Thought For A Day

I figured it out right away!

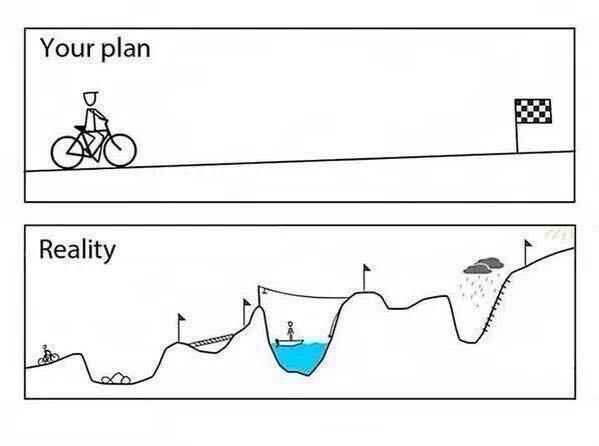

1. Have a Plan: If you are going to actively trade, you must have a comprehensive plan. All too many investors I deal with have no strategy at all — its strictly seat of the pants reaction to each and every market twitch. The old cliche “If you fail to plan, than you plan to fail” is absolutely true.

I suggest that traders write up a business plan for their strategy, as if they were asking Venture Capitalists for money for a start up; In fact, you are asking an investor for capital — just because that investor is someone you know a long time (you) doesn’t mean you should skip the planning stages.

2. Expect to be Wrong: Accept this fact: You will be wrong, and often. The plea for help is at least a tacit recognition that you are doing something wrong — and that means you are a giant leap ahead of many failing traders.

Egotists who refuse to recognize the simple truism of being wrong often give up unacceptable amounts of capital. It is only stubborn pride — and lack of risk management — that keeps people in stocks down 50% or more.

Even the best stock pickers in the world are wrong about half the time.

Michael Jordan has the best quote on the subject: “I’ve missed more than 9,000 shots in my career. I’ve lost almost 300 games. Twenty-six times, I’ve been trusted to take the game winning shot and missed. I’ve failed over and over and over again in my life. And that is why I succeed.”

Mike is the greatest player of all times not merely because of his superb physical skills: He understands the nature of failure — and its importance — and places it within a larger framework of the game

3. Predetermine Stops Before Opening Any Position: Once you have come to understand that you will be frequently wrong, it becomes much easier to use stops and sell targets.

I suggest signing a “prenuptial agreement” with every stock you participate in: When it hits a predetermined point, regardless of methodology — below support or a moving average or a specific percentage amount or the monthly low or whatever your stop loss method is — that’s it, you’re out, end of story. No hopin’ or wishin’ or prayin’ or . . . (Apologies to Dusty Springfield)

The prenup means you are making the exit decision before you are in a trade, and when you are neutral and objective. (more…)

Dear Readers, Today morning I wrote 5077 as Peak NF possibility for the day. It went upto 5072 only. Sensing its failure here, my Message to all Subscribers: Now, at 5065…. Short NF with a Risk of Rs.13. Below 5055 it will tumble upto 5004. Within minutes NF tumbled to 5006. Instant gain of 59

Dear Readers, Today morning I wrote 5077 as Peak NF possibility for the day. It went upto 5072 only. Sensing its failure here, my Message to all Subscribers: Now, at 5065…. Short NF with a Risk of Rs.13. Below 5055 it will tumble upto 5004. Within minutes NF tumbled to 5006. Instant gain of 59

In the same message: Now at 1075, Sell RIL with a stop of 1086-1092. Reliance just in Minutes slid from 1077 to 1056, nearest to its day’s low 1053

At opening bell :Catch Bharti above 289.50 for supergains tgt 297 ,303.50 (It kissed 302)

The point tobe noted here is: Shorting at the peaks. Its possible only when I am committed in my market analysis work at the bottom of my heart. My Levels mentioned in the web-site are the same but my MESSAGES at the right time will trigger action to subscribers for grand gains, unhesitant to Short too which is a rarity.

Just Follow Levels, Make your Vallets Deep, Deeper, Deepest

Join us live during trading hrs and get Intraday live calls of Nifty Future/Stocks.

The mechanics of trend following:

The mechanics of trend following:

– know what to trade

– know when to enter the trade

– know what to do once in the trade

– know when to exit the trade