Archives of “January 12, 2019” day

rssBuffett answering a college student's question…

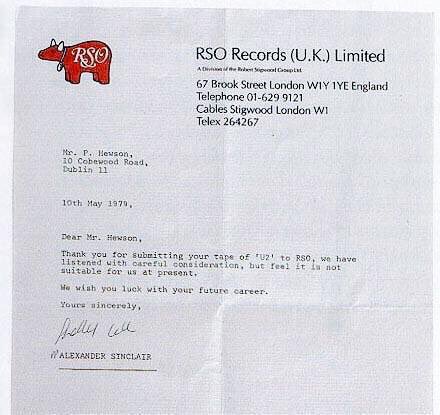

A rejection letter that U2 received in 1979.

Trading Wisdom For Traders

Twenty Six Market Wisdoms from Warren Buffett

1. It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.

2. Chains of habit are too light to be felt until they are too heavy to be broken.

3. Risk comes from not knowing what you’re doing.

4. Only when the tide goes out do you discover who’s been swimming naked.

5. If past history was all there was to the game, the richest people would be librarians.

6. I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.

7. It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price

8. We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful

9. Time is the friend of the wonderful business, the enemy of the mediocre. (more…)

3 Quotes For Traders

Don't look for others to give you permission to be yourself.

TRADE WHAT IS NOT WHAT YOU THINK SHOULD BE

Trade what is… for in doing so your trading is based on fact, substance and reality. It provides clarity, confidence, manageability, and useful feedback for consistent success where appreciation for winning, and respect for losing, keeps you in the game.

Do not trade what you think should be….for in doing so your trading is based on egotism, a false sense of foresight, the desire for validation and approval, and the “win at all cost” mentality, which leads to confusion, anxiety, anger, and despair…not to mention the inability to trade another day.

W. D. Gann’s Never-Failing / Valuable Rules

- Amount of capital to use: Divide your capital into 10 equal parts and never risk more than one-tenth of your capital on any one trade.

- Use stop loss orders. Always protect a trade when you make it with a stop loss order 1 to 3 cents, never more than 5 cents away, cotton 20 to 40, never more than 60 points away. (3 to 5 points away for stocks)

- Never overtrade. This would be violating your capital rules.

- Never let a profit run into a loss. After you once have a profit of 3 cents or more, raise your stop loss order so that you will have no loss of capital. For cotton when the profits are 60 points or more place stop where there will be no loss.

- Do not buck the trend. Never buy or sell if you are not sure of the trend according to your charts and rules.

- When in doubt, get out, and don’t get in when in doubt.

- Trade only in active markets. Keep out of slow, dead ones.

- Equal distribution of risk. Trade in 2 or 3 different commodities, if possible. (Trade in 4 or 5 stocks, is possible.) Avoid tying up all your capital in any one commodity or stock.

- Never limit your orders or fix a buying or selling price. Trade at the market.

- Don’t close your trades without a good reason. Follow up with a stop loss order to protect your profits.

- Accumulate a surplus. After you have made a series of successful trades, put some money into a surplus account to be used only in emergency or in times of panic.

- Never buy or sell just to get a scalping profit. Never buy just to get a dividend.

- Never average a loss. This is one of the worst mistakes a trader can make.

- Never get out of the market just because you have lost patience or get into the market because you are anxious from waiting.

- Avoid taking small profits and big losses.

- Never cancel a stop loss order after you have placed it at the time you make a trade.

- Avoid getting in and out of the market too often.

- Be just as willing to sell short as you are to buy. Let your object be to keep with the trend and make money.

- Never buy just because the price of a commodity or stock is low or sell short just because the price is high

- Be careful about pyramiding at the wrong time. Wait until the commodity or stock is very active and has crossed Resistance Levels before buying more and until it has broken out of the zone of distribution before

selling more. - Select the commodities that show strong uptrend to pyramid on the buying side and the ones that show definite downtrend to sell short. For stocks, select the stocks with small volume of shares outstanding to pyramid on the buying side and the ones with the largest volume of stock outstanding to sell short.

- Never hedge. If you are long of one commodity or stock and it starts to go down, do not sell another commodity or stock short to hedge it. Get out at the market; take your loss and wait for another opportunity.

- Never change your position in the market without good reason. When you make a trade, let it be for some good reason or according to some definite rule; then do not get out without a definite indication of a

change in trend. - Avoid increasing your trading after a long period of success or a period of profitable trades.

- Don’t guess when the market is top. Let the market prove it is top. Don’t guess when the market is bottom. Let the market prove it is bottom. By following definite rules, you can do this.

- Do not follow another man’s advice unless you know that he knows more than you do.

- Reduce trading after first loss; never increase.

- Avoid getting in wrong and out wrong; getting in right and out wrong; this is making double mistakes.

Try This