Annual salary in national currency: 16.7 million krónur

> Time in office: 2 years 9 months

> GDP per capita: $44,029

> Annual salary in national currency: 140,904 euros

> Time in office: 9 months

> GDP per capita: $40,661

Annual salary in national currency: 16.7 million krónur

> Time in office: 2 years 9 months

> GDP per capita: $44,029

> Annual salary in national currency: 140,904 euros

> Time in office: 9 months

> GDP per capita: $40,661

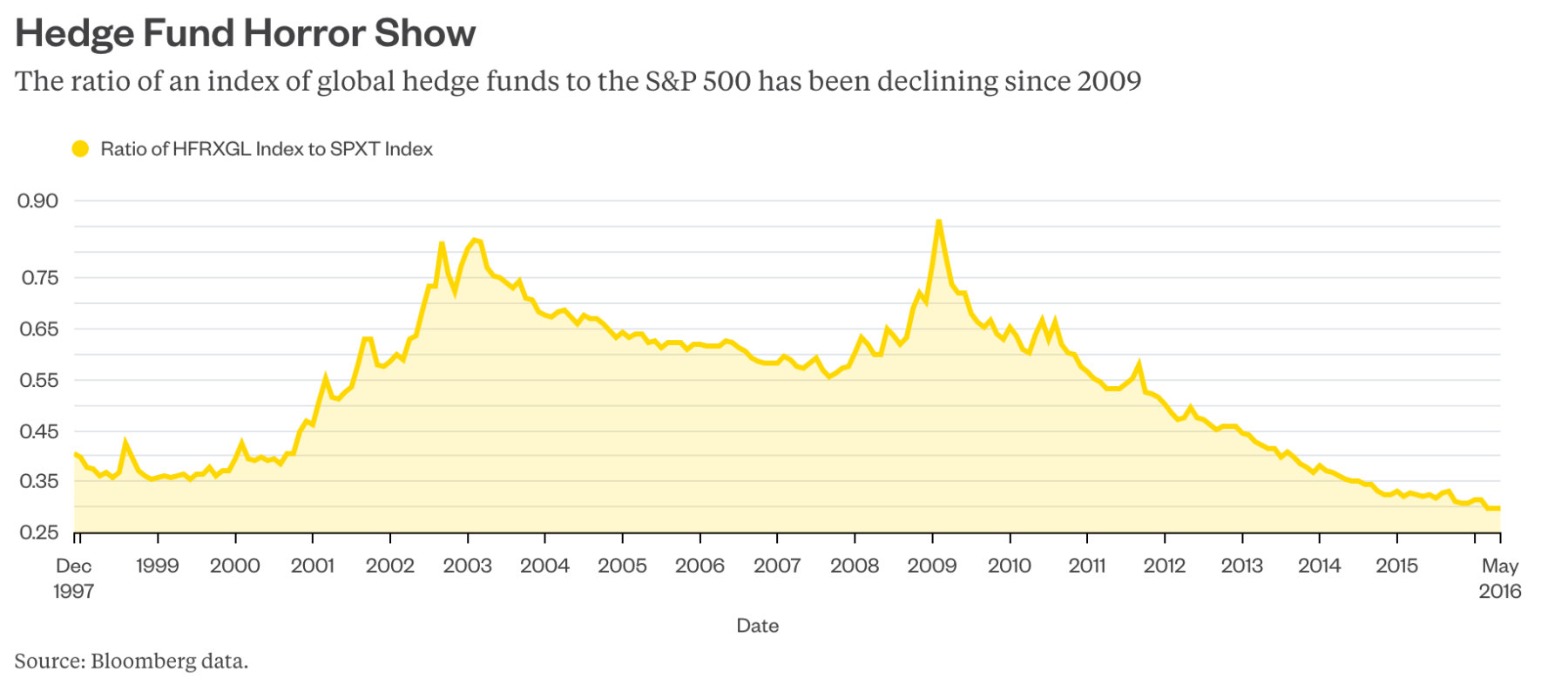

Really interesting analysis via Gadfly about under performance in the hedge fund community:

Just last week, the U.S. bull market in stocks became the second longest on record, which — fair or not — leaves it vulnerable to some age discrimination. Over that stretch, equity hedge funds as a group have underperformed the S&P 500, which is a comparison that many fund managers will insist is apples to oranges but which nonetheless is a comparison that will probably continue to be made forever by investors perusing the fruit salad of investment options.

Look at this chart, which shows a ratio of the HFRX Global Hedge Fund Index to a total-return version of the S&P 500. When the line is falling, it means the hedge funds tracked by the index are getting beaten by the S&P 500. And, whoa boy, it has been falling for the last seven years:

Deciding to be a profitable financial trader is the first step in becoming one. Trite you say? Not really. Missing this one step or doing it out of order xplains why 90% of brokerage accounts go to zero within the first year, many doing so in the first 4 months!

In addition to arbitrarily deciding to be a profitable financial trader, a more powerful and lasting way is to use psychological conditioning on yourself so that you CONSISTENTLY decide that you are a profitable trader Here’s my interpretation of the method for doing this that I learned from the famous success guru I alluded to in my comments two blogs back.

First, write out the sentence below on a piece of paper.

“FROM THIS MOMENT FORWARD, I AM A PROFITABLE TRADER”.

Second, consider the pain you have experienced before because you have not consistently thought of yourself as a profitable trader. Imagine experiencing that again in the present and future. Do this for 30 seconds. Notice how you feel as you do that. (more…)

Ed Seykota:

Seasoned traders know the importance of risk management. If you risk little, you win little. If you risk too much, you eventually run to ruin. The optimum, of course, is somewhere in the middle.

Placing a trade with a predetermined stop-loss point can be compared to placing a bet: The more money risked, the larger the bet. Conservative betting produces conservative performance, while bold betting leads to spectacular ruin. A bold trader placing large bets feels pressure — or heat — from the volatility of the portfolio. A hot portfolio keeps more at risk than does a cold one. Portfolio heat seems to be associated with personality preference; bold traders prefer and are able to take more heat, while more conservative traders generally avoid the circumstances that give rise to heat. In portfolio management, we call the distributed bet size the heat of the portfolio. A diversified portfolio risking 2% on each of five instrument & has a total heat of 10%, as does a portfolio risking 5% on each of two instruments.

Our studies of heat show several factors, which are:

1. Trading systems have an inherent optimal heat.

2. Setting the heat level is far and away more important than fiddling with trade timing parameters.

3. Many traders are unaware of both these factors.

Trade the market, not the money

• Always trade value, never trade price

• The answer to the question, “What’s the trend?” is the question, “What’s your timeframe?”

• Never allow a statistically significant unrealized gain to turn into a statistically significant realized loss (ATR)

• Don’t tug at green shoots

• When there’s nothing to do, do nothing

• Stop adjustments can only be used to reduce risk, not increase it.

• There are only two kinds of losses: big losses and small losses, given these choices – always choose small losses.

• Risk no more than 1% of AUM on any single position

• Never risk less than 1% of asset under management on any single position (as long as your models are performing well)

• Don’t Anticipate, Just Participate

• Buy the strongest, sell the weakest (RSI)

• Sideways markets eventually resolve themselves into trending markets and vice versa

• Stagger entries & exits – Regret Minimization techniques

• Look for low risk, high reward, high probability setups

• Correlations are for defense, not offense

• Drawdowns are for underleveraged trading and research

• Develop systems based on the kinds of “pain” (weaknesses) endured when they aren’t working or you’ll abandon them during drawdowns.

• Be disciplined in risk management & flexible in perceiving market behavior

• It’s not about the best RAROR, it’s about the best RAROR for your trading personality