Buffett’s having fun with his new partnership-purchase of Heinz. The structure of the deal: Both Berkshire and a Brazilian private equity firm bought the company’s common stock, and then Berkshire, as the financing partner, bought a preferred stock paying 9% interest with the ability to exchange it for even more common shares later. Early results of the takeover have been encouraging and Buffett seems tickled by the creativity of the transaction. “With the Heinz purchase, moreover, we created a partnership template that may be used by Berkshire in future acquisitions of size.” Including Heinz, Berkshire now owns 8 1/2 companies that would be included in the Fortune 500 if they were standalone entities, we are told. One could envision Berkshire doing a Heinz-like transaction once a year!

Archives of “January 2, 2019” day

rssTrue False Questions

True or False

True or False

- The big money in trading is made when one can get long at lows after a big downtrend.

- It’s good to average down when buying.

- After a long trend, the market requires more consolidation before another trend starts.

- It’s important to know what to do if trading in commodities doesn’t succeed.

- It is not helpful to watch every quote in the markets one trades.

- It is a good idea to put on or take off a position all at once.

- Diversification is better than always being in 1 or 2 markets.

- If a day’s profit or loss makes a significant difference to your net worth, you are overtrading.

- A trader learns more from his losses than his profits.

- Except for commission and brokerage fees, execution costs for entering orders are minimal over the course of a year.

- It’s easier to trade well than to trade poorly.

- It’s important to know what success in trading will do for you later in life.

- Uptrends end when everyone gets bearish.

- The more bullish news you hear the less likely a market is to break out on the upside.

- For an off-floor trader, a long-term trade ought to last 3 or 4 weeks or less.

- Other’s opinions of the market are good to follow.

- Volume and open interest are as important as price action.

- Daily strength and weakness is a good guide for liquidating long term positions with big profits.

- Off-floor traders should spread different markets of different market groups.

- The more people are going long the less likely an uptrend is to continue in the beginning of a trend.

- Off-floor traders should not spread different delivery months of the same commodity.

- Buying dips and selling rallies is a good strategy.

- It’s important to take a profit most of the time.

- Of 3 types of orders (market, stop, and resting), market orders cost the least skid.

- The more bullish news you hear and the more people are going long the less likely the uptrend is to continue after a substantial uptrend.

- The majority of traders are always wrong.

- Trading bigger is an overall handicap to one’s trading performance.

- Larger traders can muscle markets to their advantage.

- Vacations are important for traders to keep the proper perspective.

- Undertrading is almost never a problem.

- Ideally, average profits should be about 3 or 4 times average losses.

- A trader should be willing to let profits turn into losses.

- A very high percentage of trades should be profits.

- A trader should like to take losses.

- It is especially relevant when the market is higher than it’s been in 4 and 13 weeks.

- Needing and wanting money are good motivators to good trading.

- One’s natural inclinations are good guides to decision making in trading.

- Luck is an ingredient in successful trading over the long run.

- When you’re long, limit up is a good place to take a profit.

- It takes money to make money.

- It’s good to follow hunches in trading.

- There are players in each market one should not trade against.

- All speculators die broke

- The market can be understood better through social psychology than through economics.

- Taking a loss should be a difficult decision for traders.

- After a big profit, the next trend following trade is more likely to be a loss.

- Trends are not likely to persist.

- Almost all information about a market is at least a little useful in helping make decisions.

- It’s better to be an expert in 1-2 markets rather than try to trade 10 or more markets.

- In a winning streak, total risk should rise dramatically.

- Trading stocks is similar to trading commodities.

- It’s a good idea to know how much you are ahead or behind during a trading session.

- A losing month is an indication of doing something wrong.

- A losing week is an indication of doing something wrong.

- One should favor being long or being short – whichever one is comfortable with.

- On initiation one should know precisely at what price to liquidate if a profit occurs.

- One should trade the same number of contracts in all markets.

- If one has $10000 to risk, one ought to risk $2500 on every trade.

- On initiation one should know precisely where to liquidate if a loss occurs.

- You can never go broke taking profits.

- It helps to have the fundamentals in your favor before you initiate.

- A gap up is a good place to initiate if an uptrend has started.

- If you anticipate buy stops in the market, wait until they are finished and buy a little higher than that.

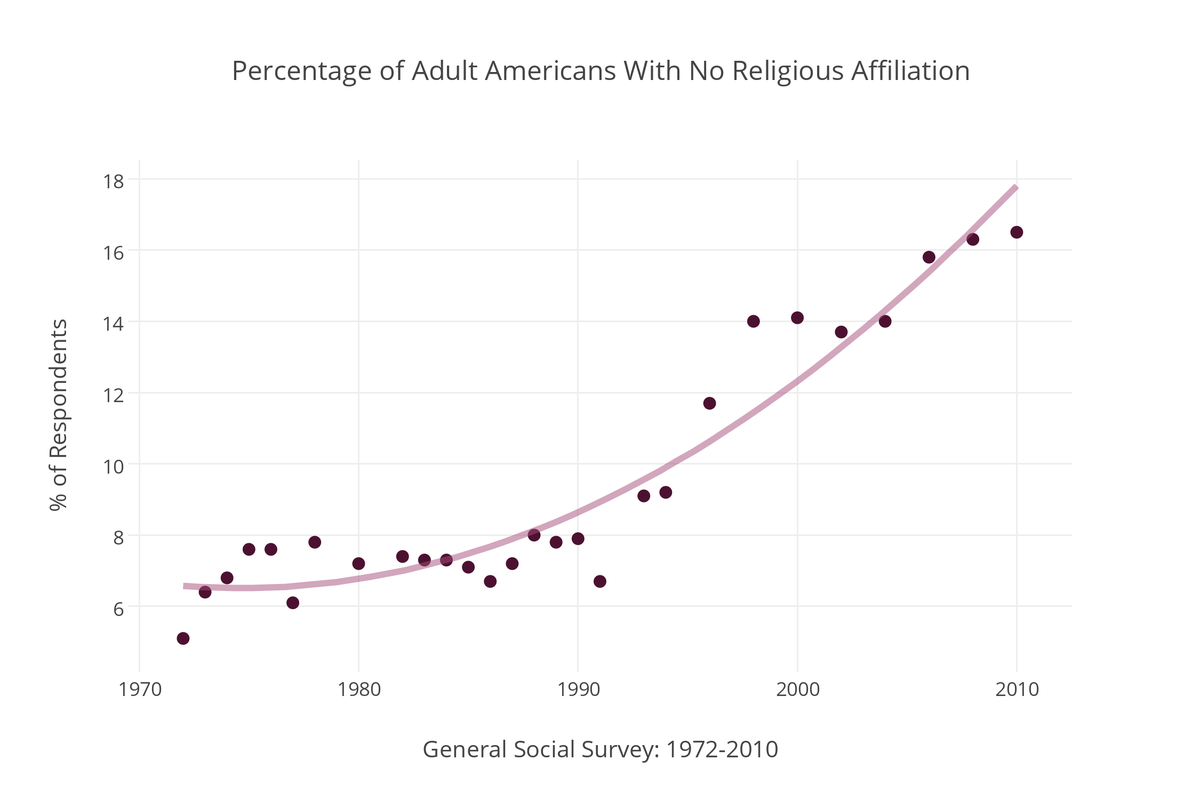

America is Becoming Less Religious

Your head is the medicine

Recessions risks jump, increasing the likelihood of a global economy stalling

Top Trend Traders Bank Millions, Ride The Trend

Famed Stanford University psychologist Leon Festinger once said, “A man with a conviction is a hard man to change. Tell him you disagree and he turns away. Show him facts or figures and he questions your sources. Appeal to logic and he fails to see your point.”

Although trend following has been one of the most successful trading strategies for decades, some critics downplay the massive profits accumulated by trend followers, arguing there are just a few chance winners — “lucky monkeys,” they claim.

BEAT THE AVERAGES

Not true. Large numbers of trend followers have found a way to outpace market averages. They have done so with hard work and the ability to stick with a trading plan — usually for a very long time. Some argue, “There’s no romance in trend following.” The romance is found in returns. Money is the ultimate aphrodisiac.

PROFITS COUNT

Think of it this way: Performance data examples from the great trend followers could be the foundation of every college finance class. When you show up on the first day, instead of your teacher handing you a syllabus and telling you to buy certain books, you are handed one piece of paper that simply shows the performance histories of professional trend following traders for the last 50 years.

HUGE WINNERS

The entire semester could be built around that study alone. But first, to judge systematic trend following performance, you need a baseline. The S&P 500 is the barometer for making money in the markets. Comparing to it is wholly appropriate (even though some might carp). Who are some of the top-performing trend following traders over the last 30 years? How much have they made? Consider:

o Bruce Kovner is worth more than $4.1 billion

o John W. Henry is worth $840 million

o Bill Dunn made $80 million in 2008

o Michael Marcus turned an initial $30,000 into $80 million

o David Harding is now worth more than $690 million

o Ed Seykota turned $5,000 into $15 million over 12 years

o Kenneth Tropin made $120 million in 2008

o Larry Hite has made millions upon millions over 30 years

o Louis Bacon is worth $1.7 billion

o Paul Tudor Jones is worth $3 billion

o Transtrend, a trend-trading fund, has produced hundreds of millions, if not billions, in profit (more…)

Tolerance and Apathy are the last virtues of a dying society

Leaders spend 5% of their time on the problem & 95% of their time on the solution. Forget A, get to Z.

Citigroup ceo wants to thank you for the $45 billion bailout

March 4 (Bloomberg) — Citigroup Inc. Chief Executive Officer Vikram Pandit plans to tell U.S. taxpayers he’s grateful for the $45 billion bailout that helped stave off a deposit run at the bank in 2008, a person close to the company said.

March 4 (Bloomberg) — Citigroup Inc. Chief Executive Officer Vikram Pandit plans to tell U.S. taxpayers he’s grateful for the $45 billion bailout that helped stave off a deposit run at the bank in 2008, a person close to the company said.

Pandit, scheduled to appear in Washington today before a panel overseeing the bank-bailout program, will acknowledge that the infusion stabilized Citigroup, said the person, who requested anonymity because the planned testimony isn’t public. Pandit will thank the government for providing the money, the person said

Nature first!