Archives of “February 2019” month

rssThis is the importance of risk management (Mantra For Traders )

Cut Losses Short

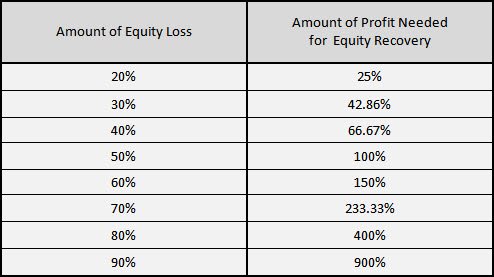

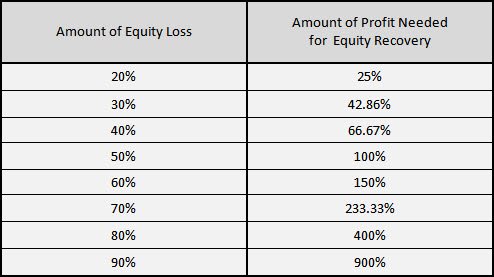

Cut losses short is the sister rule to the let profit run, and is usually just as difficult to implement. In the same way that profitability comes from a few large winning trades, capital preservation comes from avoiding the few large losers that the market will toss your way each year. Setting a maximum loss point before you enter the trade so you know before-hand approximately how much you are risking on this particular position is relatively straightforward. You simply need to have a exit price that says to you this trade is a loser and I will exit before it gets any bigger. Due to gaps at the open, or limit moves in futures we can never be 100%

Cut losses short is the sister rule to the let profit run, and is usually just as difficult to implement. In the same way that profitability comes from a few large winning trades, capital preservation comes from avoiding the few large losers that the market will toss your way each year. Setting a maximum loss point before you enter the trade so you know before-hand approximately how much you are risking on this particular position is relatively straightforward. You simply need to have a exit price that says to you this trade is a loser and I will exit before it gets any bigger. Due to gaps at the open, or limit moves in futures we can never be 100%

certain that we can get out with our maximum loss, but simply having the rules, and always sticking to it will save us from the nasty trades that just keep on going and going against our position until we have lost more than many winning trades can make back.

If you have a losing position that is at you maximum loss point, just get out. Do not hope that it will turn around. Given that trades are either winners or losers, and this one is shouting Loser at you, the chances that it will turn around and become a large winner is tiny. Why risk any more money on this losing trade, when you could simply close it out (accept the loss) and move on. This will leave you in a much better place financially and mentally, than holding the position and hoping it will go back your way. Even if it did do this, the mental energy and negative feelings from holding the losing position are not worth it. Always stick to your rules and exit a position if it hits your stop point.

Corporate Lessons

CORPORATE LESSON 1

CORPORATE LESSON 1

A man is getting into the shower just as his wife is finishing up her shower when the doorbell rings. The wife quickly wraps herself in a towel and runs downstairs. When she opens the door, there stands Bob, the next door neighbor. Before she says a word, Bob says, ‘I’ll give you $800 dollars to drop that towel.”

After thinking for a moment, the woman drops her towel and stands naked in front of Bob. After a few seconds, Bob hands her $800 dollars and leaves. The woman wraps back up in the towel and goes back upstairs. When she get to the bathroom, her husband asks, “Who was that?”

“It was Bob the next door neighbor” she replies.

“Great!” the husband says. “Did he say anything about the $800 he owes me?”

Moral of the story: If you share critical information pertaining to the credit and risk with your shareholders in time, you may be in a position to prevent avoidable exposure.

———————–

CORPORATE LESSON 2

A sales rep, an administration clerk, and the manager are walking to lunch when they find an antique oil lamp. They rub it and a Genie comes out. The Genie says, “I’ll give each of you just one wish.”

“Me first! Me first!” says the admin. clerk. “I want to be in the Bahamas, driving a speedboat, without a care in the world.” Poof! She’s gone.

“Me next! Me next!” says the sales rep. “I want to be in Hawaii, relaxing on the beach with my personal masseuse, an endless supply of Pina Coladas and the love of my life.” Poof! He’s gone.

“OK, you’re up,” the Genie says to the manager. The manager says, “I want those two back in the office after lunch.”

Moral of the story: Always let your boss have the first say. (more…)

Jim Chanos Is Bearish On China

Jim Chanos is bearish on China and I think he has a very good point. China suffers from huge overcapacity in every sector and their statistics are made up.

“Jim Chanos, head of investment firm Kynikos Associates and famous for his call to short Enron in 2001, has found his next big target.

Chanos and other China bears say the country has overcapacity in just about every sector of its economy, and the government’s massive stimulus isn’t working. They think China is simply covering things up with faulty statistics.

For example, they point to the huge reported increases in car sales in contrast to numbers showing little growth in gasoline consumption, which suggests state-run companies are buying huge numbers of cars and putting them in storage.” in The Daily Crux

Marc Faber on the market

On 5/25/10, Marc Faber makes a trading call but longer term he is very bearish on everything.

Marc Faber thinks we rebound in June and July just for a little bit but we go down in all the way to October and November.

Daiwa to launch 'Trump-related' mutual fund

Daiwa Asset Management is set to start operating a mutual fund that invests in stocks related to U.S. President-elect Donald Trump’s infrastructure investment policy. Daiwa will launch the product on Tuesday.

The open-end mutual fund — the first of its kind in Japan since Trump’s election victory in November 2016 — is likely to be made available to retail investors by the end of the month.

The U.S. infrastructure builder equity fund, which invests in U.S. companies, will quantify how much each stock will benefit from Trump’s infrastructure policy, based on criteria such as sales ratio in the U.S. and the degree of obsolescence of the target infrastructure. The details of the portfolio will be determined by how much share prices are undervalued and how competitive the companies are.

The portfolio, comprising 30-50 companies — mostly in the construction, transport and materials sectors — will be adjusted as appropriate as Trump’s policy takes form.

Trump has pledged to spend $1 trillion to overhaul the country’s aging infrastructure over the next decade.

Trading and Behavior

Gandhi said a person cannot be different from himself in different areas of his life. He meant a person really cannot be someone at work and a entirely different person at home, with his friends, etc. The personality is a whole –- you can’t have a mask for different occasions. What you do in private life echoes in your business life, and vice-versa. What you do in the different areas of your life (private, professional, friendship, religion, spirituality, fun) echoes in every other part.

If you are a fighter in your work, one cannot expect you to be a daisy flower at home -– you will treat your family with the same authority and discipline. If you are kind, you will be kind whether at home or at office. One cannot really perform different roles separately. The person is an unity.

That means if you are lazy, undisciplined, late, in your behavior, it will reflect in your trading. Have you ever thought your trading problems may not be trading related? If you find yourself… (more…)

Perfect description of a stock market mania. From “The Money Game” (1967), Adam Smith.

Addictiveness

Trading is also highly addictive. When behavioral psychologists have compared the relative addictiveness of various reinforcement schedules, they found that intermittent reinforcement – positive and negative dispensed randomly (for example, the rat doesn’t know whether it will get pleasure or pain when it hits the bar) – is the most addictive alternative of all, more addictive than positive reinforcement only. Intermittent reinforcement describes the experience of the compulsive gambler as well as the future trader. The difference is that, just perhaps, the trader can make money.” However, as with most affective aspects of trading, its addictiveness constantly threatens ruin. Addictiveness is the reason why so many players who make fortunes leave the game broke.”

Trading is also highly addictive. When behavioral psychologists have compared the relative addictiveness of various reinforcement schedules, they found that intermittent reinforcement – positive and negative dispensed randomly (for example, the rat doesn’t know whether it will get pleasure or pain when it hits the bar) – is the most addictive alternative of all, more addictive than positive reinforcement only. Intermittent reinforcement describes the experience of the compulsive gambler as well as the future trader. The difference is that, just perhaps, the trader can make money.” However, as with most affective aspects of trading, its addictiveness constantly threatens ruin. Addictiveness is the reason why so many players who make fortunes leave the game broke.”