On a broad sense most commonly used algorithmic strategies are Momentum strategies, as the names indicate the algorithm start execution based on a given spike or given moment. The algorithm basically detects the moment (e.g spike) and executed by and sell order as to how it has been programmed.

One another popular strategy is Mean-Reversion algorithmic strategy. This algorithm assumes that prices usually deviate back to its average.

A more sophisticated type of algo trading is a market-making strategy, these algorithms are known as liquidity providers. Market Making strategies aim to supply buy and sell orders in order to fill the order book and make a certain instrument in a market more liquid. Market Making strategies are designed to capture the spread between buying and selling price and ultimately decrease the spread.

Another advanced and complex algorithmic strategy is Arbitrage algorithms. These algorithms are designed to detect mispricing and spread inefficiencies among different markets. Basically, Arbitrage algorithms find the different prices among two different markets and buy or sell orders to take advantage of the price difference.

Among big investment banks and hedge funds trading with high frequency is also a popular practice. A great deal of all trades executed globally is done with high-frequency trading. The main aim of high-frequency trading is to perform trades based on market behaviors as fast and as scalable as possible. Though, high-frequency trading requires solid and somewhat expensive infrastructure. Firms that would like to perform trading with high frequency need to collocate their servers that run the algorithm near the market they are executing to minimize the latency as much as possible.

Adaptive Shortfall

Adaptive Implementation Shortfall algorithm designed for reduction of market impact during executing large orders. It allows keeping trading plans with automatic reactions to price liquidity.

Basket Trading

Basket Orders is a strategy designed to automated parallel trading of many assets, balancing their share in the portfolio’s value.

Bollinger Band

Bollinger bands strategy is a trading algorithm that computes three bands – lower, middle and upper. When the middle band crosses one of the other from the proper side then some order is made.

CCI (more…)

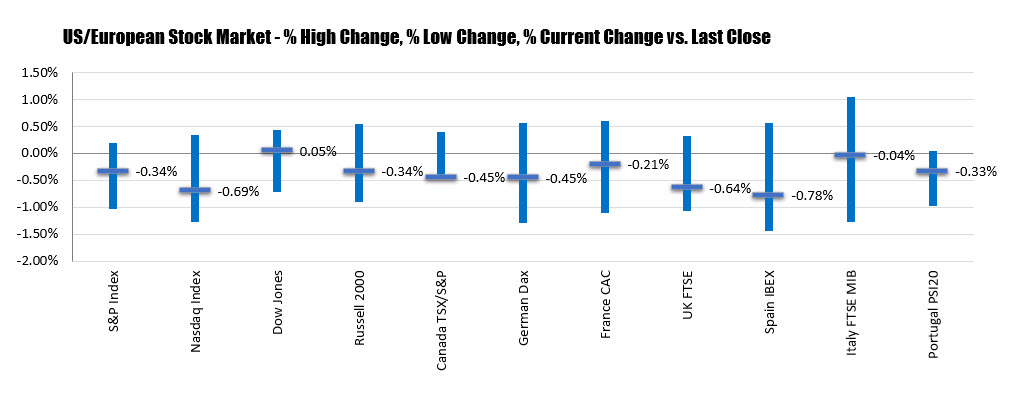

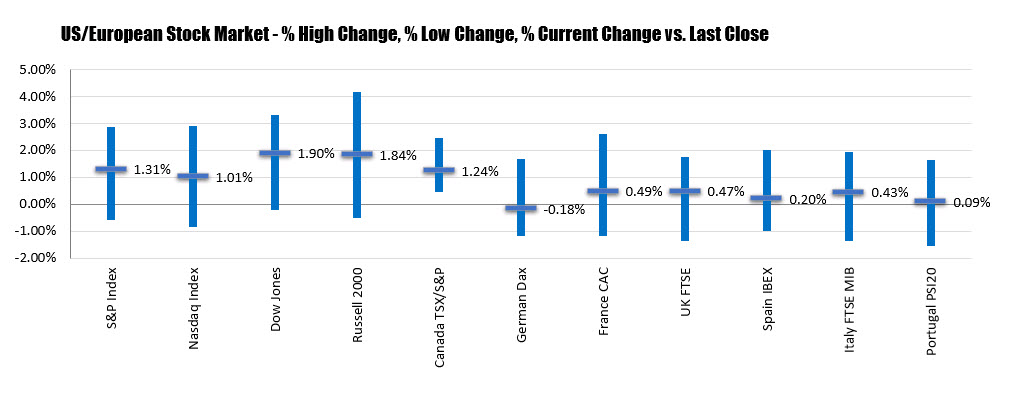

For the week, the major indices all fell with the Dow the weakest.

For the week, the major indices all fell with the Dow the weakest.