The stock market is like sex. It feels the best just before it ends. Trading is like sex. You don’t have to be good at it to enjoy it. |

Archives of “January 7, 2019” day

rssStock Market & Sex

Intraday Update :Nifty -Bank Nifty

As expected ,Both Future are moving up up and up

Now ,Once NF crosses 5137 level with volumes then more fire work u will see.

Two close above 5137 level.Next Target 5218—-5245 level.

For Bank Nifty ,Already it had crossed first Hurdle of 9327.Now While updating trading at 9350……(Our Susbcribers had bought in Truck load at 9330)

My Last Hurdle exist at 9391

Decisive crossover above 9391 & close will take to 9583–9647 level.

101% from 14 hrs till end session…………..One side move in Mkt.Its our Challenge.

Updated at 13:27/4th June/Baroda

"A lot of money has been lost in trying to be the first to identify the trend"

AFFIRMING BETTER TRADING

“Any thought put into your mind and nourished regularly, will produce results in your life.” John Kehoe

An affirmation is a statement made in the present about the future as if it had already occurred in the past. Let me say it more simply. An affirmation is a simple statement about what you want to become true in your life. You state it in the present tense as if it were already true. You repeat your hopes and dreams. You declare the opposite of your fears. For example, the fear that you could lose all your money becomes: “I grow my capital through consistently applying my winning methods.”

Be careful to word the affirmation in the present tense. Statements made in the future stay in the future. “Next month I’ll turn my trading around.” stays out there in the future. Now is when you need to turn the trading around.

Affirmations can be repeated to yourself silently or aloud. You can incant them with feeling or whisper them to yourself. You can record them and play them, or write them and read them. A good time to assert them is just as you’re falling asleep or waking up, or any other time of the day. You can say them while you drive or wait in a bank line or as you watch the market or manage a trade. (more…)

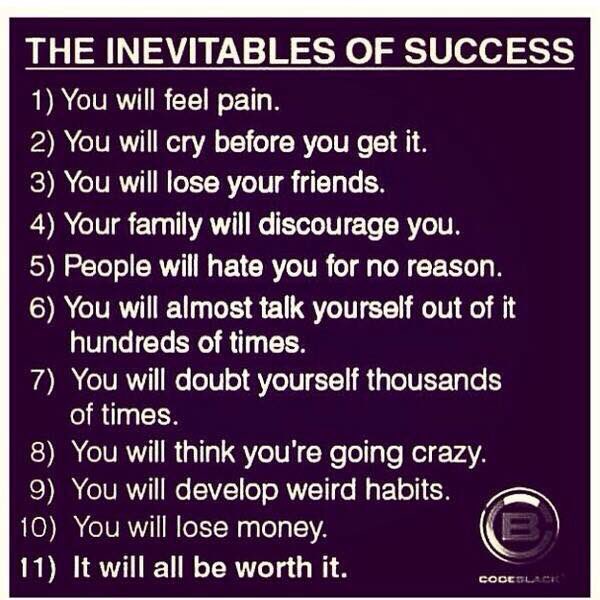

Entrepreneurs, Humanitarians & Traders will understand this

Your win rate expectancy sets the probability for your longest losing streak:

Write down your plan. You need to know exactly under what conditions you will enter / exit a trade.

Important Trading Lessons

These are some of those fundamental and undeniable truths, as I have come to understand them over the course of my trading career:

- Most of the time, markets are very close to efficient (in the academic sense of the word.) This means that most of the time, price movement is random and we have no reason, from a technical perspective, to be involved in those markets.

- There are, however, repeatable patterns in prices. This is the good news; it means we can make money using technical tools to trade.

- The biases and statistical edges provided by these patterns are very, very small. This is the bad news; it means that it is exceedingly difficult to make money trading. We must be able to identify those points where markets are something a little “less than random” and where there might be a statistical edge present, and then put on trades in very competitive markets.

- Technical trading is nothing more than a statistical game. The parallels to gambling and other games of chance are very, very close. A technical trader simply identifies the patterns where an edge might be present, takes the correct position at the correct time, and manages the risk in the trade. This is, of course, a very simplified summary of the trading process, but it is useful to see things from this perspective. This is the essence of trading: find the pattern, put on the trade, manage the risk, and take profits. (more…)

SYMPTOMS OF LACKOFFOCUSPHILITUS

Do you suffer from lackoffocusphilitus?

You know it is so easy to talk about a trader losing his or her focus and to discuss the importance of focus but what good does it do if the trader is not aware of her lack of focus? To lack focus is one thing but to not be aware of it is quite another. In creating proper self awareness it is important to recognize symptoms. Once the symptoms are determined then the cause can be discovered. Much like a physician who asks what is wrong, “what ails you” so he can then determine the disease and with it design a proper course of action. What follows are some of the symptoms of the lack of focus. If several of these are present then you are most likely suffering from lackoffocusphilitus.

1. Unusually high string of losses uncommon with your trading history and probability statistics.

2. Loss of interest in Market study.

3. Ignoring your open position account balance (otherwise known as denial).

4. Anticipating and looking forward to the Market close instead of the open.

5. Spending more time reading chat room comments than reading the charts.

6. General fatigue.

7. Tendency to beat yourself up with negative self talk.

8. Lack of confidence in entering your own high probability edge.

9. Not recognizing your edge when it is offered.

10. Blaming the Market for mistakes and losses.

11. Studying the charts and suggestions of others in place of, instead of in conjunction with, your own studies.