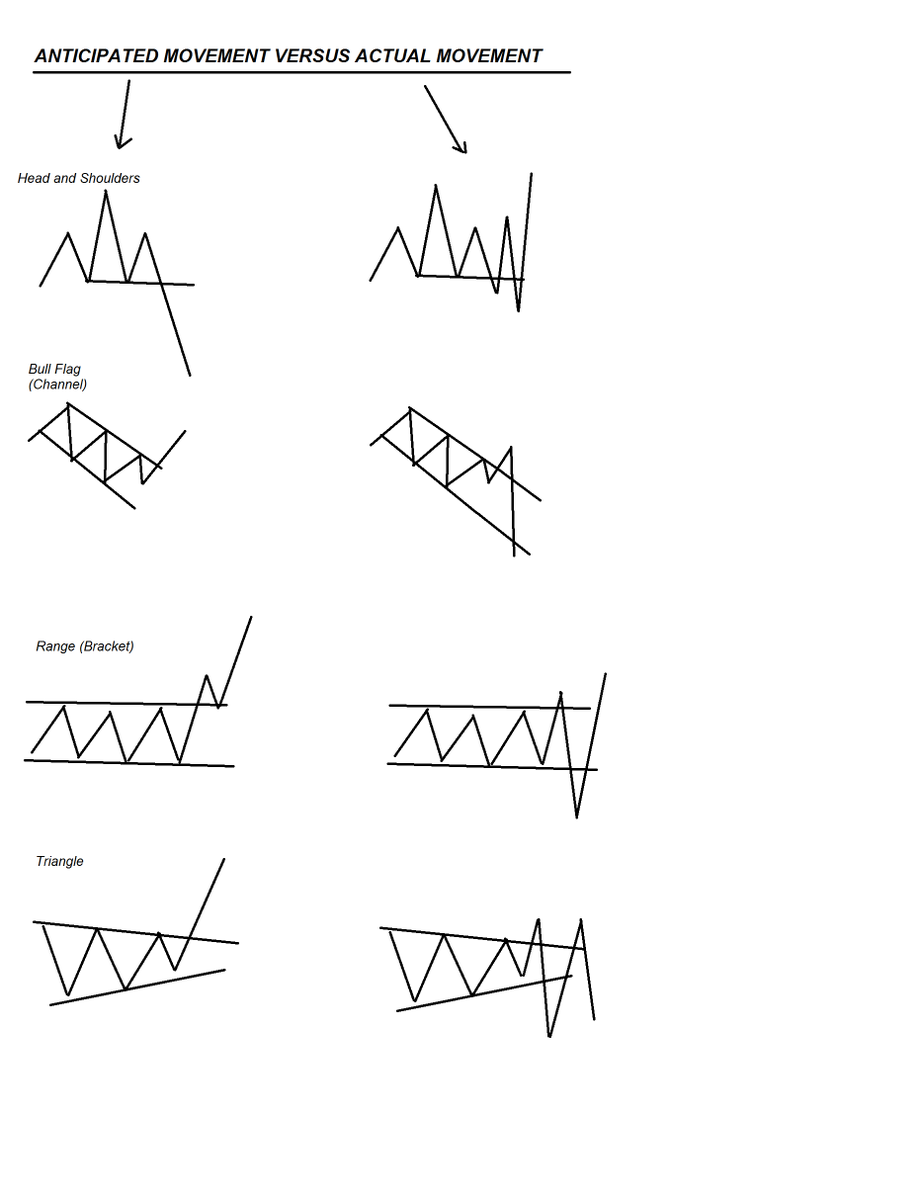

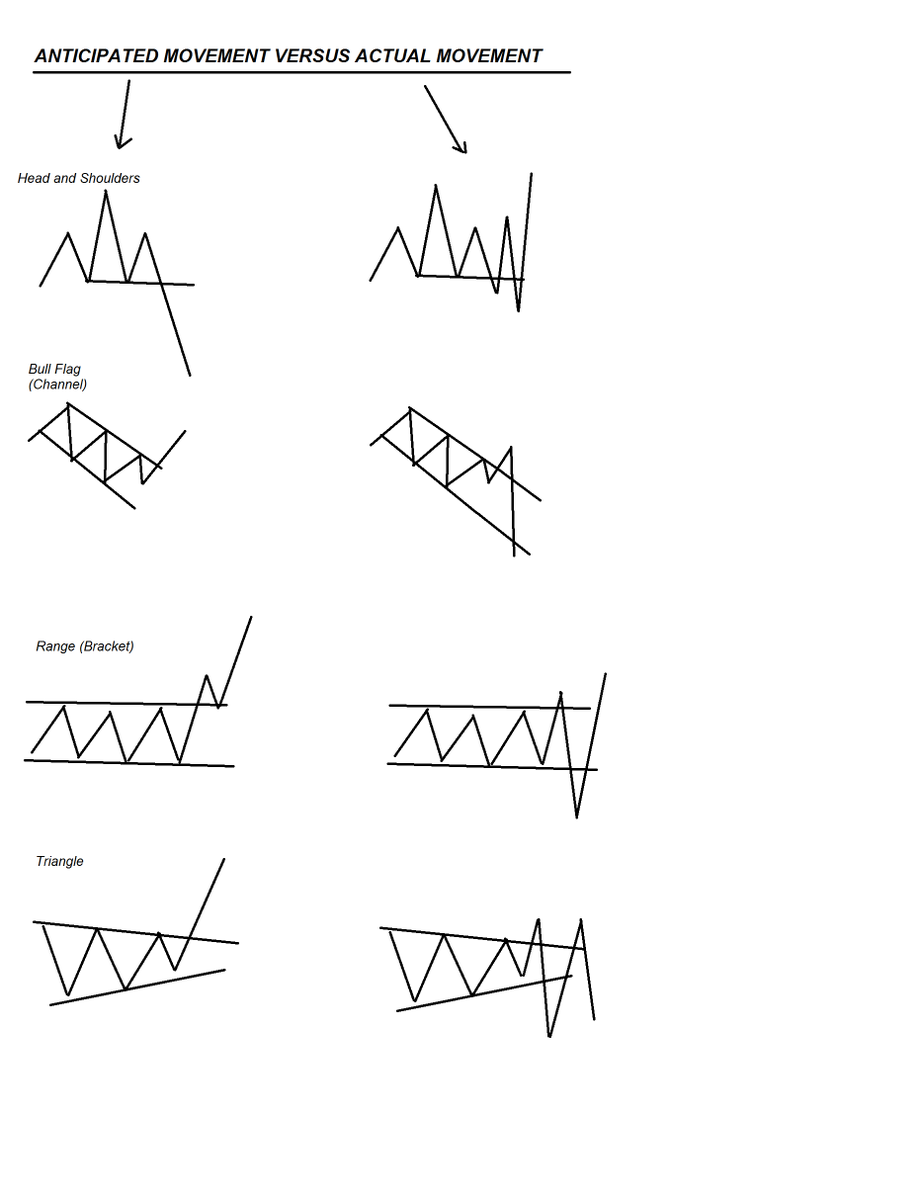

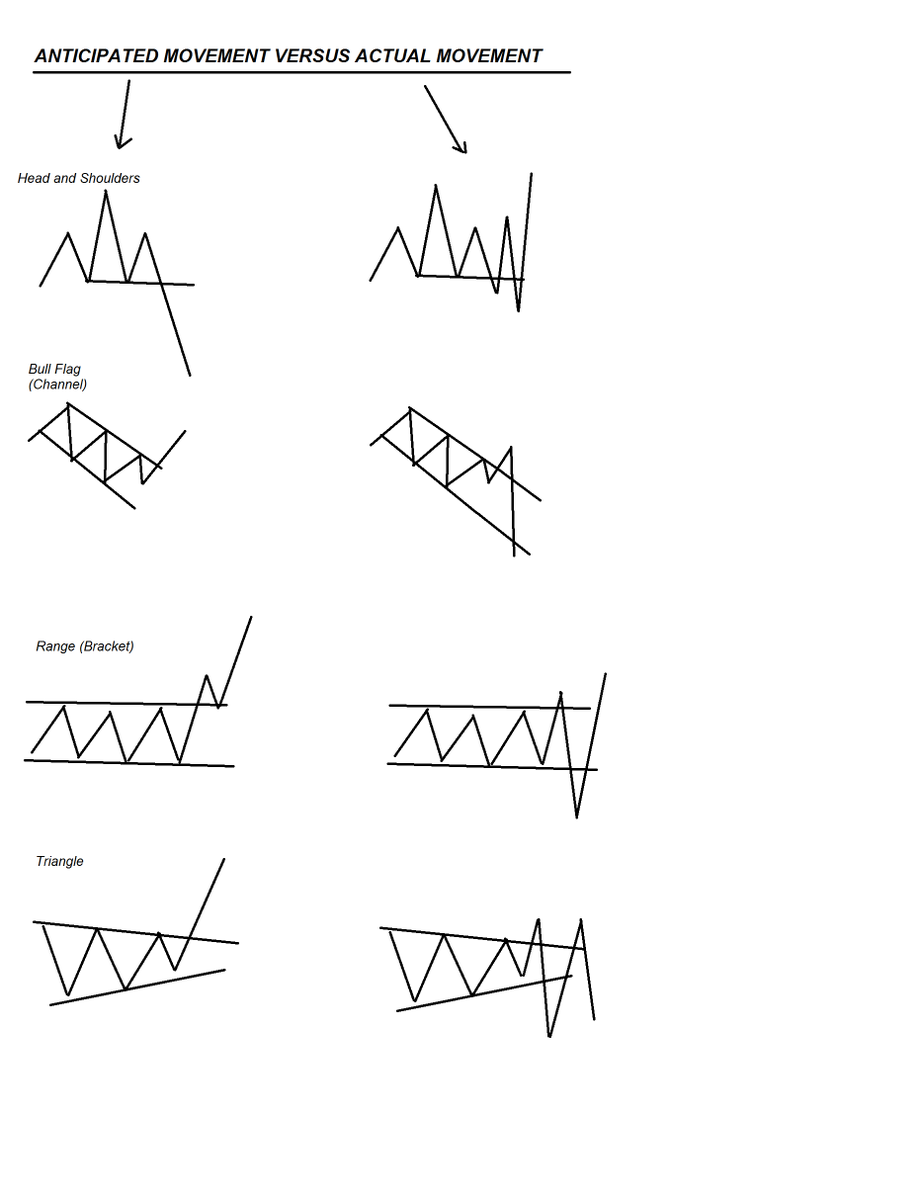

Anticipated Movement vs Actual Movement

1) Trading rules don’t normally fall out of the sky.

2) The emotional work is normally not undertaken by developing traders. After all this game should be easy.

3) Not enough time has been spent finding a system that is a fit to the personality of the trader.

4) You don’t really feel congruence with the approach.

5) As soon as you have a few losers you tinker with the approach or move to a new approach.

6) You are under-capitalized or for some other reason you mess with the approach then don’t hold yourself accountable for the fiddling and blame the approach.

7) You have unrealistic expectations as to the performance of the system in terms of win rate.

8) You are ‘bricking it’ about entering drawdown territory.

9) Your system actually isn’t complete. You haven’t got all of the following bases covered: market selection, position sizing, entries, stops, exits, tactics.

10) You learned a system or got a system from a marketeer or pseudo trader and it’s actually just crap.

Recently most traders probably have spent a great deal of time managing risk and emotions. I know I have. When it comes to correctly gauging and dealing with emotions it is paramount to analyze your reactions in a detached way. The best way to get objective insight is to imagine taking a step back and then ‘watching yourself.’ It’s as if you were your own mentor or trading coach. This is not an easy task. Good results require emotional detachment, a lot of experience and the ability to honestly assess the degree of trading proficiency you have attained. Ultimately it will tell you what those gut feelings you are occasionally experiencing really are worth. That’s exactly what G.C. Selden addresses at the end of his classic trading book : ‘Psychology of the Stock Market’ which was first published in 1912. Here’s an excerpt dealing with ‘hunches and gut feelings.’ Lots of additional and valuable insight for traders is provided. Enjoy!

Recently most traders probably have spent a great deal of time managing risk and emotions. I know I have. When it comes to correctly gauging and dealing with emotions it is paramount to analyze your reactions in a detached way. The best way to get objective insight is to imagine taking a step back and then ‘watching yourself.’ It’s as if you were your own mentor or trading coach. This is not an easy task. Good results require emotional detachment, a lot of experience and the ability to honestly assess the degree of trading proficiency you have attained. Ultimately it will tell you what those gut feelings you are occasionally experiencing really are worth. That’s exactly what G.C. Selden addresses at the end of his classic trading book : ‘Psychology of the Stock Market’ which was first published in 1912. Here’s an excerpt dealing with ‘hunches and gut feelings.’ Lots of additional and valuable insight for traders is provided. Enjoy!

An exaggerated example of “getting a notion” is seen in the so-called “hunch.” This term appears to mean, when it means anything, a sort of sudden welling up of instinct so strong as to induce the trader to follow it regardless of reason. In many cases, the “hunch” is nothing more than a strong impulse.

Almost any business man will say at times, “I have a feeling that we ought not to do this,” or “Somehow I don’t like that proposition,” without being able to explain clearly the grounds for his opposition. Likewise the “hunch” of a man who has watched the stock market for half a lifetime may not be without value. In such a case it doubtless represents an accumulation of small indications, each so trifling or so evasive that the trader cannot clearly marshal and review them even in his own mind. (more…)

Apr Curr Acct Surplus Y750bn

Japan’s current account balance produced a surplus for the third straight month in April, the Ministry of Finance said Monday, as the weaker yen helped boost the value of income from overseas investments, more than offsetting for the nation’s massive trade deficits.

The surplus in the current account, the broadest measure of Japan’s trade with the rest of the world, stood at Y750.0 billion in April before seasonal adjustment, the data showed. That’s wider than expected by economists surveyed by Dow Jones Newswires and the Nikkei, who estimated a surplus of Y310 billion.

The figure compares with a year-ago surplus of Y373.5 billion, and the previous month’s surplus of Y1.251 trillion.

Jan-Mar Revised Annualized GDP +4.1%; Prelim +3.5%

Japan’s gross domestic product expanded at a faster pace than initially estimated during the January-March quarter, offering a fresh indication that Prime Minister Shinzo Abe’s economic policies have started to take effect. (more…)

The National Spelling Bee is upon us, an annual event that dates back to the Coolidge administration that has served as a defining moment of immortality for 91 victorious children.

While the point of the Bee is to spell the words, not define them, half of the fun for the viewer is to get a taste of some of the more arcane elements of language.

We went back through the history of Spelling Bee winners to find the coolest words that won a kid a trophy.

Ordered sequentially by year:

2009: Laodician (adj.) – lukewarm or indifferent in religion or politics

Spelled by Kavya Shivashankar.

2004: autocthonous (adj.) – formed or originating in the place where found, native

Spelled by David Tidmarsh

2002: prospicience (noun) – the act of looking forward, foresight

Spelled by Pratyush Buddiga

1999: logorrhea (adj.) – excessive and often incoherent talkativeness or wordiness

Spelled by Nupur Lala

1997: euonym (noun) – a name well suited to the person, place, or thing named

Spelled by Rebecca Sealfon (more…)

With her face & body it doesnt matter how the book is positioned

99% of Technical Analyst in India :Look Chart This way only & Not able to Earn Money….Whole Day Do BLA BLA on Blue Channels !

“I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling the other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements – that is, not in reading the tape but in sizing up the entire market and its trend.”

“I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling the other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements – that is, not in reading the tape but in sizing up the entire market and its trend.”

In all of “Reminiscences” this crucial idea that the Really Big Money is always earned by prudently riding the large trends over time and not in day trading every minute fluctuation is one of the central themes of the book. Livermore hammers this again and again, attacking it from countless angles and spicing up all of his amazing lessons with his own enthralling personal experiences.

This old and successful speculator that Livermore mentions, Mr. Partridge, would always politely tell the younger speculators who asked him trading questions that it was a bull market. The young speculators were always eager to trade, but Partridge was old and battle-scarred enough to know that no mere mortal could even hope to catch every individual fluctuation so the wisest strategy was just to ride the major trends. His simple reply, which would annoy the youngsters since they couldn’t yet perceive the deep wisdom in it, was to subtly advise them to just ride the primary trend and not worry about rapid-fire trading.

If a particular market happens to be in a primary bull trend, then just be long and don’t worry about trying to interpret and trade upon the essentially random day-to-day market noise. If a particular market is in a primary bear trend, then either sit out in cash or stay short and wait for the trend to fully mature and run its course. Don’t try to frantically outguess the primary trend everyday, just accept it and trade with it and you will win in the end.