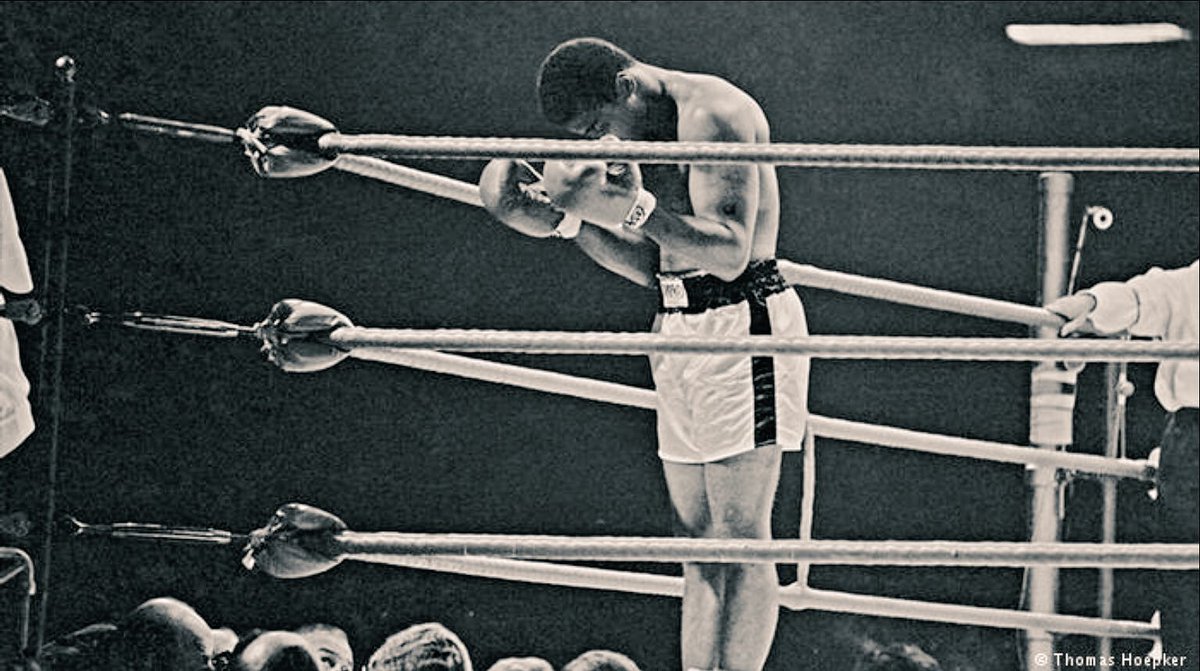

A Trader's Journey to profitability- Graphic

If I’ve learned anything in my decades of trading, I’ve learned that the simple methods work best. Those who need to rely upon complex stochastics, linear weighted moving averages, smoothing techniques, Fibonacci numbers etc., usually find that they have so many things rolling around in their heads that they cannot make a rational decision. One technique says buy; another says sell. Another says sit tight while another says add to the trade. It sounds like a cliche, but simple methods work best.

The Trading Plan comes first and should account for the following parameters: 1. Entering a trade. 2. Exiting a trade. 3. Stop Placement. 4. Position Sizing. 5. Money Management. 6. What to Trade. 7. Trading Time Frames. 8. Back Testing. 9. Performance Review. 10. Risk vs. Reward. The Game Plan consists of putting the parameters of the Trading Plan to work in day to day trading with the following benefits: 1. It will force the trader to select a trading style. 2. It will encourage market study. 3. It will aide in helping pick the correct trades. 4. It will prepare the trader for what the market has to offer. 5. It will help in properly monitoring and exiting trades. 6. It will keep the trader from overtrading. 7. It will help with finances. 8. It will keep the trader focused. 9. It will take the gambling out of trading. 10. It will make a better trader out of you. |

“Technical analysis, I think, has a great deal that is right and a great deal that is mumbo jumbo…

“There is a great deal of hype attached to technical analysis by some technicians who claim that it predicts the future. Technical analysis tracks the past; it does not predict the future. You have to use your own intelligence to draw conclusions about what the past activity of some traders may say about the future activity of other traders.

“For me, technical analysis is like a thermometer. Fundamentalists who say they are not going to pay any attention to the charts are like a doctor who says he’s not going to take a patient’s temperature. But, of course, that would be sheer folly. If you are a responsible participant in the market, you always want to know where the market is — whether it is hot and excitable, or cold and stagnant. You want to know everything you can about the market to give you an edge. (more…)

| Know what your tolerance for risk is.Traders who are able to make smart decisions can beat the market. However, the greatest hurdle to doing so is overcoming the emotional traps that cause traders to make bad decisions.The reason we succumb to our emotions is because we are afraid of losing. It is the risk we take that creates emotion; take too much risk and you are likely to make bad decisions.Therefore, you need to know what your limits are. What dollar amount of risk causes you anxiety? If you can not make a trade with out fear then you are taking too much risk. For some, that means never trading since they simply can not handle the risk of financial loss. However, over time and with success you will begin to build up your tolerance for risk, just take it one step at a time. |