All banks and markets remain open

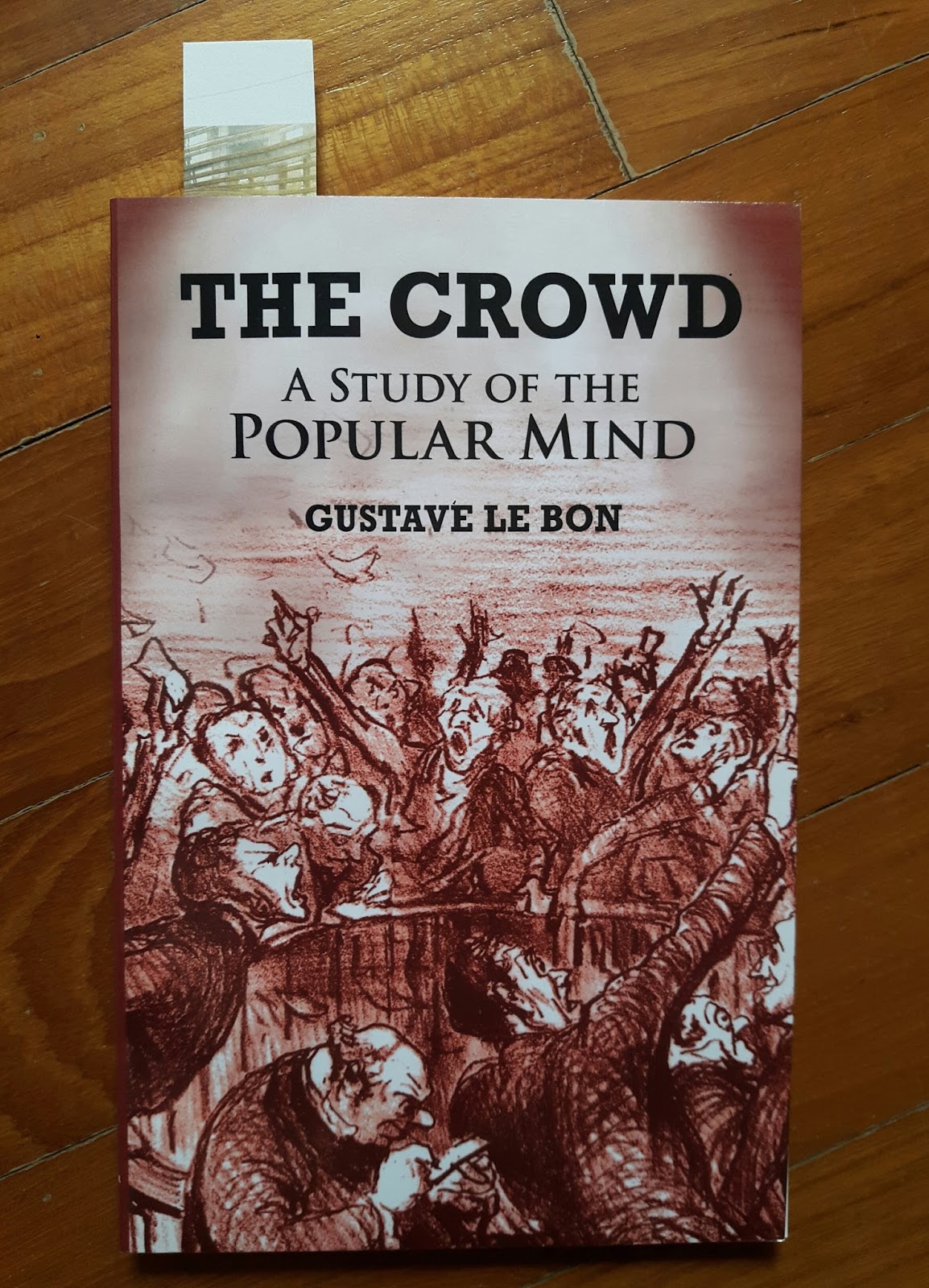

The improbable does not exist for a crowd, and it is necessary to bear this circumstance well in mind to understand the facility with which are created and propagated the most improbable legends and stories.

Crowds, being incapable both of reflection and of reasoning, are devoid of the notion of improbability; and it is to be noted that in a general way it is the most improbable things that are the most striking.

Crowds being only capable of thinking in images are only to be impressed by images. It is only images that terrify or attract them and become motives of action.

Clarification: If crowds are incapable of distinguishing between the improbable and the probable, and the images it associates with the improbable invoke action, then odd things are designed to happen.

…the individual forming part of a crowd acquires, solely from numerical considerations, a sentiment of invincible power which allows him to yield to instincts which, had he been alone, he would perforce have kept under restraint.

A crowd …is not prepared to admit that anything can come between its desire and the realisation of its desire.

Ambitious

Makes and follows long term business plan

•Unambitious

Will ignore long term business plan

•Calm

Will handle times of market volatility and make smart decisions

•Worrying

Will panic when markets are volatile and make stupid decisions

•Cautious

Strictly follows Stop-Loss rules and Protects Trading Capital

•Rash

Will not be diligent with Stop losses and will risk trading capital

•Cheerful (more…)

Your losses are getting smaller and smaller.

Remember…

1. Education, education, education.

1. Education, education, education.

The old cliche touted by politicians when they can’t think of anything clever to say to their audience. The importance of education to success in trading cannot be placed on a high enough pedestal. You have to learn to earn, the best traders work obsessively to refine their edge further to stay ahead of the curve.

2. Adapt or Die.

Market conditions change and technology advances, thus the conditions for trading are always evolving, the rise in mechanical trading is testament to that. The very best traders through a process of education and adaptation are constantly staying ahead of the curve and creating ever new and ingenious methods to profit from the markets evolution.

3. Fail to plan, you plan to fail.

The best traders have a well documented plan; they know exactly what they are looking for and follow that plan to the letter. Their preparation for a trade starts long before the market open, it is this meticulous planning and importantly adherence to that plan that helps them avoid the biggest demons for any trader, over trading and revenge trading.

4. “Be like Machine”

As human beings emotions pay a key role in our existence, for a trader emotions can be a source of great pain. Trading psychology and the management of your emotions in a trade play a key role in overall success. Fear and greed can cut your winners short and let your losers run. Dealing with emotions follows on from your plan; the more robust your plan the less likely you are to fall into the emotional mine field. (more…)