Just Click above Image

Archives of “January 5, 2019” day

rssEmotions

Emotions are at the root of trading problems. Yes, emotions can interfere with concentration and performance, but that doesn’t mean that they are a primary cause. Indeed, emotional distress is as often the result of poor trading as the cause. When traders fail to manage risk properly, trading size that is too large for their accounts, they invite outsized emotional responses to their swings in P/L. Similarly, when traders trade untested patterns that possess no objective edge in the marketplace, they are going to lose money over time and experience an understandable degree of emotional frustration. I know many successful traders who are fiercely competitive and highly emotional. I also know many successful traders who are highly analytical and not at all emotional. Trading is a performance field, no less than athletics or the performing arts. Success is a function of talents (inborn abilities) and skills (acquired competencies). No amount of emotional self-control can turn a person into a successful musician, football player, or trader. Once individuals possess the requisite talents and skills for success, however, then psychological factors become important. Psychology dictates how consistent you are with the skills and talents you have; it cannot replace those skills and talents.

Emotions are at the root of trading problems. Yes, emotions can interfere with concentration and performance, but that doesn’t mean that they are a primary cause. Indeed, emotional distress is as often the result of poor trading as the cause. When traders fail to manage risk properly, trading size that is too large for their accounts, they invite outsized emotional responses to their swings in P/L. Similarly, when traders trade untested patterns that possess no objective edge in the marketplace, they are going to lose money over time and experience an understandable degree of emotional frustration. I know many successful traders who are fiercely competitive and highly emotional. I also know many successful traders who are highly analytical and not at all emotional. Trading is a performance field, no less than athletics or the performing arts. Success is a function of talents (inborn abilities) and skills (acquired competencies). No amount of emotional self-control can turn a person into a successful musician, football player, or trader. Once individuals possess the requisite talents and skills for success, however, then psychological factors become important. Psychology dictates how consistent you are with the skills and talents you have; it cannot replace those skills and talents.

+307 Points -NF Up in 2 Days. One day we in Bear mkt, next day bulls run over bears. So We Dont gamble on direction, We trade with levels

Technically Yours/ASR TEAM/BARODA

From 9:00 Till 3:30……………Become ARJUN of Mahabharat !

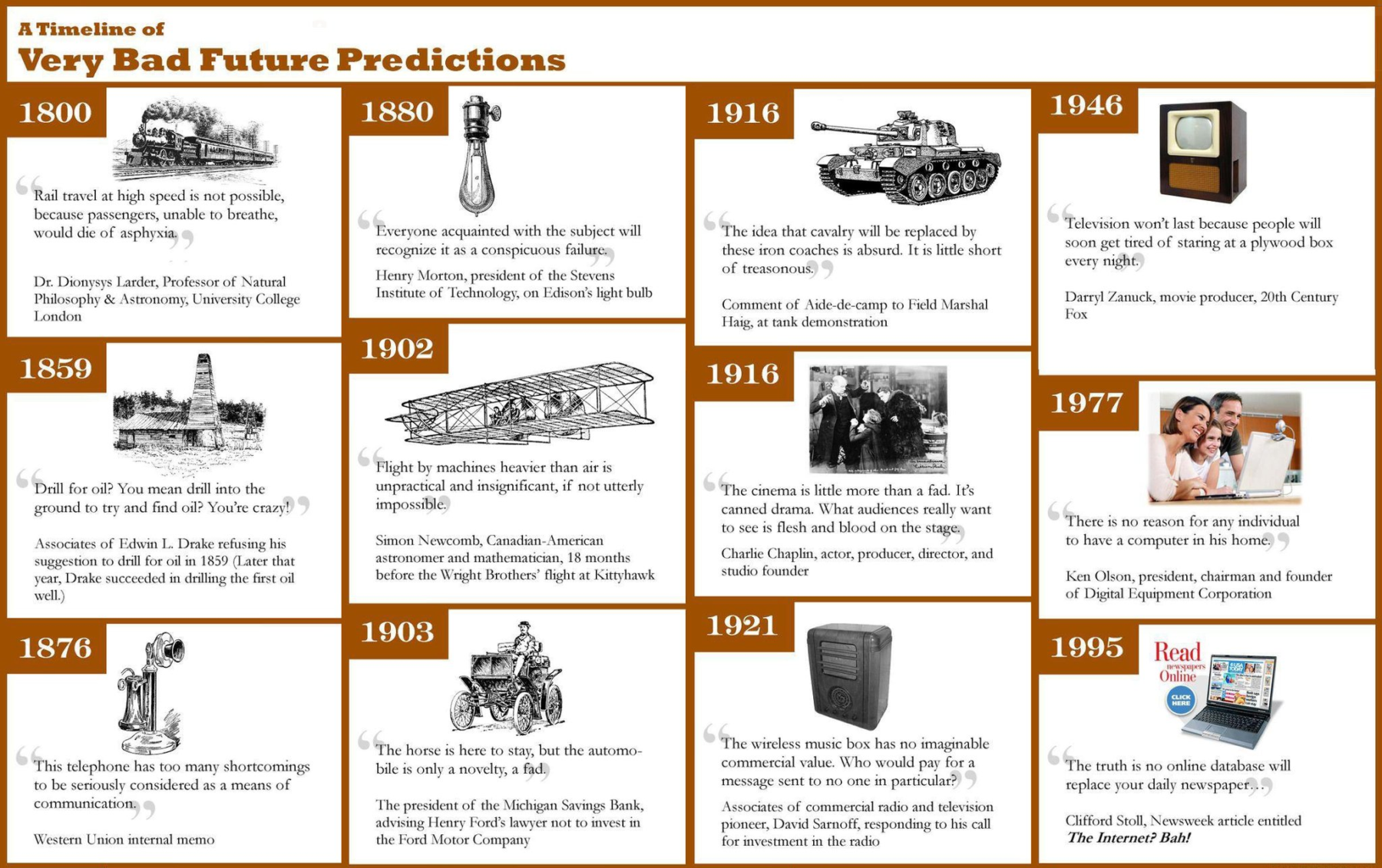

A Timeline Of Very Bad Future Predictions

Being right at the edge of the wave

"The greatest pleasure in life is doing what people say you cannot do."

Trading Rules for Thirsty Traders

“Don’t ever put your ego out there where you’re afraid to say that you’re wrong, because the market is right and you are wrong. Respect that.”

“If you’re right at the wrong time, you’re wrong.”

“The markets are like water. They will flow to the weakest point that they can push through, and they always do.”

“The market is smarter than you will ever be, with its combined knowledge of all participants. Pay attention to the signs. Be quick to admit that you’re wrong. Don’t be afraid to miss something.”

“I believe money is fascist. It craves stability more than anything else. Nothing bothers money more than uncertainty.”

Rosie’s Rules to Remember (an Economist’s Dozen)

1. In order for an economic forecast to be relevant, it must be combined with a market call.

2. Never be a slave to the date – they are no substitute for astute observation of the big picture.

3. The consensus rarely gets it right and almost always errs on the side of optimism – except at the bottom.

4. Fall in love with your partner, not your forecast.

5. No two cycles are ever the same.

6. Never hide behind your model.

7. Always seek out corroborating evidence.

8. Have respect for what the markets are telling you.

9. Be constantly aware with your forecast horizon – many clients live in the short run.

10. Of all the market forecasters, Mr. Bond gets it right most often.

11. Highlight the risks to your forecasts.

12. Get the US consumer right and everything else will take care of itself.

13. Expansions are more fun than recessions (straight from Bob Farrell’s quiver!).

6 BIG misunderstandings among traders

Set Goals -Or You'll Work For Someone who Does