The markets are nothing more than a reflection of cumulative sum of human reactions to financial data inflow. As a trader, you are part of it, and millions like you create that entity that appears to be moving so intelligently in all time frames.

The markets are nothing more than a reflection of cumulative sum of human reactions to financial data inflow. As a trader, you are part of it, and millions like you create that entity that appears to be moving so intelligently in all time frames.

So how it is possible that you and millions like you can create the greatest illusionist, the market, and ironically fight against it in every moment of your trading life.

In other words, the market becomes the ultimate enemy of yours and you fight it all the time? As an unit reflection of the market’s image, can you defeat yourself?

Your fight can only be as good as your best, but you create your enemy with your best as well.

That is why this is an endless game because no one can win it all the time as no one can keep beating himself all the time… UNLESS YOU ARE A SELFLESS PERSON. (more…)

Archives of “January 19, 2019” day

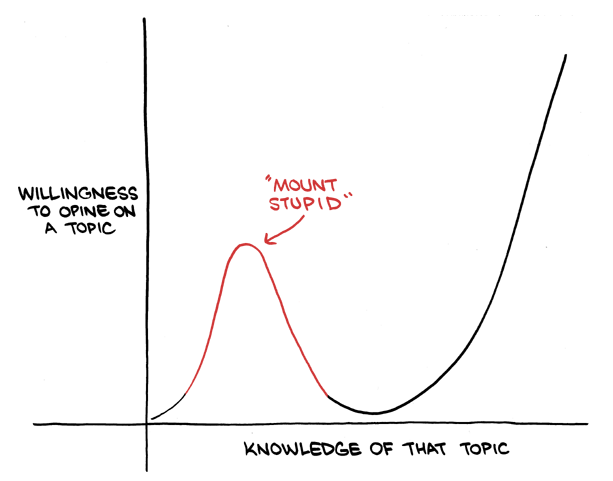

rssMount Stupid

How money is created by the central bank and the banking system

Wine and Trading

Like a fine wine the surety of a trend reversal gets better with time. The more a trend has aged, the more likely you are to get a valid reversal.

Like a fine wine the surety of a trend reversal gets better with time. The more a trend has aged, the more likely you are to get a valid reversal.

The older a trend gets the more ripe it is for falling off, and the more likely a new more robust trend will take over. A trend that is young and vigorous maybe side tracked briefly, but is not very likely to be defeated. The end of the uptrend says that the last of the big buyers are gone and the end of a down trend says that the last of the big sellers are gone and that trend has now become ripe for a take over.

Think of a trend like a young lion protecting his pride, another lion is not likely to usurp his authority. As he gets older, he is much more likely to lose his pride in defeat to a younger more energetic lion. The same is true with a trend as it gets older it becomes much more likely to be taken over. When considering whether or not to take a reversal (especially in the short term) gauge the age of the trend first. If the trend has just begin then you are not likely to have a legitimate reversal on your hand. If the trend is still very close to the trend line then it is not likely to be a valid reversal.

There are no absolutes in the market, but you do need to keep an eye out for things that put the odds the most in your favor.

Webinar :On 6th January '2018 : Gartley Pattern & Time Goal Days Method -By Anirudh Sethi

To Register /Join………………Send mail at :

My Official Twitter account : Twitter/Iamanirudhsethi

Technically Yours /ANIRUDH SETHI/BARODA

Controlling your Emotions

The fact is, the majority of traders lose because they cannot control their emotions – and their emotions cause them to make irrational trades and lose.

The fact is, the majority of traders lose because they cannot control their emotions – and their emotions cause them to make irrational trades and lose.

Trading psychology is one of the keys to investment success, but its impact is not understood by many investors, who simply think they need a good trading method, but this is only part of the equation for winning at Stock market trading.

The influence Of Hope and Fear

In trading psychology, two emotions that are constantly present are:

Hope and fear. One of the traders who recognized this was the legendary trader W D Gann. (more…)

The Ticker does not concern itself with the why and wherefore.

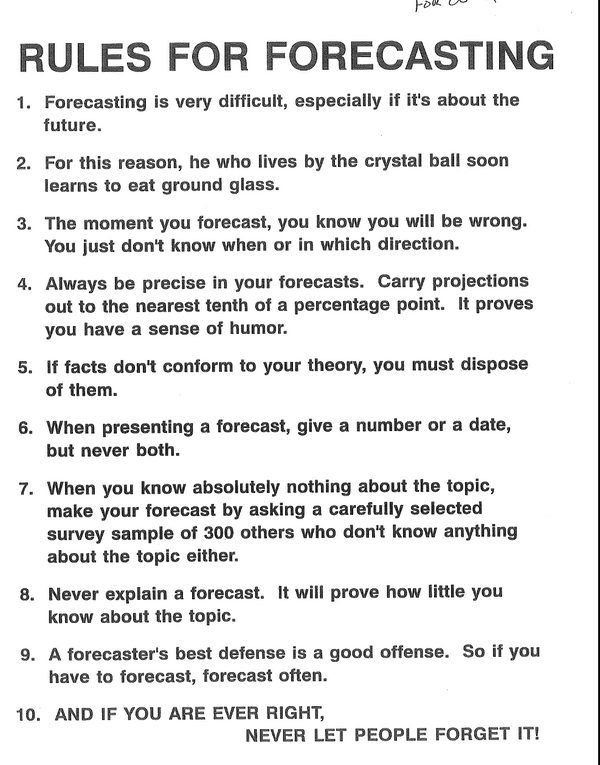

The trouble with forecasting

Great Quote By Jesse Livermore

Thought For A Day