- You consistently trade huge position sizes in volatile trading vehicles.

- You enter a trade with no exit strategy.

- You care more about being right than making money.

- Your emotions fluctuate wildly with your trading capital equity curve.

- You are trading your opinions instead of a robust trading method.

- Your ego is tied to your trading results. (more…)

Archives of “January 9, 2019” day

rssThe Top Ten Trades of All Time

What were the greatest trades of all time? Who made them? Here is a list of the who, what, when, where, and how of the greatest trades that were ever made.

While the risk management while executing many of these trades is not what many traders would want, we can see many of these as trend trades and the dangers of fighting the trends. These trades were not all entered into at one time, most of them were built slowly and grew by adding as profits accrued. Most were also watched closely with and eye on the exit button when a true reversal began. Livermore made many probing shorts that he had to stop out as the bull market reversed off support and continued upwards after appearing to roll over. Some of these traders had the sell button ready to push at a seconds notice in case a reversal knocked them out. Some could have been ruined with a little blind sided government intervention that modern day traders are faced with now. But you can not argue with the profits and many of these traders have very long proven records, these were not random trades and they did not just get lucky, most of these were the great play that they landed after decades of research, study, and a life time of great trading.

1. John Paulson’s bet against sub-prime mortgages made his hedge fund a cool $15 billion in 2007, that is billion with a ‘B’. he is only one of a very exclusive club that was able to make this call and win with it. That was a call of a lifetime that everyone was blind to even deep into the crises.

2. Jesse Livermore’s call on the Crash of 1929, Jesse Livermore did not need any computer models, technical indicators, or derivatives to make $100 million dollars ($1.2 billion in today’s dollars) for his own personal account during a time when everyone was bullish and then almost everyone lost their shirts. It was an amazing day when Jesse came home and his wife thought they were ruined and instead he had the second best trading day of anyone in history.

3. John Templeton invested heavily into Japan during the 1960s, when Japan was beginning its three-decade long economic miracle, Templeton was one of the country’s first outside investors. At one point, he boldly put more than 60 percent of his fund in Japanese assets.

From its founding in 1954, his Templeton Growth Fund grew at an astonishing rate of nearly 16 per cent a year until Templeton’s retirement in 1992, making it the top performing growth fund in the second half of the 20th century. (more…)

Running For Money 24 x 7 ?Read This :August 20 ,1931

Response Alexander Graham Bell received when trying to sell his telephone patent to a telegraph company for $100,000

Trading Wisdom

The most important thing is to have a method for staying with your winners and getting rid of your losers. By having thought out your objective and having a strategy for getting out in case the market trend changes, you greatly increase the potential for staying in your winning positions. The traits of a successful trader: The most important is discipline – I am sure everyone says that. Second, you have to have patience; if you have a good trade on, you have to be able to stay with it. Third, you need courage to go into the market, and courage comes from adequate capitalization. Fourth, you must have a willingness to lose; that is also related to adequate capitalization. Fifth, you need a strong desire to win. You have to have the attitude that if a trade loses, you can handle it without any problem and come back to do the next trade. You can’t let a losing trade get to you emotionally. If a trade doesn’t look right, I get out and take a small loss.

Rule Your Mind Or It will Rule You

Market moves outside the statistical bell curve

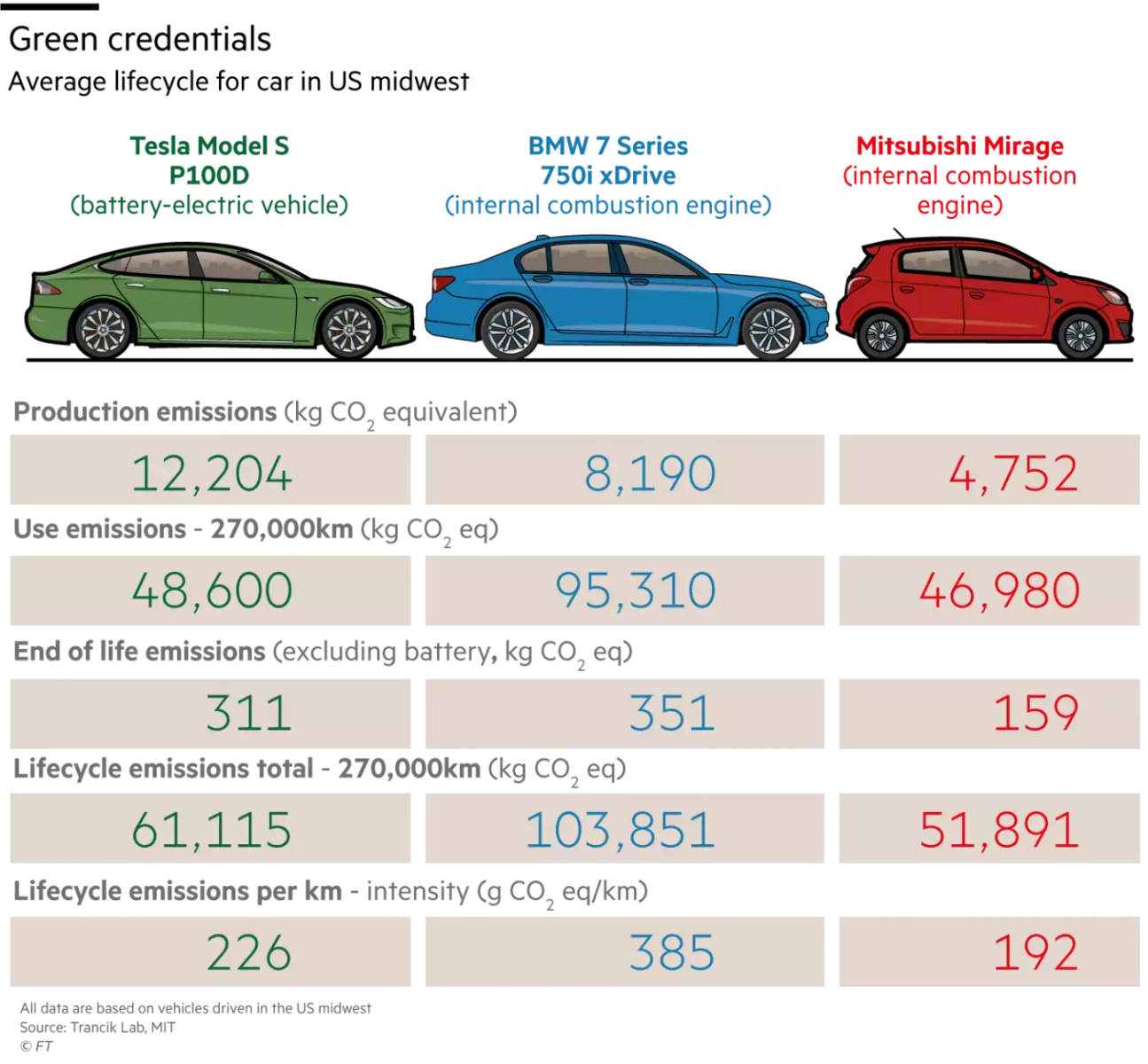

How Green Are Electric Cars?

Very interesting analysis on how green hybrid, electric and petrol cars actually are:

“According to data from the Trancik Lab at the Massachusetts Institute of Technology, a Tesla Model S P100D saloon driven in the US midwest produces 226 grammes of carbon dioxide (or equivalent) per kilometre over its lifecycle — a significant reduction to the 385g for a luxury 7-series BMW. But the Mirage emits even less, at just 192g.

The MIT data substantiate a study from the Norwegian University of Science and Technology last year: “Larger electric vehicles can have higher lifecycle greenhouse gas emissions than smaller conventional vehicles.”

The Stock Market is like a Beautiful Woman

The stock market is like a beautiful woman, always

The stock market is like a beautiful woman, always

appealing

challenging

fascinating

captivating

mystifying.

Appealing The stock market appeals to everyone – the ignorant and illiterate, barbers and bartenders, brokers and bankers, best and brightest, professionals and people from all walks of life.

Generally, the stock market is perceived as a marketplace to get-rich-quick, make a fast buck, make a killing and turn rags to riches.

Challenging The stock market challenges all kinds of players – gamblers, speculators and investors. In the game of sports, amateurs play against amateurs, professionals challenge professionals, and olympians compete with olympians on different level playing fields; whereas in the stock market, novices, amateurs and professionals challenge each other on the same level field. (more…)

Thought For A Day