The more i trade, the more i realize that trading with big size is just stupid. Sure, you will have your occasional huge win. Sure, there are a rare times when trading with size is good to capitalize on ‘easy’ trading setups but i believe that 95% of the time trading with size will surely lead to over trading, micro managing, flinching at the smallest wiggles, lead to emotional decision making, stressful trading and burnout.Trade small positions and you will see how you will think more clearly, you will stay objective, you will stay calm under pressure, you will trade less and ride out bigger

The more i trade, the more i realize that trading with big size is just stupid. Sure, you will have your occasional huge win. Sure, there are a rare times when trading with size is good to capitalize on ‘easy’ trading setups but i believe that 95% of the time trading with size will surely lead to over trading, micro managing, flinching at the smallest wiggles, lead to emotional decision making, stressful trading and burnout.Trade small positions and you will see how you will think more clearly, you will stay objective, you will stay calm under pressure, you will trade less and ride out bigger

trends for more ‘profits’. Small positions will not bank you the thrilling homerun but they will accumulate into your account at the end of the month/year. Large positions will give you a homerun from time to time and they will eat your lunch from time to time too and at the of the day, you are left wondering ‘what happened’??So, trade small positions and stay unemotional!

Archives of “January 10, 2019” day

rssGermany Ban Short Selling

Germany’s financial-markets regular said it is banning naked short-selling of certain euro-zone debt and credit default swaps as well as some financial stocks effective at midnight local time, saying “excessive price movements” could endanger the stability of the financial system.

The ban will remain in effect through March 31, 2011. (more…)

Sovereign Debt Estimates

Sovereign debt is a key driver of the current economic jitters. The chart below shows next year’s sovereign debt estimates for the G-7 and other key global economies – the U.S. debt in 2011 would be about equal to GDP ($15 trillion), while the debt loads carried by Japan, Italy and Greece would exceed GDP.

New James Bond film -Spectre: Aston Martin vs Jaguar in – VIDEO

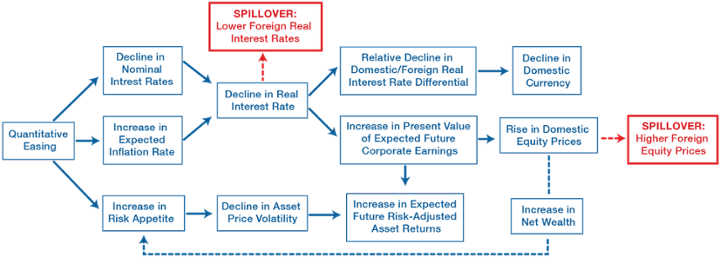

Transmission of QE Policies to Interest Rates, Exchange Rates and Equities

Links For Traders -Investors

Interesting reads:

- Hedge Funds Ready to Ride Out Stock Turmoil

- Goodbye to the genius who changed the way we think (and you didn’t even know it)

- Paul Tudor Jones, Analogs, and Jeff Bezos

- Swedroe: Debunking Gold Mythology

- Stop Universities From Hoarding Money

- Here’s how to make sure your kid grows up to be a loser

- The Short-Termism Myth

- Decoding the Dow Death Cross: Market Myth or Omen?

- Passive Hedge Funds

- The Case Against Hedge Fund Managers

- Decoding the Dow Death Cross: Market Myth or Omen?

- Passive Hedge Funds

- Less Correlation Good News for Investors

- Michael Mauboussin: “The Success Equation: Untangling Skill and Luck”

- SMN Investment Services: Isn’t The Discretionary Trader The Real “Black Box”?

- Swedroe: Virtues Of A Long/Short Strategy

- Down Commodities Benefits CTA Funds

- Walks are way down in baseball, because of ‘capitalism’

- Mind the Gap 2015

- ‘God-trader’ Andy Hall’s fund loses $500M

- Charley Ellis: Why active managers extract value from the investment process

- Is Momentum Misunderstood?

My take on how to read financial news headlines

Headline: Stocks Rose/Fell Today by 1% Because of _______

How to read it: Millions of shares traded hands today because investors all have different goals, strategies, risk profiles, holding periods and ideas.

Headline: [Popular economist/fund manager] Expects Market Volatility to Pick Up Later This Year

How to read it: Saying you expect volatility to pick up at some point in the future is like saying you expect it to rain at some point in the future. And volatility works both ways — to the upside and the downside — so really this is just a way of saying the markets will fluctuate, which of course they will.

Headline: George Soros Gained/Lost $1 Billion

How to read it: Soros has around $25 billion so what he does with his money shouldn’t concern most investors.

Headline: Markets Got Slaughtered Today: A Sign of Worse Things to Come?

How to read it: No one ever really knows why stocks rise or fall on a single day. The market is up just over 50% of all trading days and down just under 50% of all trading days so you can never put too much stock in any one day.

Headline: Investors Are Dealing With More Uncertainty

How to read it: The future is always uncertain. The past just feels more certain because now we know what really happened.

Headline: Are Market Overbought Here?

How to read it: Ask us again in a few months.

Headline: [Democrats/Republicans/current or past president] Caused X% of Economic or Stock Market Growth

How to read it: Presidents or political parties don’t personally control economies or stock markets made up of millions of participants and trillions of dollars all wrapped up within a complex adaptive system. These things don’t come with levers that you can pull to make them rise or fall.

Headline: The Stock Market Enters a Painful Correction

How to read it: Retirement savers rejoice as stocks fall on the week. Those with decades to save & invest should hope it continues.

Headline: _____ Could Cause Gold Could Rise to $1500/oz.

How to read it: Total guess. No one has a clue.

Headline: Is This the Stock-Picker’s Market We’ve Been Waiting For?

How to read it: It’s both always and never a stock-picker’s markets because it all depends on the quality of the stock-picker, not the market.

Headline: Goldman Sachs Expects Stocks to Rally For the Next 3 Months

How to read it: Big financial firms have so many strategists that there will surely be a research piece put out in the coming days that totally contradicts whatever they just predicted.

Headline: When Will the Fed Raise Rates?

How to read it: Has Fed policy really ever helped you make better investment decisions? Even if you knew exactly what they were going to do in the future you still have no idea how other investors will react.

Headline: Investors Panic as Stocks Enter a Bear Market

How to read it: Don’t panic — expected returns and dividend yields go up during bear markets. This is a good thing for long-term investors.

Headline: A Perfect Storm Caused Markets to Fall

How to read it: Stuff happens in the markets and we like to attach important-sounding narratives to everything. 100-year storms now seem to come around once a month or so. (more…)

When you see girls like this on Instagram

Trading Wisdom

THE 5 FUNDAMENTAL TRUTHS OF TRADING:

1. Anything can happen.

2. You don’t need to know what is going to happen next to make money.

3. There is a random distribution between wins and losses for any given set of

variables that define an edge.

4. An edge is nothing more than an indication of a higher probability of one thing

happening over another.

5. Every moment in the market is unique.

THE 7 PRINCIPLES OF CONSISTENCY:

1. I objectively identify my edges.

2. I predefine the risk of every trade.

3. I completely accept the risk or I am willing to let go of the trade.

4. I act on my edges without reservation or hesitation.

5. I pay myself as the market makes money available to me.

6. I continually monitor my susceptibility for making errors.

7. I understand the absolute necessity of these principles of consistent success

and, therefore, I never violate them.