Technically Yours/ASR TEAM/BARODA

Technically Yours/ASR TEAM/BARODA

In 1992, George Soros brought the Bank of England to its knees. In the process, he pocketed over a billion dollars. Making a billion dollars is by all accounts pretty cool. But demolishing the monetary system of Great Britain in a single day with an elegantly constructed bet against its currency? That’s the stuff of legends.

Though just two decades ago, Soros made his nation-shaking bet in a very different time. Back then, hedge funds hadn’t yet entered the public consciousness, restrictions on capital flowing from one country to another were just lifted, and the era of the 24 hours a day news cycle had just begun.

To appreciate how Soros made a fortune betting against the British pound requires some knowledge of how exchange rates between countries work, the macroeconomic tools governments use to stimulate economies, and how hedge funds make money. Our readers are invited to correct us if we stumble in explaining any of these concepts.

And so onwards with the story of how George Soros led a group of traders to break the entire foreign currency system of Great Britain and profit handsomely at the expense of British taxpayers and others who were on the wrong side of the greatest financial bet of the 20th century. (more…)

To summarize, there are five general brain types. Among traders and investors, the three most important brain types are Compulsive, Impulsive and Anxious.

People with Compulsive Brains tend to get stuck in a particular thought about the market. “It’s too high.” “It’s too manipulated.” “It’s too risky.” It’s too…” whatever. People with Compulsive Brains tend to operate entirely on their own terms and are generally not open to feedback or other options.

People with Impulsive Brains are the exact opposite. They are unpredictable and lack impulse control in trading/investing and in daily life. Without much discipline, they start many more projects than they finish. They live for creativity and for what’s possible.

People with Anxious Brains live with a rain cloud overhead. They pay more attention to the obstacles to their own success (or the success of others) than to the ways that something might work. They don’t like to try new things and don’t appreciate novelty. (more…)

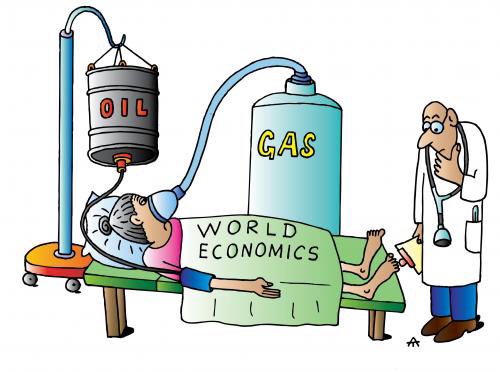

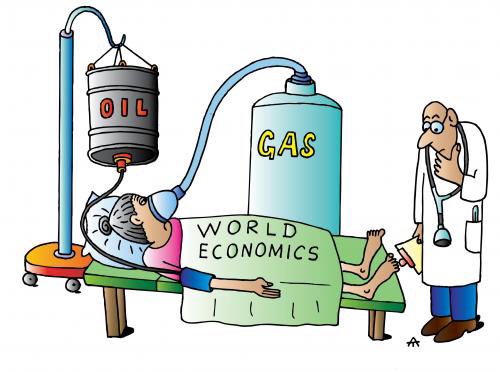

Jim Rogers, chairman of Rogers Holdings, talks with Bloomberg’s Haslinda Amin about China’s yuan policy and calls for the mainland to allow the currency to appreciate. Speaking from Singapore, Rogers also discusses the outlook for global economies, currencies and the commodities market. Bloomberg’s Paul Gordon and Patricia Lui also speak.

Elections are held after every 5 years

Results declared on 13th

Jayalalitha is back to power after 5 years

Congress got only 5 seats in Tamilnadu

Jagan Reddy got 5 lakh majority in Andhra

Mamata demolishes Communist Bastion after 34 years

Trinamool Congress was formed 13 years ago

At ASR we always strive to apply Technical Tools in hitherto unexplored areas.

Y’day we have published about IIP Data chart and forecasted it as 7.3

Earlier we have even forecasted Inflation Numbers using Technical charts.

Technically Yours/Anirudh Sethi/BARODA/India

Warren Buffett is not called the ‘Oracle of Omaha’ for nothing.

Warren Buffett is not called the ‘Oracle of Omaha’ for nothing.

‘Be fearful when others are greedy, and be greedy when others are fearful’ is good investment advice looking back at the turmoil of September 2008.

The demise of Lehman Brothers five years ago marked the start of a truly fearful six months for investors. Only in March 2009 had risky asset prices fallen far enough for bargain-hunting buyers to begin picking up equities and lower-quality bonds.

On the anniversary this weekend of Lehman’s collapse, those investors who stayed the course in equities and junk bonds can afford a smile. The S&P 500 index has gained 50 per cent.

They have done well, though alternative bets made in 2008, such as buying a New York City taxicab medallion, have done even better. (more…)