Archives of “January 2, 2019” day

rssThe dangers & symptoms of extreme trading stress

8 ways to measure your trading performance

1. Number of winning vs losing trades

The success rate of your trades is an important number to have in order to monitor improvements in other areas of trading.

There’s a general view that you’ll want to win more often than you lose – but there are many successful traders out there who’ll take lots of small losses and fewer bigger winners. What matters is how this figure balances with your average win/loss size (see number 3 below).

2. Largest number of consecutive winners and losers

Take a look at when these happened – what were the market conditions at the time?

This will give you a picture of what markets you’re good at trading, and which ones you should be wary of. How can you protect yourself against the poor market conditions, and maximize the benefits of the good conditions?

3. Average win size vs average loss size

I often bang on about how the 2:1 risk-reward principle should be viewed as an ‘aim’ rather than a ‘rule’.

Achieving double the reward on winners than the loss on losers is a tough call for any trading strategy to maintain – it’s certainly a lot harder than many trading gurus would have you believe.

However, if your losses are too big and keep wiping out all your gains –you’ve got a problem. This figure needs to be carefully balanced with your success rate (number 1, above) to achieve profitability.

4. Largest and longest draw-down periods (more…)

10 jobs that didn’t exist 10 years ago

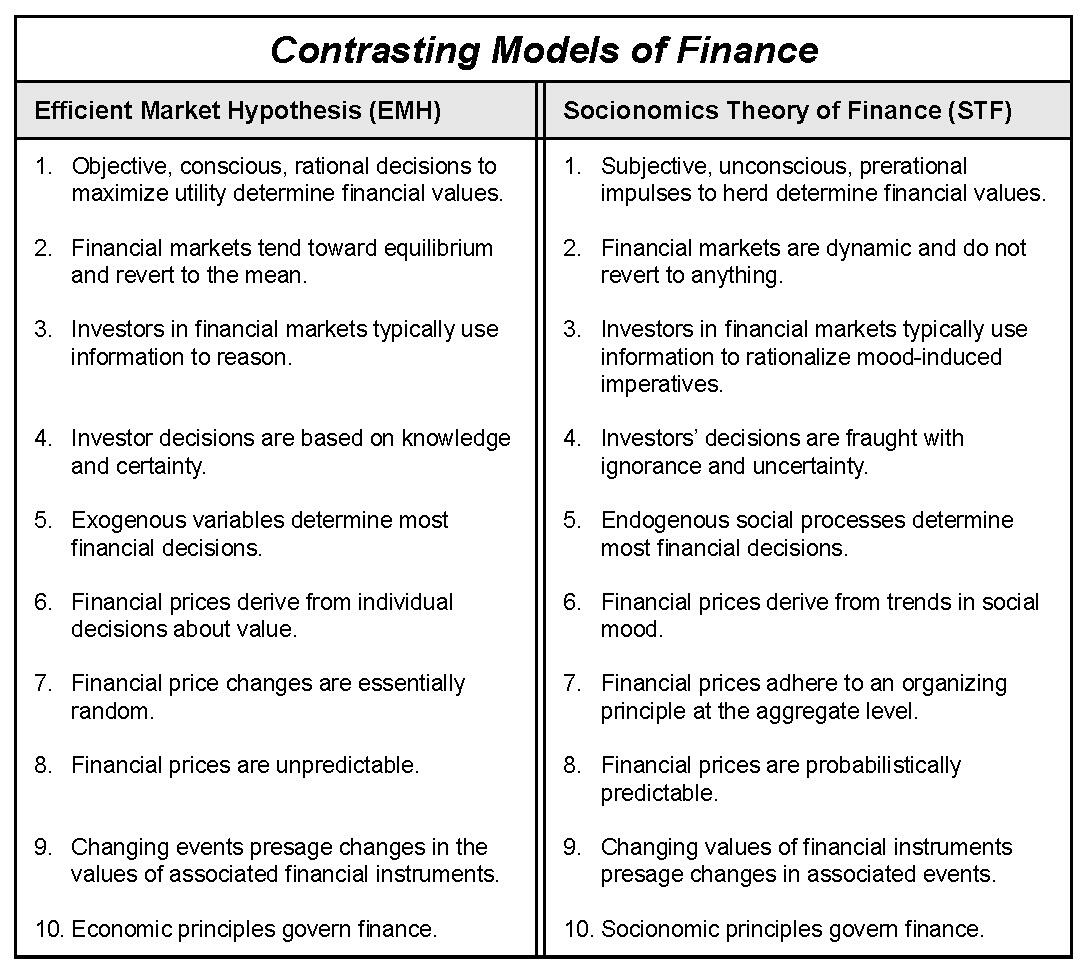

Learn the basics: Efficient Market Hypothesis vs Socionomic Theory of Finance

Only 5% of Successful Traders -Knows this Secret ,Rest 95% Wasting Time ,Money ,Energy

THE IMPORTANCE OF SITTING

Patience is important not only in waiting for the right trades, but also in staying with trades that are working. The failure to adequately profit from correct trades is a key profit-limiting factor. Quoting again from Lefevre in Reminiscences, “It never was my thinking that made big money for me. It was always my sitting. Got that? My sitting tight!” Also, recall Eckhardt’s comment on the subject: “One common adage … that is completely wrongheaded is: You can’t go broke taking profits. That’s precisely how many traders do go broke. While amateurs go broke by taking large losses, professionals go broke by taking small profits.”

Patience is important not only in waiting for the right trades, but also in staying with trades that are working. The failure to adequately profit from correct trades is a key profit-limiting factor. Quoting again from Lefevre in Reminiscences, “It never was my thinking that made big money for me. It was always my sitting. Got that? My sitting tight!” Also, recall Eckhardt’s comment on the subject: “One common adage … that is completely wrongheaded is: You can’t go broke taking profits. That’s precisely how many traders do go broke. While amateurs go broke by taking large losses, professionals go broke by taking small profits.”

A Matter of Perspective

SOMETIMES I JUST SITS

Sitting is ok when the markets are not set up for your trading edge…if you have one. If you do have a trading edge experience has taught you that there are certain times when it works, and works well, and other times when it doesn’t. The quicker you recognize the difference and make the necessary adjustments to suit market conditions, the quicker you can limit losses, thus leading to greater gains.

And right here let me say one thing: After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level, which should show the greatest profit. And their experience invariably matched mine –that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance.

Jesse Livermore, Reminiscences of a Stock Operator