|

Archives of “January 2019” month

rssThis Way Corporates are Manipulating Result & You Should Not Trust

Here's what commodities did this month. They were spiking all of April

Countries by S&P credit rating

If you're not feeling stupid, you're not managing risk

The Fed and Lehman Brothers

Lehman by TBP_Think_Tank on Scribd

Trading lessons are simple—but not so easy

1. Be with the trade you are in at the moment. Stop trying to control anything but your own trade. The markets are going to do exactly what they want to and when they want to. YOU have the power to control what YOU feel, think, believe and do.

1. Be with the trade you are in at the moment. Stop trying to control anything but your own trade. The markets are going to do exactly what they want to and when they want to. YOU have the power to control what YOU feel, think, believe and do.

2. All that matters for you is the trade you are in. You may never see that trade again. Savor it, cherish it and be with it for as long as it lasts.

3. Celebrate your victories with yourself. Celebrate the trade and with the trade. The instruction is to refrain from boasting or grandiose behavior when you make a winning trade. The markets will humble you, and pride always comes before a fall. Napoleon said that the most dangerous moments come with victory. Decry and avoid hubris.

Also celebrate your defeats with yourself and the trade because they are mistakes. Mistakes are our greatest teachers because it is through them that we learn. What do we learn? Not to make them again!

Constantly strive to look inward, to know yourself, to raise yourself to the highest level of authenticity. Be rigorously honest about who you are.

How are you perceiving your market?

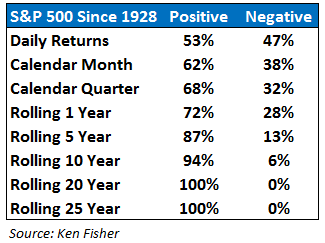

See Daily Returns in S&P 500 Since 1928 -Traders Must See

You can see that daily returns in the market are more or less a fifty-fifty proposition. Since loss aversion means that losses make us feel worse than gains make us feel better by a factor of 2:1, this means that if you check the value of your stock portfolio on a daily basis, you will feel terrible every single day.

Every good feeling you get from gains will get completely wiped out by the terrible feelings from the down days. But lengthen your time horizon and the effects of loss aversion slowly start to fade. (more…)

The 10 Bad Habits of Unprofitable Traders

The 10 Bad Habits of Unprofitable Traders

- They trade too much. A major edge small traders have over institutions is that we can pick our trades carefully and only trade the best trends and entries. The less I trade the more money I make because being picky is an edge, over trading is a sure path to losses.

- Unprofitable traders tend to be trend fighters always wanting to try to call tops and bottoms, while they eventually will be right there account will likely be too small by then to really profit from the actual reversal. The money is made swimming with the flow of the river not paddling up stream the whole time.

- Taking small profits quickly and letting losing trades run in the hopes of a bounce back is a sure path to failure. The whole thing that makes traders profitable is their risk/reward ratio, big wins and small losses. Being quick to take profits but allowing losses to grow is a sure way to eventually blow up your trading account.

- Wanting to be right more than wanting to make money will be VERY expensive because the trader won’t want to take losses and he definitely will not want to reverse his position and get on the right side of the market because in his mind that is a failure, in a profitable trader’s mind that is a success if they start making money.

- Unprofitable traders trade too big and risk too much to make too little. The biggest key to profitability is to not to have BIG LOSSES. Your wins can be as big as you like but the downside has to be limited.

- Unprofitable traders watch BLUE CHANNELS for trading ideas. Just stop it. (more…)