Archives of “January 2019” month

rss9 Wisdom Lines From Jesse Livermore

1. “Money is made by sitting, not trading.”

2. “It takes time to make money.”

3. “It was never my thinking that made the big money for me, it always was sitting.”

4. “Nobody can catch all the fluctuations.”

5. “The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money everyday, as though they were working for regular wages.”

6. “Buy right, sit tight.” (more…)

The Best Traders Are Simply Slaves To The Market's Price Action

This I had Learned in 1992 …………….Yes it’s saying in Gujarati :Bhaav Baap Che !!

Just Doubt Your Limits

Overcome Indecisive Trading- Take 5 Steps

Admit it. Face up to what it is. Call it a slump, call it shattered confidence, call it a big scary market monster. Whatever “it” is, you have to get it on the table so you can deal with it.

Seek help. Maybe you shouldn’t go it alone. Without some accountability, it’s easy to relapse. Find a mentor or some coaching to get you back on track, and add some skills to your repertoire. The fact of the matter is that left to your own abilities as they currently stand, you may very well be facing a similar situation again.

Take inventory. Take an inventory of what’s left of your capital, both in terms of cash and confidence. It may be that you simply don’t have enough left to consider a comeback right away, so perhaps you incubate for a while and prepare in other ways for your eventual return. Or perhaps you assess your situation and realize you have more than enough to start the process.

Get uncomfortably familiar with the cause. What was it that put you in need of recovery to begin with? Overconfidence? Lack of respect for the market? A series of small mistakes which compounded your problems? Understanding the root cause of your wounds, even if painful, will help you prevent it from happening again in the future. After all, you’ve already paid the tuition, you might as well get the lesson.

Get back in the saddle. The last step in the sequence is to return to trading and begin rebuilding. Start thinking about what that’s going to look like for you and how you’ll avoid the same pitfalls which got you this time around. Visualize yourself back in the routine again, making plays, staying disciplined, and having success.

Hemingway was asked to use 6 words to write a story that would make people cry, this was it.

This is For Buy & Hold Believer

Trading Mathematics and Trend Following

Some quick points, to be making money, Profit Factor must be greater than 1.

- Profit Factor (PF)

- = Gross Gains / Gross Losses

- = (Average win * number of wins) / (Average loss * number of losses)

- = R * w / (1-w)

- where R = Average win / Average loss

- w = win rate, i.e. % number of winners compared to total number of trades

Re-arranging, we have

- w = PF / (PF + R)

- R = PF * (1 – w) / w

Sample numbers showing the minimum R required to break-even (i.e. PF = 1, assuming no transaction costs) for varying win rates.

- w = 90% >> R = 0.11

- w = 80% >> R = 0.25

- w = 70% >> R = 0.43

- w = 60% >> R = 0.67

- w = 50% >> R = 1

- w = 40% >> R = 1.5

- w = 30% >> R = 2.33

- w = 20% >> R = 4

- w = 10% >> R = 9

The style of trading strongly influences the win rate and R (average winner / average loser). For example, (more…)

Thought For A Day

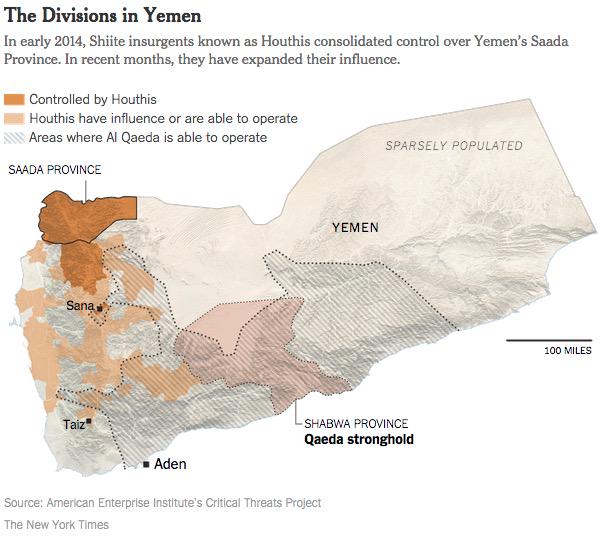

So many countries in Middle East no longer operate by recognized borders. Syria, Iraq, Libya…here's Yemen.