US equities snapped back to losses yesterday, though they finished off the lows at least. Futures are keeping mildly higher today but the overall mood remains more tepid as we start to move towards European morning trade.

Archives of “futures contract” tag

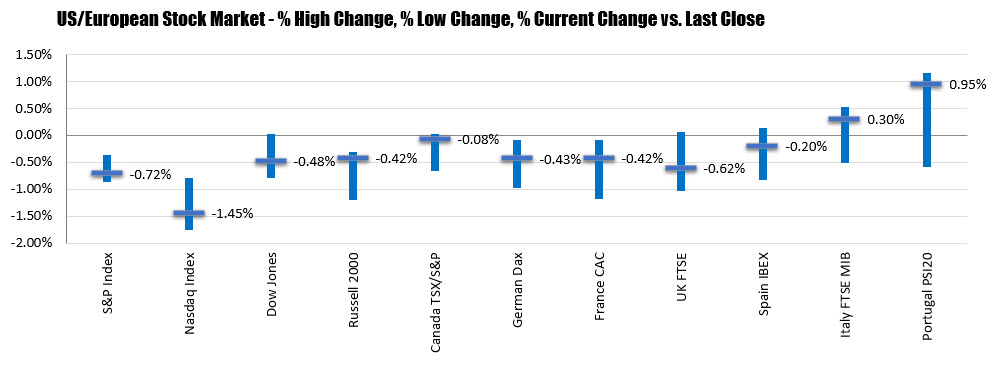

rssEuropean shares end the session with mixed results

Italy and Portugal indices move higher

the major European indices are ending the session with mixed results. Germany, France, UK and Spain show declines while Italy and Portugal eked out gains. The closes are showing:

- German DAX, -0.43%

- France’s CAC, -0.42%

- UK’s FTSE 100, -0.62%

- Spain’s Ibex, -0.2%

- Italy’s FTSE MIB, +0.3%

- Portugal’s PSI 20, +0.95%

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:- spot gold $-4.25 or -0.23% $1806.05. The high for the day reached $1813.48. The low extended to $1802.97

- WTI crude oil futures fell $0.19 or -0.46% to $41.01. It’s high price reached $41.18 while the low extended to $40.60. The September contract is currently down $0.21 or -0.51% of $41.19

- GBPUSD. The GBPUSD is trading at new session highs in the currently hourly bar. In the process, the price has moved back above its 200 and 100 hour moving average. That tilted the bias back to the upside in what has been an up and down market over the last 7 or so trading days. On the topside a trendline connecting highs from this we currently comes in at 1.2634. The high from yesterday reached 1.26487. The high for the week on Monday reached 1.26652.

- EURUSD: The EURUSD moved higher in the London session after finding support buyers near the 38.2% retracement of the move up from the Friday low at 1.13759. The high price reached 1.1441. The high price from yesterday reached 1.14512. There is close support at 1.14223 area

Dollar selling creeps in, S&P 500 futures higher

Risk on the theme

Eurostoxx futures +1.1% in early European trading

- German DAX futures +1.0%

- UK FTSE futures +2.4%

- Spanish IBEX futures +1.0%

ICYMI – US Senate moves to punish China on coronavirus

From the US afternoon, when equities and risk currencies dropped away …. or more accurately, continued to drop away …

- accused China’s Communist Party of deception over the virus

- “I’m convinced China will never cooperate with a serious investigation unless they are made to do so.”

- requiring China provide “a full and complete accounting to any COVID-19 investigation led by the United States, its allies or UN affiliate such as the World Health Organization

- require certification that China had closed all wet markets

- bill would authorize the president to impose a range of sanctions

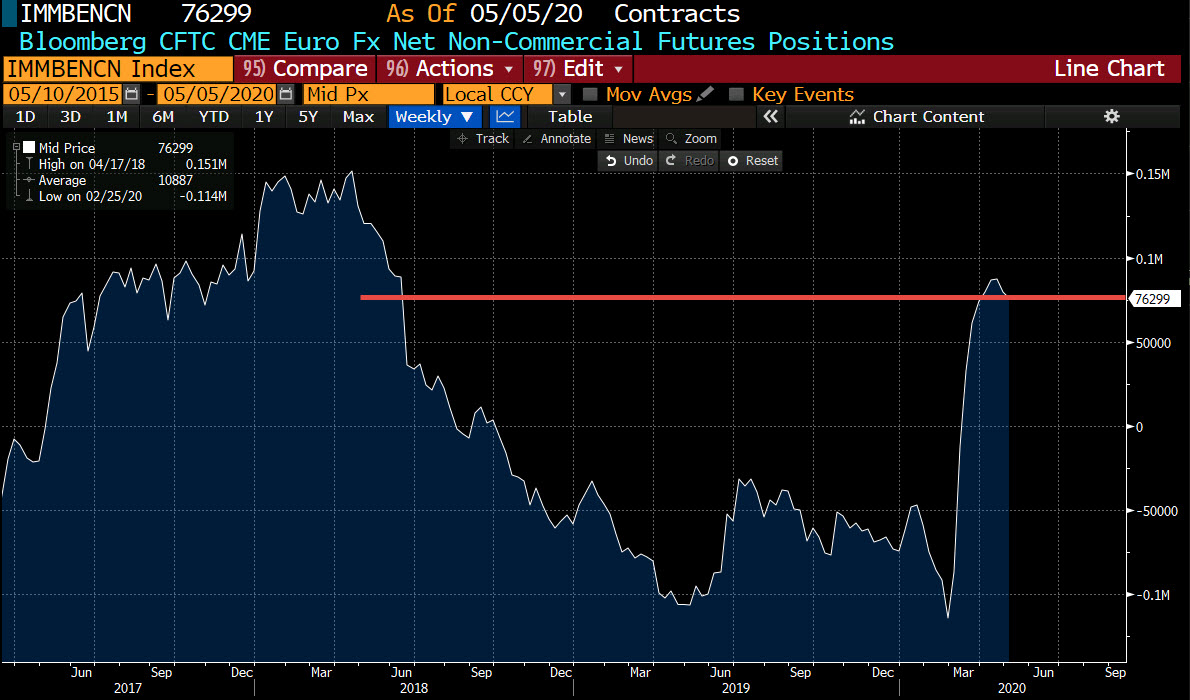

CFTC commitments of traders: EUR longs trimmed for the 2nd week in a row.

Forex futures positioning data for the week ending May 5, 2020.

- EUR long 76K vs 80K long last week. Shorts trimmed by 4K

- GBP short 12K vs 7K short last week. Shorts increased by 5K

- JPY long 27K vs 32K long last week. Longs trimmed by 5K

- CHF long 8K vs 6K long last week. Longs increased by 2K

- AUD short 33k vs 38K short last week. Shorts trimmed by 5K

- NZD short 15K vs 14K short last week. Shorts increased by 1K

- CAD short 32k vs 29K short last week. Shorts increased by 3K

Highlights:

- the largest position change was 5K in the GBP, JPY and AUD. The GBP positions were increased by 5K, while the JPY and AUD positions were trimmed by 5K

- The EUR long remains the largest position, but is lower for the 2nd week in a row. The net long over the last 2 weeks has seen the 87K to 76K this week

- The AUD and CAD are the next largest positions at 33K and 32K respectively. However, traders are short AUD,and long CAD.

Eurodollars

I have some questions regarding eurodollars and attempted to answer them myself: Why is GE quoted as interest rates, but de facto acts like a commodity ? Why were GE quotes up (rates on eurodollar deposits down) during the 2008/2020 crises. There was lots of cash demand.

– GE futures prices DO show de facto demand for cash (any fx cash offshore demand)

– GE is priced as rate to par of deposits

– GE reacts to or anticipates FED rates, as FED reacts to cash demand

– the rate of the deposits are not directly driven by supply and demand of global cash, but are driven by “external”/ non-eurodollar-mkt interest rates

– GE quotes can not be understand by the internal supply and demand of the eurodollar mkt conclusion: even GE-quotes are interest rates, GE-quotes act de facto like commodity prices, e.g. currently show huge cash demand.

Does you agree with my answers?

European shares end with solid gains as risk on sentiment increases

Hopes f him him him rom Gilead news propel European shares higher.

- German DAX, +3.0%

- France’s CAC, +2.32%

- UK’s FTSE 100, +2.77%

- Spain’s Ibex, +3.24%

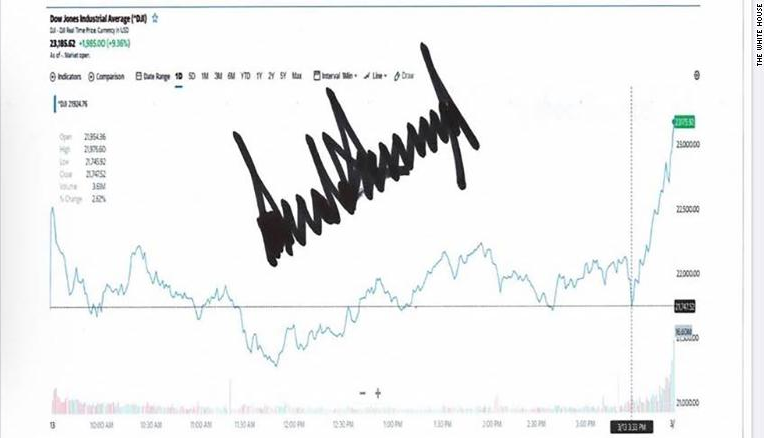

Nasdaq worst day ever. Stocks plunge.

What an active day:

- The Fed cut rates 1% in the Asian session, surprising the market.

- The Fed announced quantitative easing to the tune of 500bn Treasuries & 200bn MBS

- The Fed announced that banks can borrow from the Discount window for up to 90 days

- They added liquiidity via daily repo action. The Fed basically said, whatever you need, we will provide

- Later in the day, the Senate Democrats offered a $750B stimulus package (TBD how it progresses).

So what happened in the markets?

Stocks plummeted

- The Nasdaq had its worst day ever.

- The Dow and the S&P % decline was the worst since 1987

- The Dow’s point drop was the worst point loss ever

- Dow industrial average fell 2997.10 points or -12.93% to 20188.52.

- S&P index fell -324.89 points or -11.98% to 238-6413

- Nasdaq index fell -970.28 points or -12.32% at 6904.59

In the gold and precious metals market, prices fell.

- Spot gold had a volatile day and is closing down $-18.46 or -1.21% at $1511.37. The high for the day was up at $1575.47 while the low extended all the way down to $1451.55

- Spot silver also traded violently. It is closing at $12.90, down $-1.81 or -12.35% It traded in a $3.30 trading range. The high reached $15.15, while the low extended to $11.80. Crazy volatility

- WTI crude oil futures $28.70. $-3.03 or -9.55%. The high price reached $33.75. The low price extended to $28.10.

- Brent crude oil is trading at $29.52, or $-4.33 or -12.79% on the day. It’s high price extended to $35.84 while the low fell to $29.50.

Circuit breaker levels to watch in the S&P 500 later today

How low can you go?

- Level 1: 2,521.25 or down 7% from Friday close

- Level 2: 2,358.59 or down 13% from Friday close

- Level 3: 2,168.82 or down 20% from Friday close