Archives of “January 13, 2019” day

rssTrading From Your Gut : Curtis Faith

Not Today or Tomorow…Whenever u get time ,Just Read this Mind Blowing Book.Iam having in my Library and already read twice and again….soon will read !!

The obstacles of the day trader are:

The obstacles of the day trader are:

The obstacles of the day trader are:

Fear – Fear causes the day trader to hesitate and freeze when positions should be entered and exited. Fear can also cause day traders to take losses,

Doubt – Doubt causes great opportunity to be missed and causes a mind to be scattered and without firm direction.

Greed – Greed will cause day traders to hold onto positions too long often causing profit to turn into loss.

Hope – Hope will cloud the eyes of probability. Hope is not for day traders.

THE BEST OF JESSE LIVERMORE

On emotions:

The unsuccessful investor is best friends with hope, and hope skips along life’s path hand in hand with greed when it comes to the stock market. Once a stock trade is entered, hope springs to life. It is human nature to be positive, to hope for the best. Hope is an important survival technique. But hope, like its stock market cousin’s ignorance, greed, and fear, distorts reason. See the stock market only deals in facts, in reality, in reason, and the stock market is never wrong. Traders are wrong. Like the spinning of a roulette wheel, the little black ball tells the final outcome, not greed, fear or hope. The result is objective and final, with no appeal.

I believe that uncontrolled basic emotions are the true and deadly enemy of the speculator; that hope, fear, and greed are always present, sitting on the edge of the psyche, waiting on the sidelines, waiting to jump into the action, plow into the game.

Fear keeps you from making as much money as you ought to.

On herd behavior:

I believe that the public wants to be led, to be instructed, to be told what to do. They want reassurance. They will always move en masse, a mob, a herd, a group, because people want the safety of human company. They are afraid to stand alone because they want to be safely included within the herd, not to be the lone calf standing on the desolate, dangerous, wolf-patrolled prairie of

contrary opinion.

On cash:

First, do not be invested in the market all the time. There are many times when I have been completely in cash, especially when I was unsure of the direction of the market and waiting for a confirmation of the next move….Second, it is the change in the major trend that hurts most speculators. (more…)

Thought For A Day

Traders ,Always Remember This Quote

Quotes from chapter 1 – Challenge of Speculations from the book "How to Trade in Stocks by JESSE LIVERMORE

Focus on each area to reach your strategic goals as a trader

Lessons from Martin Schwartz

To succeed in trading one must learn from the best, so it is wise to consider the advice of Martin Schwartz.

I highly recommend you read his book Pit Bull – Lessons from Wall Street’s Champion Trader.

“I took $40,000 and ran it up to about $20 million with never more than a 3 percent drawdown.” (Month-end data)

“By living the philosophy that my winners are always in front of me, it is not so painful to take a loss. If I make a mistake, so what!”

“My trading style was to take a lot of small profits rather than go for one big one.“

“After a devastating loss, I always play very small and try to get black ink, black ink. It’s not how much money I make, but just getting my rhythm and confidence back.”

“The market does not know if you are long or short and could not care less. You are the only one emotionally involved with your position. The market is just reacting to supply and demand and if you are cheering it one way, there is always somebody else cheering it just as hard that it will go the other way.” (more…)

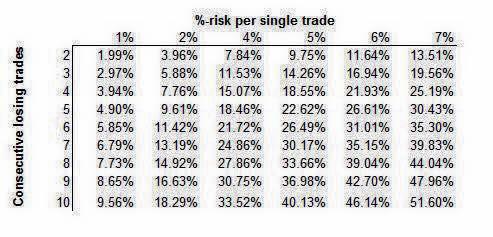

Equity drawdowns based on the percentage of capital risked per trade & consecutive losses.