1) The amount of time spent on their trading outside of trading hours (preparation, reading, etc.);

2) Dedicated periods to reviewing trading performance and making adjustments to shifting market conditions;

3) The ability to stop trading when not trading well to institute reviews and when conviction is lacking;

4) The ability to become more aggressive and risk taking when trading well and with conviction;

5) A keen awareness of risk management in the sizing of positions and in daily, weekly, and monthly loss limits, as well as loss limits per position;

6) Ongoing ability to learn new skills, markets, and strategies; (more…)

Archives of “January 2, 2019” day

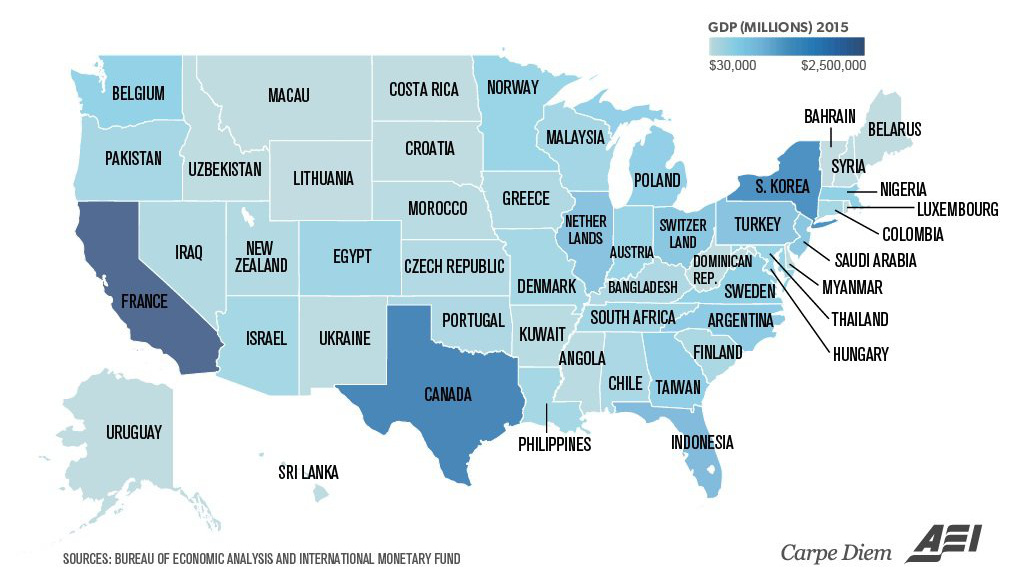

rssU.S. States Renamed for Countries With Similar GDPs

Pretty fascinating depiction of the US economy relative to other countries:

Thought For A Day

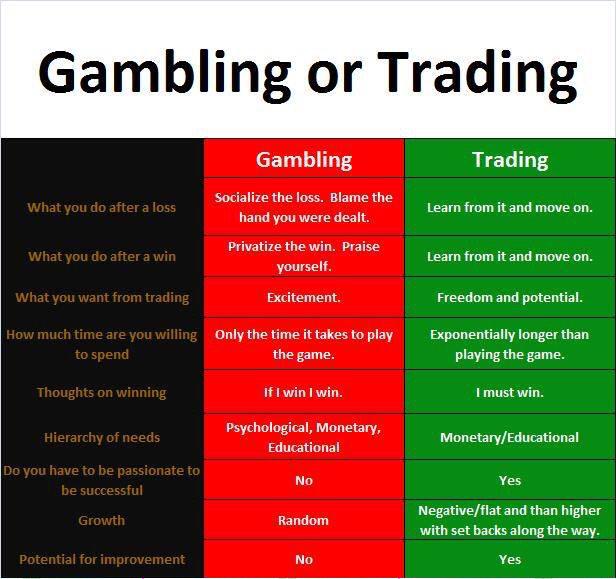

Are you gambling or trading?

If You Don't Understand Why You are in Trade

Why Traders Fail 20 Points ,VIDEO

The Anatomy of a Trend: 10 Guidelines

- A trend begins with capital flowing into an asset based on a perceived increase in the future value of the asset.

- Trends are identified by higher highs and higher lows for several days in a row or the reverse lower highs and lower lows.

- Moving averages can also identify trends based on a moving average sloping up or sloping down visibly.

- A moving average can also act as support or resistance for a stock as it trends in one direction and bounces off a key moving average.

- Trends tend to persist because the owners of the asset have no reason to sell and tend to just let their position ride causing the trend to continue.

- Supply and demand causes trends when you have a lot of dollars chasing a limited asset.

- In stocks, up trends are caused by mutual fund managers building large positions in their favorite stocks.

- Down trends in stocks are caused when institutions start to unload a stock or investors cash in their mutual fund shares during bear markets and managers have to raise cash by selling their holdings.

- Capital is always looking for great returns so they chase stocks with the biggest earnings expectations planning on the stock price following.

- Trends tend to persist until acted on by an opposing force. Sometimes this is as simple as running out of buyers or sellers of the asset.

The money is in the big trends, look for them, find them, and ride them until they end.

“The trend is your friend until the end when it bends” -Ed Seykota

A dozen lessons from Jim Simons

1. “Models can lower your risk…. It reduces the daily aggravation.” With old-fashioned stock picking: “One day you feel like a hero. The next day you feel like a goat. Either way, most of the time it’s just luck.” “We don’t override the models.”

2. “Certain price patterns are nonrandom and will lead to a predictive effect.”

3. “Efficient market theory is correct in that there are no gross inefficiencies, but we look at anomalies that may be small in size and brief in time.”

4. “Great people. Great infrastructure. Open environment. Get everyone compensated roughly based on the overall performance… That made a lot of money.”

5. “Luck, is largely responsible for my reputation for genius. I don’t walk into the office in the morning and say, ‘Am I smart today?’ I walk in and wonder, ‘Am I lucky today?’”

6. “We have three criteria. If it’s publicly traded, liquid and amenable to modeling, we trade it.” (more…)

Five Stages of Trader Evolution

Gambler. This is the oldest trader’s ancestor. He was fairly naive, highly emotional and addicted gambler. The gambler perceived the market as his casino-like entertaining arena. He bet large and he bet often. His goal was to get rich quick. Most, if not all, of his capital was quickly distributed to more evolved traders.

Gambler. This is the oldest trader’s ancestor. He was fairly naive, highly emotional and addicted gambler. The gambler perceived the market as his casino-like entertaining arena. He bet large and he bet often. His goal was to get rich quick. Most, if not all, of his capital was quickly distributed to more evolved traders.

Which stage are you at?

5 Great Things about Great Traders

Everyone is wrong in the markets at times. The difference between the great traders and the unsuccessful ones is in how long they stay wrong.

* Addictive traders get high from action; great traders get high from mastering markets–and mastering themselves.

* Great traders do their best work when they are not trading; unsuccessful traders do not work when they are not trading.

* Every loss of discipline is a self-betrayal; great traders are true to themselves and stay disciplined as a result.

* Great traders focus on the two things they can always control: when they play and how much they bet.