We Have an Edge

We Define Risk

We Accept losses

We Trade With Discipline

We Trade Price Action

Archives of “January 20, 2019” day

rssFACT: Stock exchanges have existed for hundreds of years

The market is like an ocean

The market is like an ocean – it moves up and down regardless of what you want. You may feel joy when you buy a stock and it explodes in a rally. You may feel drenched with fear when you go short but the market rises and your equity melts with every uptick. These feelings have nothing to do with the market – they exist only inside you.

The market is like an ocean – it moves up and down regardless of what you want. You may feel joy when you buy a stock and it explodes in a rally. You may feel drenched with fear when you go short but the market rises and your equity melts with every uptick. These feelings have nothing to do with the market – they exist only inside you.

The market does not know you exist. You can do nothing to influence it. You can only control your behavior.

The ocean does not care about your welfare, but it has no wish to hurt you either. You may feel joy on a sunny day, when a gentle wind pushes your sailboat where you want it to go. You may feel panic on a stormy day when the ocean pushes your boat toward the rocks. Your feelings about the ocean exist only in your mind. They threaten your survival when you let your feelings rather than intellect control your behavior.

A sailor cannot control the ocean, but he can control himself. He studies currents and weather patterns. He learns safe sailing techniques and gains experience. He knows when to sail and when to stay in the harbor. A successful sailor uses his intelligence.

The things that you think can stop you to become who you really are can be ABSOLUTELY nothing!Think outside the box!

Average Global Equity Returns YTD.. In US Dollars: +5.4% In Local Currency: +2.1% Brazil leading in both…See India

Four Common Emotion Pitfalls Traders’ Experience

Peak performance in trading is frequently hindered because of the emotions a trader feels, and more importantly how their trading behaviors change based on those emotions. I have found that the following four emotional experiences have the greatest, direct impact on a trader’s ability to achieve higher levels of success.

Peak performance in trading is frequently hindered because of the emotions a trader feels, and more importantly how their trading behaviors change based on those emotions. I have found that the following four emotional experiences have the greatest, direct impact on a trader’s ability to achieve higher levels of success.

1) Fear of Missing Out

2) Focusing on the Money and Not the Trade

3) Losing Objectivity in a Trade

4) Taking Risk Because you are Up (or down) Money

Fear of missing out occurs when a trader is more afraid of missing an opportunity than they are of losing money. As a result, traders tend to overtrade in a desperate effort to ensure that they do not miss out on money-making situations. This overtrading can then potentially trigger an undertrading response if the traders experience a “trading injury” such as a big loss along the way. The way to solve this is first to accept the reality that you’re always going to miss out on something, somewhere. The second step is to establish game plans on paper and hold yourself accountable to executing those plans.

Focusing on the money and not the trade limits performance because the trader quantifies their success based on their profit and loss data. As a result, when he or she is up or down a certain amount of money that they view as significant, they alter their trading behaviors regardless of what the actual, real trading opportunity is that is presented to them. The way to solve this is to quantify your success based on HOW you traded not HOW much you made on the trade. Did you have edge? Was it your pitch? Did you make a high-quality trade?

Losing objectivity in a trade occurs because traders develop emotional ties to their previous entry levels. The trader is no longer making trading decisions based on the trade, but rather based on how much they are up or down in the trade. The key to overcoming this is for the trader to continually ask him/herself, “Why am I in this trade?” and “If I was not in this trade right now, would I enter this trade long, short or do nothing?”

Taking bad risk because you are up or down money

People do not like to lose – especially money. Normal solid risk/reward thinking becomes skewed once a trader is up a large sum of money. They begin to experience something called “mental accounting” and they treat money differently based on how they made money or how quickly they earned it. On the flip side, when traders are down money, they tend to be consumed with trading for revenge and trying to make it back, oftentimes as quickly as they lost it. As a result, they may take “shots” or do the “screw it” trade because they feel helpless. To solve this destructive behavior, the trader should use their trading journal to document their emotional highs and lows and what triggered it so they can be in tune with when they are feeling over-confident or angry/frustrated. Once they recognize these emotions, they should immediately call a time out and step away from the computer or reduce the risk they are taking until they can bring themselves back to center court.

How Facebook plans to get to its first billion

Facebook CEO Mark Zuckerberg said it was almost guaranteed that Facebook would hit 1 billion users last month. But with developed countries largely tapped and the social network’s growth slowing in both raw and percentage terms this spring, the company is eyeing emerging markets as a new source of users.

When you get to around 500 million users, much of the low-hanging fruit has already been picked. So where to next? To learn about how the company is adapting to foreign markets to capture its next 500 million, we talked with Javier Olivan, the company’s head of international growth. He joined the company three years ago when it had less than 40 million users.

One major prong of the expansion effort depends on the company’s mobile team, which is securing deals left and right for 0.facebook.com, a free, low-bandwidth version of the site for feature phones. Olivan said operators were carrying the expense of free data access for users, not Facebook. The company also signed two major deals in the last week with Bharti Airtel in India and Beeline and MTS in Russia to provide free mobile access for users. They add to similar deals with at least 50 operators around the world that will help bring in millions of mobile users in developing countries.

Facebook’s recent acquisition of Malaysian contact importing company Octazen Solutions will also feed into its growth strategy as there’s a long tail of e-mail services used in foreign markets that can be difficult to tap into piece by piece, he said.

Right now, Southeast Asia is leading the way in terms of Facebook’s fastest-growing countries, with Indonesia and India up front. The company holds the top position in several Asian markets with the exception of Japan, South Korea, India, Taiwan and China, where the service is largely blocked, according to Comscore.

Here’s what Facebook is up to in various markets:

Japan: Japan is one of the rare developed-country markets where Facebook lags behind the pack. Competitor and blogging platform Mixi boasts 20 million users, while Twitter receives 16 million unique visitors per month. Facebook, in contrast, has just an estimated 1.2 million users in the country.

Olivan said the company has sent some of its best engineers to Tokyo to develop a version of the software that works for the market, which has a distinct mobile phone culture. One key problem was getting the mobile web site version of Facebook right. While U.S. users tend to reach the site through apps, most Japanese users try to reach Facebook through either the feature phone or touch-optimized web sites.

“If you look at the product eight months ago, it was unusable,” Olivan said. Part of the problem was that many Japanese phones don’t recognize cookies, making it difficult to keep a user logged in through the service.

India: Facebook, with 10.5 million users and growing, is closing in on Google’s Orkut, which has seen its traffic stagnate. The company is gearing up to open its first large office in India and closed the Bharti Airtel deal on Monday.

Olivan said the company made lots of subtle, “under the hood” fixes to attract users in the country away from competing social networks. They compiled a comprehensive database of all of the high schools in India to prepopulate a list when users sign-up for the service so they can easily find their friends. (more…)

DEEP THOUGHTS BY JIM ROGERS

-Don’t miss to watch this Video !!

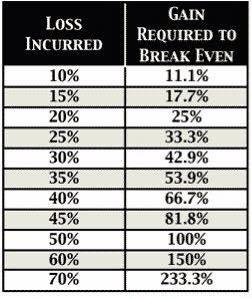

Why big losses are a bad idea. Capital destruction is an uphill climb to comeback from.

Girls can’t trade

Coates, John M., Mark Gurnell and Aldo Rustichini (2009) Second-to-fourth digit ratio predicts success among high-frequency financial traders. Proceedings of the National Academy of Science, 106/2: 623-8.

Introduction

What does traders’ success on the market floor depend on? Earlier studies have shown that one’s level of testosterone did affect one’s daily results. Since “prenatal androgens have organizing effects on the developing brain, increasing its later sensitivity to […] testosterone”, it would make sense that prenatal androgens also have a structural effect on a trader’s results on the long term.A surrogate marker is commonly used to define one’s exposure to prenatal androgens: the second-to-fourth digit length ratio, noted 2D:4D. Such market has been found to predict professional athletes’ performance. In this paper, the autors test the hypothesis that a high exposure to prenatal androgens as indicated by 2D:4D would also predict traders’ long-term profit.