Central banks doing now what they should have been doing a decade ago

The last half of the 2010s was characterized by central banks trying to get back to ‘normal’ or to ‘home’ on interest rates. They were obsessed with getting away from the zero bound, just so they could cut again in the future.

They were slaves to the Phillips Curve and few of them emphasized (or realized) that technology, globalization and deunionization were putting downward pressure on prices.

Now we arrive in the 2020s and they’ve seen the light. They’re pledging to keep rates low and goose inflation above target. Kaplan today highlighted technology-enabled disruption as justification.

The problem is that the game is likely to change again. It’s all like a general investing in trench-digging equipment after the first world war. China is now exporting inflation.

I believe that the layering on of leverage should be one of the big takeaways from the market blowup in March. Central banks should be tackling that but instead, they’re building an even-larger tower of leverage in the belief that if anything goes wrong, they can always pump in enough money to make it better. That’s a mistake.

The real danger though is inflation. Yields moved up yesterday and in Asia today before correcting back lower. If they start to move up, bond investors are going to be sitting on massive paper losses.

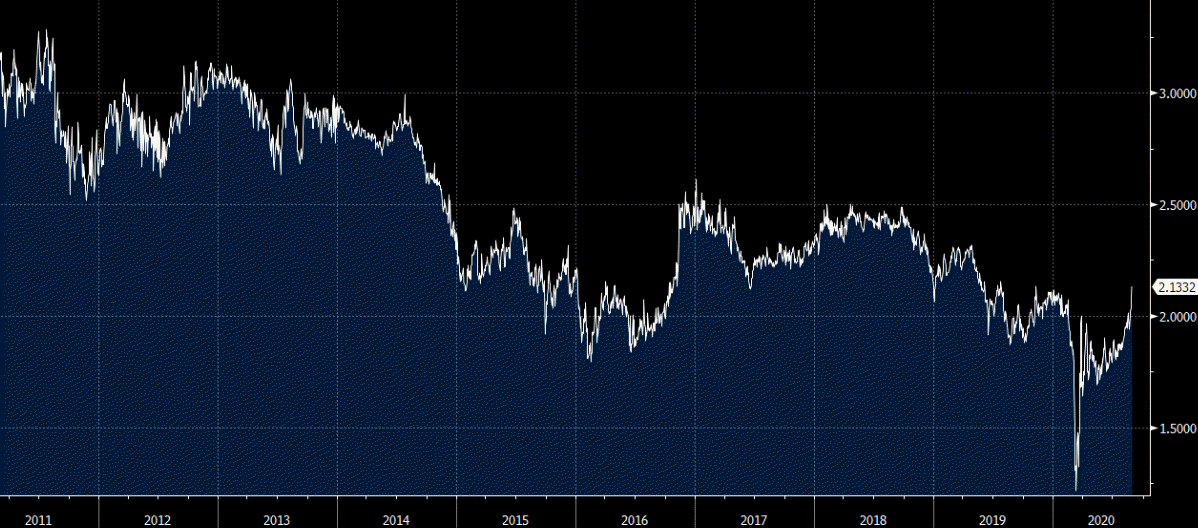

Already, parts of the market are signaling that inflation is coming.Note that 5y5y forward inflation rates today are at 2.13%; a level that would crush today’s 10-year note bond buyers at 0.73%.

That’s a long way from even the post-crisis era but you can see which direction it’s moving.

I’m the furthest thing from an evangelical on inflation but you can see the way that house prices, commodity prices and government spending are going.

Well it would appear that all the talk of the European Union and the IMF standing at the ready did not calm the

Well it would appear that all the talk of the European Union and the IMF standing at the ready did not calm the