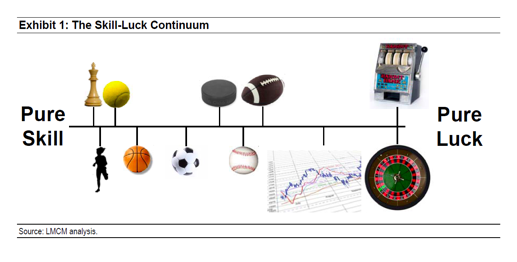

Sill & Luck :Trading is 100% Skill only

Tony Saliba

“How do you lose money? It is either bad day trading or a losing position. If it’s a bad position that is the problem, then you should just get out of it.”

“Clear thinking, ability to stay focused, and extreme discipline. Discipline is number one: Take a theory and stick with it. But you also have to be open-minded enough to switch tracks if you feel that your theory has been proven wrong. You have to be able to say, “My method worked for this type of market, but we are not in that type of market anymore.”

“Until recently, I set goals on a monetary level. First, I wanted to become a millionaire before I was thirty. I did it before I was twenty-five. Then I decided I wanted to make so much a year, and I did that. Originally, the goals were all numbers, but the numbers are’t so important anymore. Now, I want to do some things that are not only profitable, but will also be fun.”

Dr Van K. Tharp

“The composite profile of a losing trader would be someone who is highly stressed and has little protection from stress, has a negative outlook on life and expects the worst, has a lot of conflict in his/her personality, and blames others when things go wrong. Such a person would not have a set of rules to guide their behaviour and would be more likely to be a crowd follower. In addition, losing traders tend to be disorganized and impatient. Thet want action now. Most losing traders are not as bad as the composite profile suggest. They just have part of the losing profile.” (more…)

Timing your entries and exits is crucial to your success as a trader. The charts and price action tell you when the time is right. You just need to pay attention and recognize what they are saying.When you can simplify your information sources down to only a few then your task will become easier. After all , how many indicators do you really need when the chart shows it is going up and the markets show they are going up? How much confirmation do you need? And confirmation of what? The future is unwritten. The more you wait, the farther way the prime entry/exit spot is moving away from you. The more risk you take on. More risk can play on your emotions. Indicators are always behind the times. I view them as pretty useless. The price on the chart and the candles are my REAL TIME indicators. Sounds simple and it is.So if you have simplified things in the manner I describe, the next item to truly believe in is probabilities. I (and everybody else) don’t know what is going to happen in the future. However, I know that profit taking will happen after long trends, pops, drops etc. Trading the probability of a reversal after a extended uptrend when the candles are getting shorter, volume is dropping off and the overall markets showing the same is only taking the view that gravity usually takes effect and that the stock will drop. This is timing the market. My mind is not encumbered by hopes, dream and predictions of what will happen. I think of only the probability. There is a huge difference between the two psychologically after you take some losers in a row. I don’t take the losers personally as a reflection of my poor judgment. I just think that it’s the law of probabilities playing themselves out and so I can go into my next trade opportunity unafraid and without hesitation.

Could you survive on just $2.50 a day? According to Compassion International, approximately half of the population of the entire planet currently lives on $2.50 a day or less. Meanwhile, those hoarding wealth at the very top of the global pyramid are rapidly becoming a lot wealthier. Don’t get me wrong – I am a very big believer in working hard and contributing something of value to society, and those that work the hardest and contribute the most should be able to reap the rewards. In this article I am in no way, shape or form criticizing true capitalism, because if true capitalism were actually being practiced all over the planet we would have far, far less poverty today. Instead, our planet is dominated by a heavily socialized debt-based central banking system that systematically transfers wealth from hard working ordinary citizens to the global elite. Those at the very top of the pyramid know that they are impoverishing everyone else, and they very much intend to keep it that way.

As Credit Suisse tantalizingly shows year after year, the number of people who control just shy of a majority of global net worth, or 45.6% of the roughly $255 trillion in household wealth, is declining progressively relative to the total population of the world, and in 2016 the number of people who are worth more than $1 million was just 33 million, roughly 0.7% of the world’s population of adults. On the other end of the pyramid, some 3.5 billion adults had a net worth of less than $10,000, accounting for just about $6 trillion in household wealth.

And since this is a yearly report, we can go back and see how things have changed over time. (more…)

24 Hours U have to with Trading Terminal only