There’s a Danish proverb that says that “he who builds according to every man’s advice will have a crooked house.” The same is true with trading and the experience you share is quite common.

There’s a Danish proverb that says that “he who builds according to every man’s advice will have a crooked house.” The same is true with trading and the experience you share is quite common.

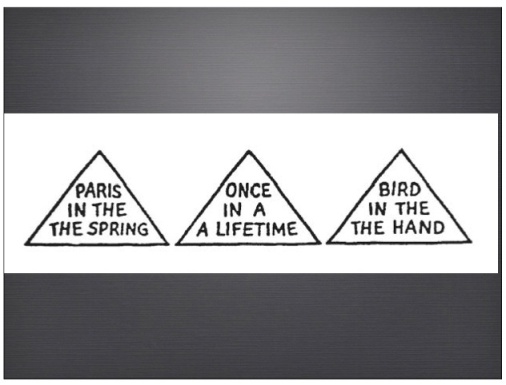

While there are some excellent role models out there to read and learn from, it takes time and lots of experience to be able to properly filter through the noise and learn how to recognize subjective and/or faulty analysis. It really is a unique skill and one that is not very common unless you’ve been at it for awhile and/or developed that skill through your education and career.

Although most traders don’t feel confident about their strategies to be able to trade in complete isolation (at least not for very long), there is a tremendous benefit from doing so. In my view, traders are now being flooded with too much real-time data, information, and opinions and they’re struggling to cope, make sense of it, and then focus on what matters. Remember, more information and analysis does not translate into better performance and we all have to place strict time limits on the energy we devote to reading the thoughts of others.

The current market seems to be manic depressive without even a shred of memory from one day to the next. How does a trader preserve control and commitment when faced with this challenge?

The current market seems to be manic depressive without even a shred of memory from one day to the next. How does a trader preserve control and commitment when faced with this challenge?