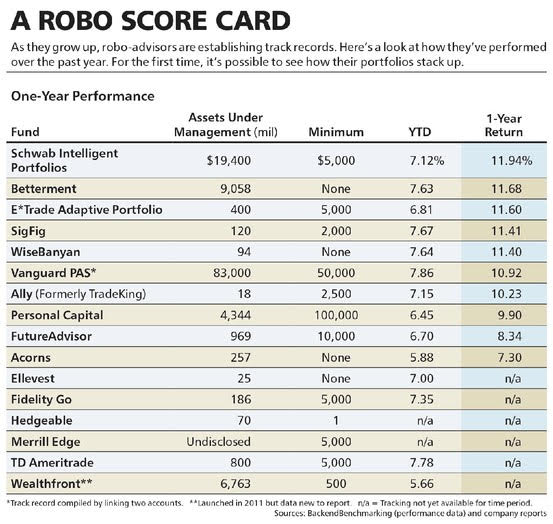

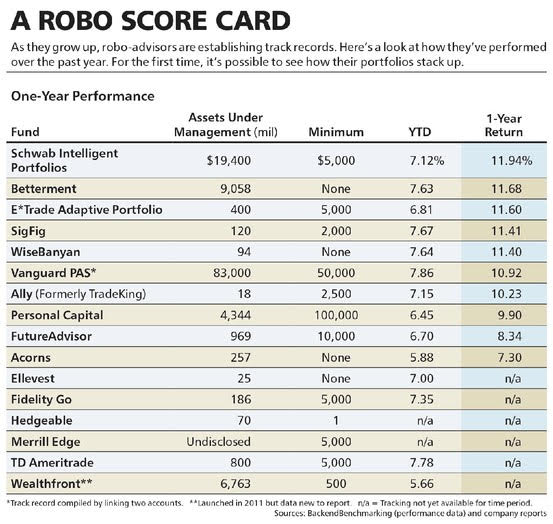

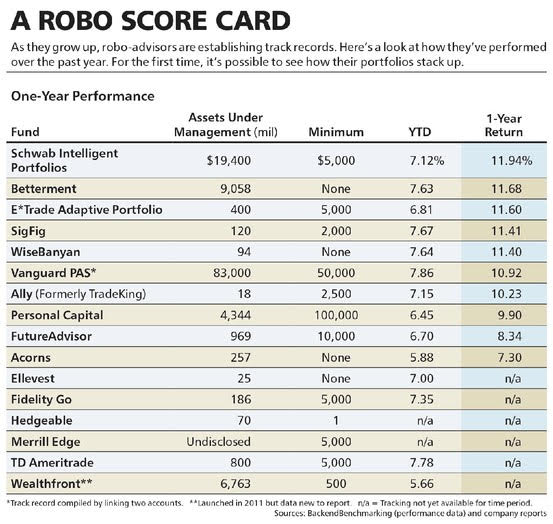

Rating the Robo-Advisors

The ancient Chinese geomantic practice of feng shui still carries huge influence in Hong Kong, with its philosophy permeating all aspects of society and the economy in this money-driven territory of gleaming office towers.

Under the feng shui system, the auspicious positioning of objects is believed to ensure harmony, health and fortune. Many in Hong Kong resort to feng shui when making almost all important decisions, especially in choosing and configuring sites and structures, to ensure good luck, especially when it comes to making money.

One Japanese woman living in Hong Kong said feng shui has come to affect just about every important decision for her family, including the selection of the day of her marriage to a local man and the name of their child.

How seriously people in Hong Kong take this tradition can be seen in the big holes deliberately made in the sides of buildings and in the popularity of wells. (more…)

k

5 brilliant insights from Kyle Bass

1.) “There’s no true science to it, it’s an Art”

2.) He has an incredibly high level of conviction with his trades

3.) He’s a master of structuring his trades

4.) “The past doesn’t necessarily tell you how the future will play out”

5.) His Fund’s strategy is a hybrid between Global Macro and Event Driven

More, and video interview, at the link

Gut feel is very important. Being a successful trader also takes courage; the courage to try, the courage to fail, the courage to succeed, and the courage to keep If trading is your life, it is a tortuous kind of excitement. But if you are keeping your life in balance, then it is fun. All the successful traders have a balanced life; they have fun outside of trading. The first rule of trading is that don’t get caught in a situation in which you can lose a great deal of money for reasons you don’t understand. Place your stops at a point that, if reached, will reasonably indicate that the trade is wrong, not at a point determined primarily by the maximum dollar amount you are will to lose per contract. A common mistake is to think of the market as a personal nemesis. The market, of course, is totally impersonal; it doesn’t care whether you make money or not. |

Your success as a trader at times hinges on your ability to conquer frustration. Frustration will always appear on the path toward greatness. Some will triumph over it, while others succumb to its pettiness. When you encounter obstacles on your trail toward achievement,  remind yourself that they were placed there in order for you to overcome them, so you can learn from them and become better than you were before”

remind yourself that they were placed there in order for you to overcome them, so you can learn from them and become better than you were before”

Regret is toxic because it encourages you to look back and to focus your energies on the past, when you should be using your valuable time and energy to focus on the here and now in order to uncover trading opportunities”