Archives of “January 13, 2019” day

rssComparative Brain Sizes. In your face, chimpanzee.

The Art of trading vs the science of technical analysis, no certainties…

Great Lines for Traders

- You are not in the game, you are in the bleachers. All you can do is enter and exit.

- If the market goes with you, all you can do is try to go with it and jump off quick if turns against you.

- If you think in terms of winning and losing, you have already lost.

- Your goal should be to make good trades not money. Good trades will make money often enough.

- Strive to have a 4 to 1 reward risk ratio.

- Trade criteria, trade neutral; your opinion + your ego + your money = Disaster on a stick.

- When you make money on a trade, you have not beaten the market, you have blended with it.

Four Possible Basic Outcomes To Any Trade

1) Wins initially, and keeps winning. 2) Wins initially, but then reverses to become a loss. 3) Loses initially, and keeps losing. 4) Loses initially, but then reverses to become a win. If you average down, you only get the chance to add to trade types 2, 3 and 4. If you average up, you only get the chance to add to trade types 1, 2 and 4. Averaging down tends to be attractive to people, since it allows the possibility of trade type 4 i.e. a trade that goes against you, but then reverses to recover your losses and more. However, that comes at the material risk of trade type 3 i.e. the trade that never recovers. Averaging down virtually guarantees that your biggest positions will be in trade type 3 i.e. the trades that never win. Pyramiding up avoids this risk, and also allows you to add to trade type 1 i.e. the trades that start off winning and keep winning. To be clear, there is a legitimate strategy of picking a range of entry into a trade. Rather than picking a particular price point, you may choose to scale into a position over a range of entries. The distinction here is that you must decide this plan before the first entry is made, rather than in response to a trade going against you. |

ICSA :Open Challenge ;Target 194-204

Your Stoploss Rs.178-177

![]()

Today ,I want this stock to trade above 184.50 with volumes for 5/10 minutes.It’s a challenge.Whole India will run.Forget world Market.

-In first hr itself or Today Intraday will kiss 190-194 level.

-Minor Hurdle at 188 (No value )

-Pls Don’t ask reasons.Just watch Inverse Head & Shoulder formation on chart.

-Fiery Intraday move on card.Yes u can Buy 10-100-1000 lots.

-Before Feb End will see stock kissing Rs.250+ level.

No if & But ,Mind blowing chart.

-Expanding Wedge +Inverse Head & Shoulder will favour Bull’s.

Now spare 5 minutes and see my Research work :

Govt. of Singapore increases stake in ICSA (India) to 7%.

The Government of Singapore Investment Corporation Private Limited (GIC) is a

sovereign wealth fund established by the Government of Singapore.

TTM EPS RS 32 at Rs 183 ICSA trades at P/E 5.7 only

Applying a reasonable P/E discounting of 8, the scrip can appreciate to Rs.250 in the short-to-medium-term

Fii sources > Expected EPS fy 10 =Rs 36

SALES =1100CR MCAP =860CR

Don’t miss to Read ……..Pls Pls Pls !!

The company has Rs 2,200 crore strong order book to be executed within next two years. Of this, the infrastructure services account for Rs 1,400 crore.

ORDER BOOK more than the Market Cap :THIS HAPPENS ONLY IN INDIA

Increased allocation of Government projects under Rajiv Gandhi Grameen Viduytikaran Yojana (RGGVY) to 7000 crores up by 27% will have see significant

orders coming in for ICSA.

Apart from Chart /Fundamentals :

On street are company to come out with Bonus in ratio of 1:1.I don’t care for Rumours…..Read chart and mint money ..Nothing else.

-But ,chart pattern indicates price of 250…so something is cooking and somebody knows……..let’s see what happens !!

Updated at 9:05/21st Jan/Baroda

Greenblatt on market efficiency

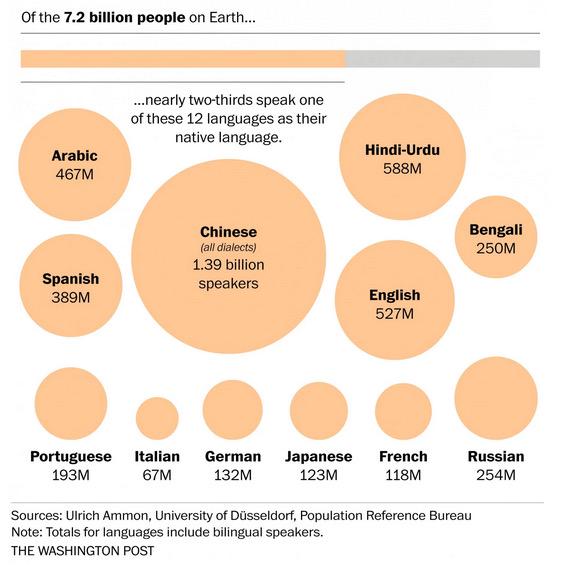

The World's Native Languages

How Chinese media is presenting their AIIB success (People’s Daily)

How Stock is Traded During Result Season in India ?Just See This Image

Yes ,4 Times in Year………………..Mint Money OFFICIALLY (No need to do scam )

The Cow Owner will Milk the Cow First (Same Like ……….Company Management will Buy or Sell or Will Manipulate Before or After Results )

Then CC people close of Management will do same thing ,Then Message to Insiders

Then Pass on Information of Local Mutual Fund Manager/Fiis

Make Position in FO Segment ,Nobody will able to catch……..Insider Trading going on.

Before Flashing on TV……………Media will play Dirty game (Will Do Bla Bla )About TOP LINE ,BOTTOM LINE ,MARGIN ,PROFIT ,EBITDA ….!!

Now After this……………Viewers & Traders will Jump to buy or sell stock……….and Will lose Money.

Everything is Leaked From Corporate House to SE …………But U have to Fight and Win

Have U seen any Insider Case in India ?Never it will happen.

Technically Yours/ASR TEAM/BARODA/INDIA