is only as good as his word. You have no one to trust but yourself and when you have rules they are there for you to follow. If you do not, then you have broken a promise to yourself. Same with traders as with cowboys.

7. Ride For The Brand. The cowboy’s greatest devotion was to his calling and his way of life. If you have clients, the clients come first; if you have family depending on your discipline, then they come first. Period.

8. Talk Less and Say More. When there’s nothing more to say, don’t be saying it. No room for bragging or boasting out on the range or in the market. Your work, devotion, and steadfastness speaks for itself. Enough said.

9. Remember That Some Things Are Not For Sale. To the cowboy, the best things in life aren’t “things.” What matters most on the range and in the trading room is not what money can buy but what can’t be bought. Reputation is all that really matters.

10. Know Where to Draw the Line. There is right and there is wrong, and nothing in between. Insider trading, whispers, rumors, secret deals behind close doors, and all manner of questionable activities may be all around us but we do not have to embrace them as our own.

Of all the places to learn a few lessons about investing and ourselves, is it not refreshing to find a few on the open range from a time not so long ago?

Book summary:

The famous turtle program was the fruit of the debate between Richard Dennis and William Eckhardt, on the issue of whether traders are can be nurtured. Dennis believed it can but Eckhardt thought otherwise. Hence, they decided to make a bet by recruiting people from diverse background and most without experience. The book covered the entire story of the turltes, from the beginning of the program to what happened after the program. Instead of summarizing the process of how the turtles were hired etc, I will only focus on the information and attributes that makes one a good trader which I picked up from the book. In addition, I will introduce the turtle trading method.

What makes a successful trader?

Courageous probability trader

A successful trader thinks in terms of odds and always enjoys playing the game of chance. He or she will experience losses but must be able to hold the nerves and keep trading like they have yet lost. Richard Dennis was $10mil down in a single day but was able to finish off with a $80mil profit for the year. Something that makes “mere mortals lose sleep”. It was said that great traders like Dennis, process information differently from majority of the investors. He does not take conventional wisdom for granted or accept anything at face value. “He knew that traders had a tendency to self-destruct. The battle with self was where he focused his energies.” During the interviews with the potential turtles, one of the abilities he was looking for was “to suspend your belief in reality”.

“Great training alone was not enough to win for the long run. In the end, a persistent drive for winning combined with a healthy dose of courage would be mandatory for Dennis’s students’ long-term survival.”

Eckhardt emphasized that they are not mean reversion traders who believe the market will always return to the mean or fluctuate around the mean. Dennis and co. believe the market trends and often come unexpected, which also means the payout will be very rewarding.

Emotionless and disciplined

Dennis taught the turtles not to think trading in terms of money so they can detach themselves from it and no matter what their account size, they would still be able to make the correct trading decisions.

The turtles were taught to be trend followers where they used a system of rules to tell them the bet size, entry and exit points. Rules “worked best” as they eliminate human judgements which do not work well in the market. That being said, even if rules are followed religiously, traders are not expected to be right all the time and it is crucial that they cut their losses and move on when they are wrong. It is important to make every trade a good trade rather than a profitable trade. As long as good trades are made, profits will come in the long run. (more…)

RULE 1 – Keep losses small. I am more concerned about protecting my capital and ensuring any losses are small, than I am about making money. I’m going to have losses, but I control them and let the winners take care of themselves. The hardest job of any trader is to get out of a losing trade, believe it.

RULE 1 – Keep losses small. I am more concerned about protecting my capital and ensuring any losses are small, than I am about making money. I’m going to have losses, but I control them and let the winners take care of themselves. The hardest job of any trader is to get out of a losing trade, believe it.

RULE 2 – Do not forget Rule 1.

RULE 4 – Position size every bet in relation to your bank.

RULE 5 – Always use stops, not as a trading tool, but as a disaster avoidance technique.

RULE 6 – Give your trade room to breathe, don’t place stops too close, most beginners lose because of this. Remember, the wider the stop the smaller the trade size. This is also dependent on the timeframe you are in, simple tip if you are trading on the 5 min. chart. Check the 10 min one as well. Stops should be placed visually in my opinion.

RULE 7 – Don’t be greedy, appreciate small and consistent gains. Once you’re in a profitable position, consider moving your stops – especially to break even – and then you are using the broker’s money. If your software has the facility, then trailing stops could the answer.

RULE 8 – Accept that the markets are totally random and unpredictable and practice makes perfect – give yourself time before trading ‘live’.

RULE 9 – Control REVENGE, after a loser take a break, always. Never strike right back, never, and never double up to recover your losses.

RULE 10 – Never HOPE that you will win, trade only when you see a good trading opportunity, and remember live trading is different mentally from demo trading.

RULE 11 – Keep accurate records of each and every trade, winners and losers, even on a demo account, you must learn the correct habits.

RULE 12 – Eliminate fear, fear of failure and fear of trading. If you suffer from fear then trading is not for you.

RULE 13 – You do not have to trade, if there are no good trading opportunities then do not trade, there is always tomorrow. You can always spend the time practicing new techniques on a demo account.

RULE 14 – Take full responsibility 100% for your own trading – only you can win at trading, do not rely on any external crutch to blame.

RULE 15 – All markets are bearish, they will eventually reverse, prepare and profit from them.

RULE 16 – If you lose, bet smaller. If you win, bet bigger. (more…)