Thought For A Day

Strategy (more…)

Be willing to stop trading and re-evaluate the markets and your methodology when you encounter a string of losses. The markets will always be there. Gann said it best in his book, How to Make Profits in Commodities, published over 50 years ago: “When you make one to three trades that show losses, whether they be large or small, something is wrong with you and not the market. Your trend may have changed. My rule is to get out and wait. Study the reason for your losses. Remember, you will never lose any money by being out of the market.”

Be willing to stop trading and re-evaluate the markets and your methodology when you encounter a string of losses. The markets will always be there. Gann said it best in his book, How to Make Profits in Commodities, published over 50 years ago: “When you make one to three trades that show losses, whether they be large or small, something is wrong with you and not the market. Your trend may have changed. My rule is to get out and wait. Study the reason for your losses. Remember, you will never lose any money by being out of the market.”

Every once in awhile I read something from another trader who I respect that I really wish I wrote myself. Today’s post from Jeff Cooper is a must-read:

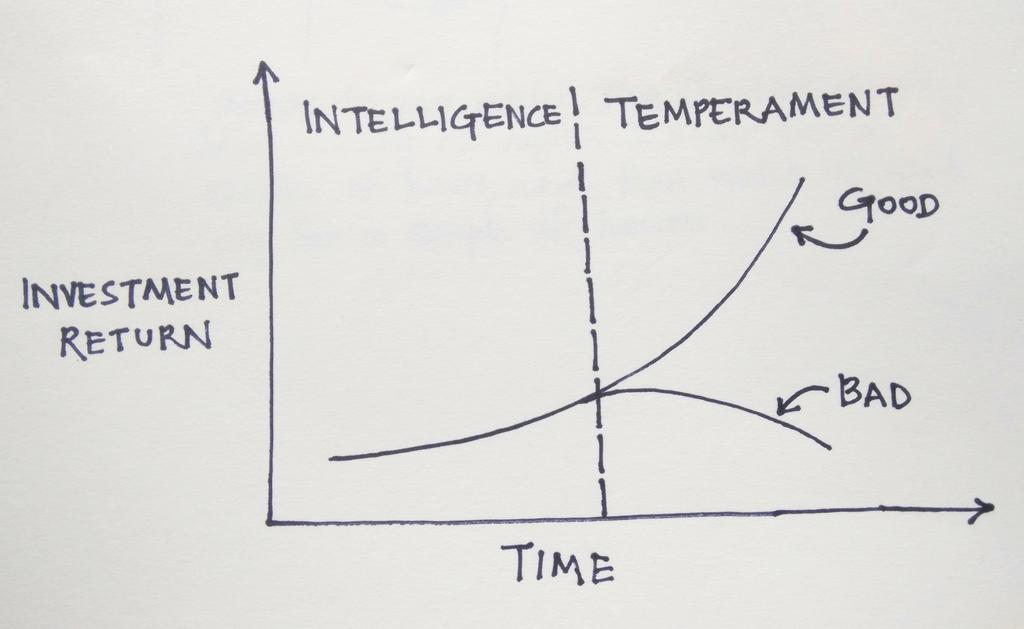

“One of the most difficult things to get investors and traders to understand is that no matter how much they investigate an investment, they will probably do better if they did less. This is certainly counter-intuitive, but the way that our brains function almost guarantees that this will happen. This kind of failure also happens to those investors frequently regarded as the smartest. In essence, the more information that investors have, the more opportunity that they have to choose the misinformation that suits their emotional purposes.

Speculation is observation, pure and experiential. Thinking isn’t necessary and often just gets in the way. Yet everywhere we turn, we read and hear opinion after opinion and explanation on top of explanation which claim to connect the dots between economic cause and market effect. Most of the marketplace is long on rationale and explanation and short on methods. (more…)

1. Reward is always relative to risk: If any product or investment sounds as if it has lots of upside, it also has lots of risk. If you can disprove this, there is a Nobel Prize waiting for you.

2. Asymmetrical information: In all negotiated sales, one party has far more information, knowledge and experience about the product being bought and sold. One party knows its undisclosed warts and risks better than the other. Which party are you?

3.Good advice is priceless: I know, easier said than done. The Street buys the best legal talent, mathematicians and strategists that money can buy. Make sure you have expert advisers and lawyers working for you as well.

4. Motivation:Always ask, what is the motivation of the outfit selling me this product? Is it the long-term stability and financial health of my organization — or their own fees and commissions?

5. Legal documents are created to protect the preparer (and its firm), not you or yours: In the history of modern finance, no large legal document has worked against its drafters. Private placement memorandums, sales agreement, arbitration clauses — firms use these to protect themselves, not you.

6. Performance: How significantly do the fees, interest rates commissions, etc., have an impact on the performance of this investment vehicle over time? Determining for yourself what the actual cost of money is will avoid more heartache in the future.

7. Shareholder obligation: All publicly traded firms (including investment banks and bond underwriters) have a fiduciary obligation to their shareholders to maximize profits. This is far greater than any duty owed of care to you, the client. Always ask yourself whether this new product benefits the shareholders or your organization. (This is acutely important for untested products.)

8. Reputational risk: Who suffers if this investment goes down the drain? Who gets fired or voted out of office if this blows up? Who suffers reputational risk?

9. Keep it simple, stupid (KISS): It’s easy to make things complicated, but it’s very challenging to make them simple. The more complexity brought to a problem, the greater the potential for things to go awry — not just astray, but very, very wrong.

10. There is no free lunch: Repeat after me: There is no free money, no riskless trade, no way to turn lead into gold. If you remember no other rule, this is the one that will save your hide time and again.