Politics determine who has the power, not who has the truth.

Archives of “January 4, 2019” day

rssSuccessful Stock Speculation, By J. J. Butler The Project Gutenberg eBook

Larry Hite from Market Wizards

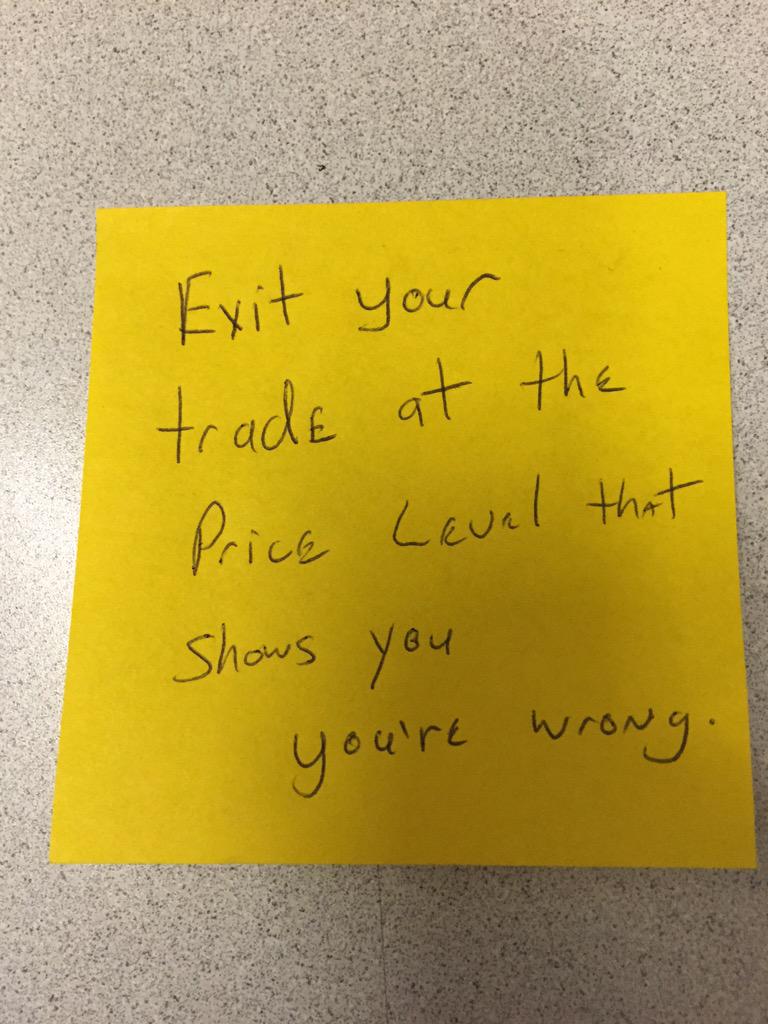

Reminder For Traders

Six Rules of Michael Steinhardt

Michael Steinhardt was one of the most successful hedge fund managers of all time. A dollar invested with Steinhardt Partners LP in 1967 was worth $481 when Steinhardt retired in 1995.

The following six rules were pulled out from a speech he gave:

1. Make all your mistakes early in life: The more tough lessons you learn early on, the fewer (bigger) errors you make later. A common mistake of all young investors is to be too trusting with brokers, analysts, and newsletters who are trying to sell you something.

2. Always make your living doing something you enjoy: Devote your full intensity for success over the long-term.

3. Be intellectually competitive: Do constant research on subjects that make you money. Plow through the data so as to be able to sense a major change coming in the macro situation.

4. Make good decisions even with incomplete information: Investors never have all the data they need before they put their money at risk. Investing is all about decision-making with imperfect information. You will never have all the info you need. What matters is what you do with the information you have. Do your homework and focus on the facts that matter most in any investing situation. (more…)

Basic Essentials of Trading

You have to be aware of what is going on around you, the levels, the moves, etc… part of the basic essentials of trading:

You have to be aware of what is going on around you, the levels, the moves, etc… part of the basic essentials of trading:

Master Po: Close your eyes. What do you hear?

Young Caine: I hear the water, I hear the birds.

Po: Do you hear your own heartbeat?

Caine: No.

Po: Do you hear the grasshopper which is at your feet?

Caine: Old man, how is it that you hear these things?

Po: Young man, how is it that you do not?

– Kung Fu (TV Series)

India's inflation highest among developing nations

15 Ways to Manage Trader Stress

- Only risk 1% of total trading capital per trade, with stop losses and proper position sizing. Proper positions sizing eliminates serious emotional impact of any one trade. Each trade is only one of the next one hundred, which gives traders a totally different mental perspective than an all in/have to be right Hail Mary trade.

- Only trade a position size you are comfortable with.

- Trade a method or system you believe in, based on backtesting of a positive expectancy.

- Know where you will get out of a trade before you get in.

- Only trade with a detailed trading plan.

- Believe in your ability to follow your trading plan. You must have faith in yourself to lower your stress level.