Symptoms of Over Trading

1. Capital comes in two varieties: Mental and that which is in your pocket or account.

Of the two types of capital, the mental is the more important and expensive of the two. Holding to losing positions costs measurable sums of actual capital, but it costs immeasurable sums of mental capital.

2. “Markets can remain illogical longer than you or I can remain solvent”, according to our good friend, Dr. A. Gary Shilling.

Illogic often reigns and markets are enormously inefficient despite what the academics believe.

3. An understanding of mass psychology is often more important than an understanding of economics.

Markets are driven by human beings making human errors and also making super-human insights.

4. The market is the sum total of the wisdom … and the ignorance…of all of those who deal in it; and we dare not argue with the market’s wisdom.

If we learn nothing more than this we’ve learned much indeed.

5. The hard trade is the right trade: If it is easy to sell, don’t; and if it is easy to buy, don’t.

Do the trade that is hard to do and that which the crowd finds objectionable.

Peter Steidelmeyer taught us this twenty five years ago and it holds truer now than then.

6. There is never one cockroach: Bad news begets bad news, which begets even worse news. (more…)

* Everyone is wrong in the markets at times. The difference between the great traders and the unsuccessful ones is in how long they stay wrong.

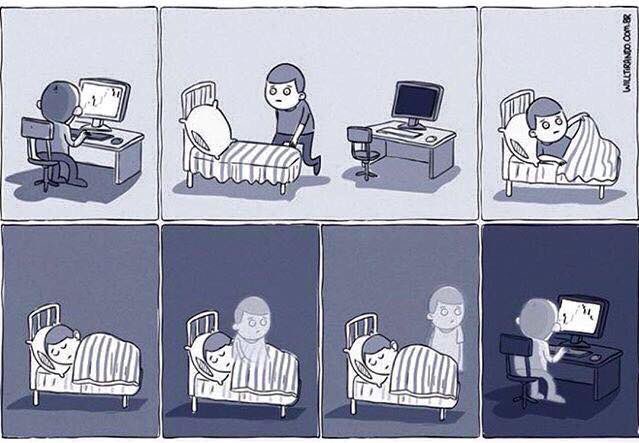

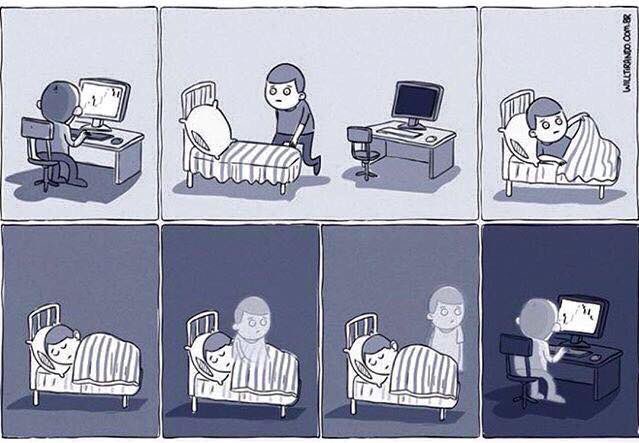

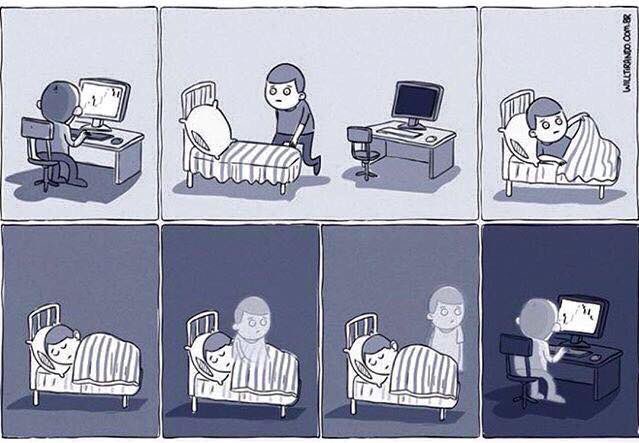

* Addictive traders get high from action; great traders get high from mastering markets–and mastering themselves.

* Great traders do their best work when they are not trading; unsuccessful traders do not work when they are not trading.

* Every loss of discipline is a self-betrayal; great traders are true to themselves and stay disciplined as a result.

* Great traders focus on the two things they can always control: when they play and how much they bet.

You will never achieve greatness by minimizing your weaknesses. At best that will bring you to average. The path to greatness lies inmaximizing strengths: becoming more of who you are when you are at your best. Here are five things I look for in successful new traders.

1) Self-awareness – Are you able to stand apart from yourself and observe your strengths and vulnerabilities in real time? Emotional self-awareness means that you observe and understand your emotional responses to market situations, and don’t automatically get caught up in those. Self-awareness also means being fully grounded in one’s “edges” as traders and not straying from those.

2) Self-management – Are you able to channel your thoughts, emotional responses, and behaviors in a constructive manner? Self-managing traders set goals that guide their activity through the day. They also behave in a rule-governed manner, whether it is with respect to entry/exit execution or risk management. Self-managing traders are ones who continuously review performance, learn from it, and place the lessons into subsequent practice.

3) Social awareness – Are you able to read participation in the marketplace? Can you pick up cues from volume, volatility, the co-movement of instruments and assets, and responses to news items that tell you whether buyers or sellers are dominant. The socially aware trader is keenly attuned to market flows, digging beneath the surface to figure out who is in the market, what they’re doing, and the price levels at which they’re acting.

4) Relationship management – Are you networking with others to make yourself better? Successful trading is a team sport, even when the trading is solo. There is simply too much information relevant to markets to process and stay on top of at all times. Successful traders filter out noise–the conversations, emails, and messages that contain little value–but actively filter in colleagues who have valuable perspectives. Very often, fresh inputs from those colleagues lead to fresh insights and trade ideas. Beneath every great individual performance is a well-functioning team, either real or virtual.