Archives of “January 2, 2019” day

rssBlack to play and win (and I found it!)

The only validation a trader needs is their trading profits.

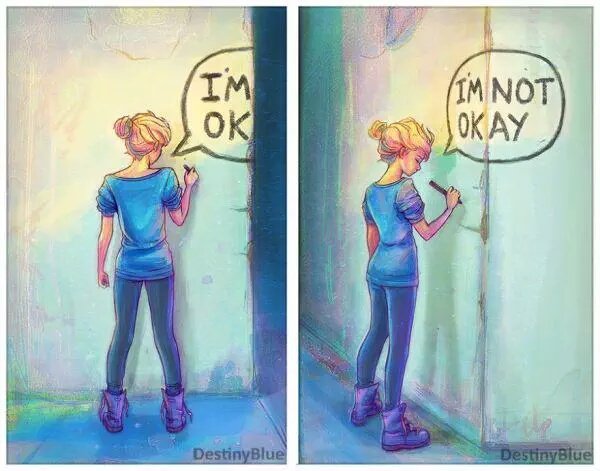

Thought- provoking image of the day

An Investment Poem

The newfound opportunity arises softly at first

The newfound opportunity arises softly at first

Like pearl shaped dew drops on a tea leaf

Quite unexpected but fast entranced and immersed

Her presence over the former solitude brings relief

More precious than any amount of money or power

More beautiful than the most stunning of jewels

You cannot appreciate the sweet without the sour

The kind of perfect pattern that makes investors drool

Finding shares to short are most difficult to borrow

But who would bet against an investment with so much potential?

Elation is now the norm starting yesterday, today and tomorrow

The biggest challenge lay in exercising prudential

Potentially an addicted lost cause am I

An investor who has witnessed too many ups and downs

Is it possible to stay grounded or is my destiny the sky?

Disciplined I promise to be, carefully soaking in the sights and sounds

Because true greatness only comes around every so often

Where your hands can’t help but shake and you feel it in your gut

The time is now, the place is here — this is Zen

As nature intended, this squirrel has found his nut

Growth is ‘driven by knowledge – at the level of society, not the individual’

Where does growth come from? Why do some countries “emerge” and take on “developed” status, while others flounder before reaching that stage?

Some once highly unlikely candidates have emerged as powerful economies. South Korea, for example, grew in two generations from a peasant economy devastated by war, to a fully paid-up member of the developed world. Others once far better placed have stumbled.

This is not simply a question of natural resources, or of educational systems. Instead, ambitious research led by Ricardo Hausmann at Harvard University suggests that growth is “driven by knowledge – at the level of society, not the individual”.

The first question asks what a society knows how to do. The follow-up is whether this knowhow can be applied in new areas. If people are already skilled in one area, are there other industries in which their skills could easily be applied?

The Harvard research involved producing a multi-modal “map” known as the Atlas of Economic Complexity , examining how knowhow forms clusters among industries. Big groups form around garments – where many successful emerging markets started their ascent – construction, machinery, chemicals and electronics. All need skills readily transferable to other sectors. (more…)

Thought For A Day

Fed Chiefs -Graphic

Find your hedgehog

TRADERS AND THEIR IRRATIONAL BELIEFS

- What goes up must come down and vice versa. That’s Newton’s law, not the law of trading. And even if the market does eventually self-correct, you have no idea when it will happen. In short, there’s no point blowing up your account fighting the tape.

- You have to be smart to make money. No, what you have to be is disciplined. If you want to be smart, write a book or teach at a university. If you want to make money, listen to what the market is telling you and trade to make money — not to be “right.”

- Making money is hard. Nope. Sorry. Making money is actually easy. Statistically, you’re going to do it about half the time. Keeping it, now that’s the hard part.

- I have to have a high winning percentage to be profitable. Not true. How often you are right on a trade is only half of the equation. The other half is how much do you make when you’re right and how much you lose when you’re wrong. You can remember that with this formula: Probability (odds of it going up or down) x Magnitude (how much it goes up or down) = Profitability.

- To be successful, I have to trade without emotions. That is both wrong and impossible. You are human so you have emotions. Emotions can be a powerful motivator to your trading.