Archives of “January 9, 2019” day

rssWebinar on Fibonacci Numbers and Reversal Keys by Anirudh Sethi on 16th Dec

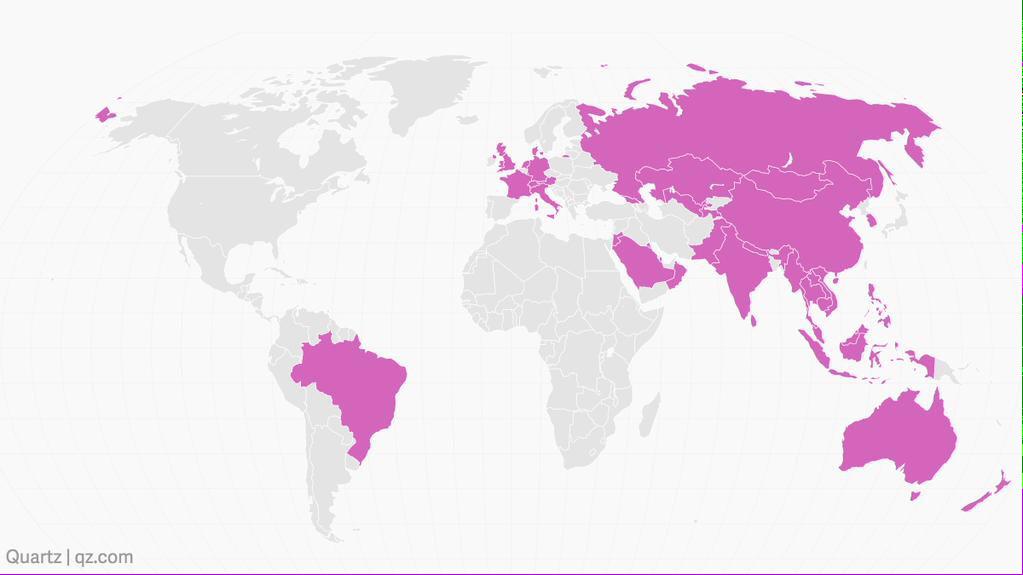

Not Joining the China-Led Asian Infrastructure Investment Bank: NAFTA & Africa

7 Mantras For Successful Trading

1. Losing traders fear losses and crave profits. Winning traders eliminate both fear and greed.

Great traders experienced a lot of losses and drawdowns in their lifes, so they don’t fear them. Losses are already familiar to them.

They know, that the biggest enemy of a trader are emotions. So the best attitude is not to be influenced by fear of loss or desire for profits. The more you fear something, the more you’ll experience it. The more you desire something, the less benefits you’ll have from it.

If you’re scared of driving at high speeds, Formula 1 career will never be a good option for you. If you’re scared of losses, trading will also never be a activity suited for you.

2. Losing traders care where the market will move in an hour, today or tomorrow. Winning traders don’t care where the market will go.

Why manual traders are so attached to their positions or market direction? The deep psychological reason behind it, is that they’ve made the trades with their own hands and heads. So they start worrying about the outcome. The automated systematic traders on the other hand, let computer programs do the job, so they cannot blame themselves or the market for the outcome of particular trades.

Why it is important in trading? The less you worry about the positions and about market direction, the less emotions can negatively impact your trading.

3. Losing traders look for 100% return a month. Winning traders look for 100% return a year (without compounding).

To achieve 100% return in a month, you have to trade with very high leverage. The most probable result trading with too high leverage is -100%. Winning traders use medium to low leverage. They may lose 30% from time to time, but with proper strategies, they are able to double the account every year. And if they combine medium leverage with the power of compounding , returns can be much higher. (more…)

The Trading Beast

The markets are no place to be unsure of yourself and wishy-washy, it is not a place for 2nd guesses, wishing, hoping, or gambling. If you want to win in this jungle you need to be an unstoppable beast .

- Complete confidence in your system and method. You do not jump around in your trading or doubt yourself, it is not about you, it is the system. Either it wins long term or it doesn’t. Either you have confidence in it or you don’t, make up your mind.

- You control risk. You do not expose yourself to being ruined because your bet size is consistently what you are comfortable with. Ten losses in a row is only a small draw down. If you are not afraid of ten losses in a row, what is stressful? NOTHING.

- You play follow the leader. You are not the lone wolf, you are going with the market not trying to predict it. Your entries and exits are based on historical patterns not your personal opinions, you are not trying to beat the market you are trying to be on its side, it always wins.

- You will not quit.Your exit strategy for your trading career? Never. You plan to never quit playing the greatest game on earth. You are a trader, that is what you do. Not quitting in most areas of life means that you eventually win big, the market is no different.

- You don’t need a guru. Your winning system is your guru. You don’t need to ask for a fish, you know how to fish. You only listen if you can learn how to catch more and bigger fish and somebody is a better fisherman than you.

The markets eat up lambs, chickens, pigs, and sloths. However beasts eat well off their prey.

The definitive paragraph on financial journalism

Five Principles of Growth and Development for Traders

1) The Bodybuilding Principle – You only grow and develop when you work against significant resistance, lifting more than you can comfortably handle. Hard workouts, then rest: a formula followed by all fine athletes.

1) The Bodybuilding Principle – You only grow and develop when you work against significant resistance, lifting more than you can comfortably handle. Hard workouts, then rest: a formula followed by all fine athletes.

2) The Process Principle – Work on doing things well and the outcomes take care of themselves. Focus on outcomes and you interfere with doing things well. Process goals spur improvement; outcome goals create pressure.

3) The Feedback Principle – Turning feedback about how you’re doing into concrete goals for further work channels your development. Work without goals is like exploring without a map: you spend much time wandering aimlessly.

4) The Strengths Principle – You reach your greatest potential by making the most of your distinctive strengths, not by incrementally improving your weaknesses. What you’re good at will fuel your greatest passion and stimulate your highest efforts. (more…)

Tips For Mental Toughness of trading psychology

| 1. Be aware of what is going on in your mind, body and feelings. Slipping into an internal focus seems automatic because we aren’t fully aware of it as it is happening. Being aware of what the mind is saying and how we are feeling is the first important step in mental toughness. You can catch yourself before things spiral out of control. 2. Know what trading actions are important to take. These are high-value actions (HVAs) under the trader’s control. HVAs are relevant to trading and include identifying sound trade setups and solid entry triggers. You must know these cold and be ready to execute them. 3. Commit to high value actions regardless of how you feel. This means being willing to accept unwanted thoughts and feelings because trading well is more important than feeling good. Maintaining an external focus and initiating positive trading actions may not be easy when feeling down, but it’s certainly not impossible. Like all skills, it takes practice. |

"People will swear they "get" this, yet 90% still won't truly absorb it." -95% Traders Think It's Easy…But Only 5% Mint Money

Mark Douglass on the four trading fears and other insights.