Big number of new coronavirus cases reported from the province. As of end Feb 12.

- Death toll in the province now totals 1,310.

- CNH down

- S&P 500 futures on Globex down

Moody’s now:

Moody’s focused on airport/travel impacts – tourist movements are significant indeed in Asia (and elsewhere of course), business-related travel also. There are significant flow-on effects from a reduced inbound flow of tourists, offset to some extent by locals otherwise taking holidays domestically.

How many different ways can you say “Record close for the US indices?” It is like a broken record.

Some of the oversize winners today include:

The EURUSD has moved to a new session low and in the process has taken out the 2019 low at 1.08787 (on my chart – bid side). The price is trading at the lowest level since May 12, 2017 him him him

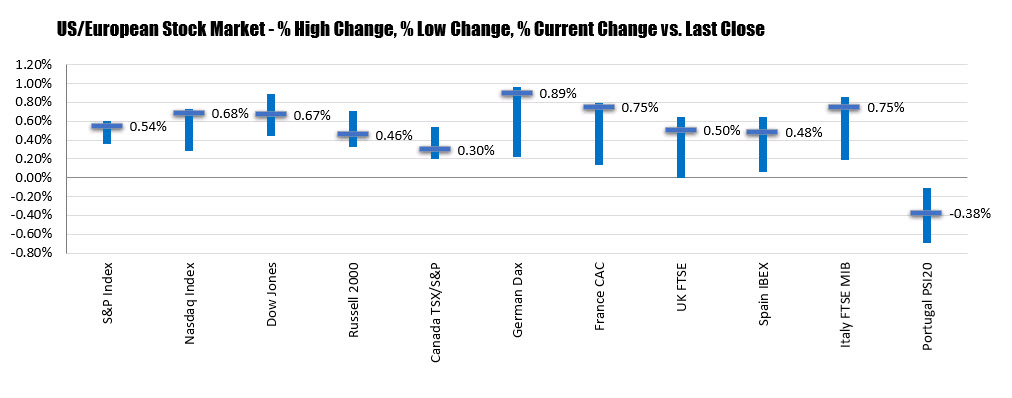

PS, the NASDAQ index and S&P index are trading near session highs. The Dow is in the middle of the trading range but still higher on the day.

PS, the NASDAQ index and S&P index are trading near session highs. The Dow is in the middle of the trading range but still higher on the day.

Fed Powell concludes his testimony at 11:24 AM ET.